Rising health insurance deductibles fuel middle-class anger and resentment

WASHINGTON — Denise Wall, a Fresno-area schoolteacher with more than $2,000 in medical bills, was outraged to hear she could get free care if she quit her job and enrolled her family in Medicaid.

Brenda Bartlett, a factory worker in Nebraska, was so angry about $2,500 in medical bills she ran up using the coverage she got at work that she dropped insurance altogether.

“They don’t give a rat’s butt about people like me,” she said.

Sue Andersen, burdened with nearly $10,000 in debt through her family’s high-deductible plan, had to change jobs to find better coverage after learning she and her husband earned too much for government help in Minnesota.

Inside the high-deductible insurance revolution that is transforming U.S. healthcare

“We are super middle class,” she said. “How are we stuck with everything?”

Health insurance — never a standard protection in the U.S. as it is in other wealthy countries — has long divided Americans, providing generous benefits to some and slim-to-no protections to others.

But a steep run-up in deductibles, which have more than tripled in the last decade, has worsened inequality, fueling anger and resentment and adding to the country’s unsettled politics, a Los Angeles Times analysis shows.

Many wealthy Americans — already reaping most of the benefits of the last decade’s economic growth — have weathered the dramatic increase in deductibles in recent years in part by putting away money in tax-free Health Savings Accounts.

Very poor Americans, millions of whom gained coverage through the 2010 Affordable Care Act, can see a doctor or go to the hospital at virtually no cost, thanks to Medicaid, the half-century-old government safety-net program.

Squeezed in the middle are legions of working Americans who face stagnant wages, insurance premiums that take more and more of their paychecks and soaring deductibles that leave them with medical bills they can’t afford.

“The system increasingly doesn’t work for this group in the middle,” said Drew Altman, longtime head of the Kaiser Family Foundation, or KFF, a California nonprofit that researches the U.S. health system.

“These people may have health insurance … but they can’t pay the bills.”

Soaring deductibles and medical bills are pushing millions of American families to the breaking point, fueling an affordability crisis that is pulling in middle-class households with health insurance as well as the poor and uninsured.

This middle-class squeeze and the class divisions it is exposing are among the corrosive effects of the high-deductible revolution, which The Times is exploring in a series of articles based on original research, academic studies and interviews with scores of American workers, doctors and experts.

Bill McInturff, a GOP pollster who has studied healthcare opinion for years, says frustration has turned into resentment for many working-class Americans struggling with high deductibles and healthcare costs.

“Among the most angry focus groups I have done in my career was [one] with working-class women in Maine talking about how much their healthcare and child care coverage was costing them compared to the women they knew on Medicaid,” he said.

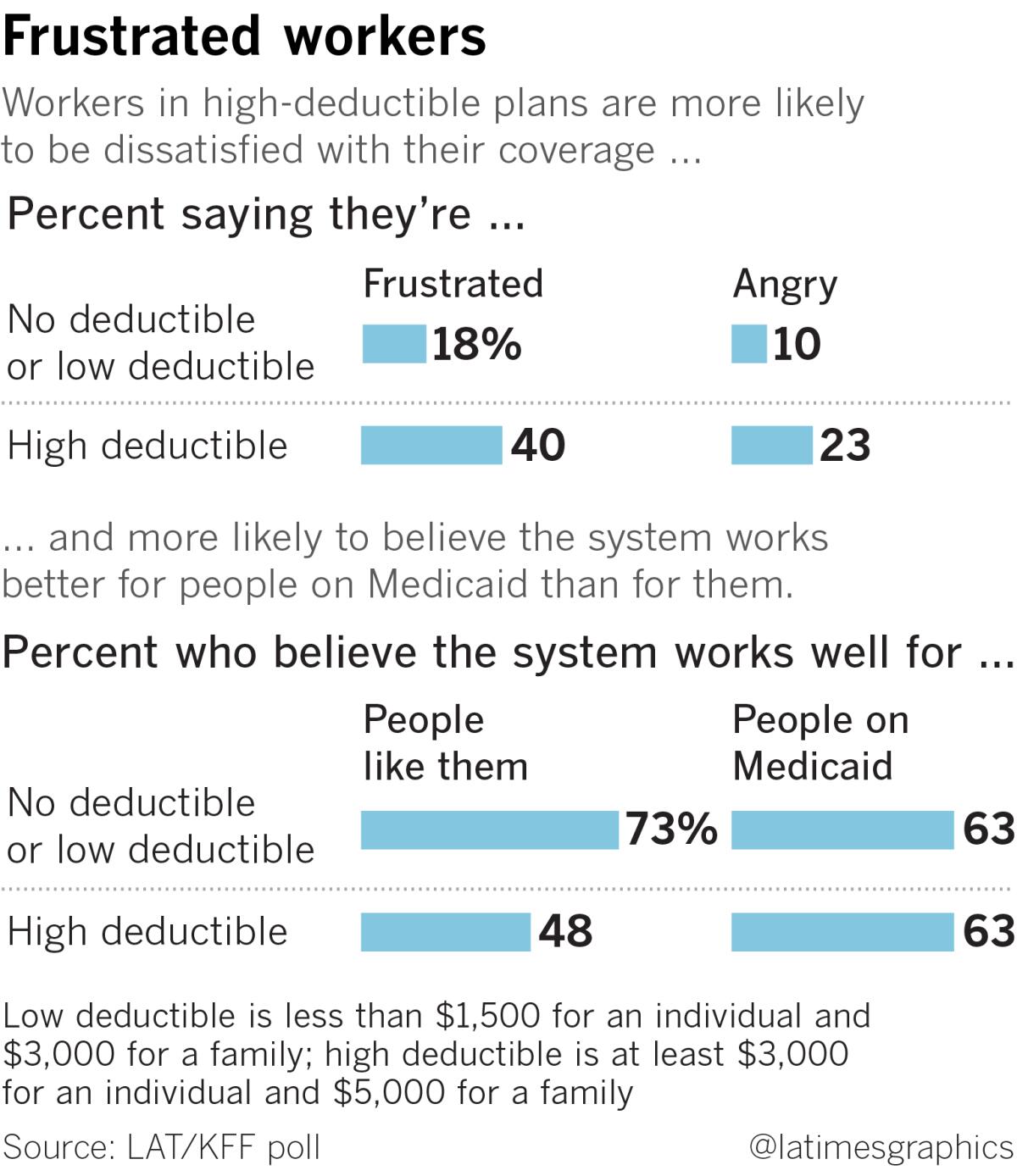

Although a majority of workers remain content with their health benefits, a quarter now report feeling frustrated, according to a nationwide poll of Americans with job-based coverage conducted for this project in partnership with KFF.

One in seven is angry about their insurance.

The discontent is even more pronounced among workers with the highest deductibles: four in 10 report frustration, and nearly a quarter say they’re angry.

“I’m not hard-core political, but it kind of stings sometimes,” said Shawn Stevens, a 40-year-old father who’s rationed his own medical care to keep the family afloat and to ensure his daughter, who has autism, gets what she needs.

“You work and do what you’re supposed to, and you really pay the price,” said Stevens, whose family was on a high-deductible plan through his Home Depot job outside Detroit. They’re paying off nearly $1,500 in medical bills, and his wife, a hospital scheduler, took a second job bartending several nights a week.

Stevens, whose family makes about $48,000 a year, looked at enrolling his daughter in Michigan’s Children’s Health Insurance Program, a subsidized government plan for working families.

“They told me I made too much,” he recalled. “I thought, ‘I’m not poor enough? I feel pretty poor.’ ”

Most workers blame drug companies and health insurers for high healthcare costs, The Times/KFF survey found.

But deep partisan lines also divide Americans’ views of the affordability crisis.

Half of Democrats struggling with the costs of their job-based health coverage blame the Trump administration for the cost pressures.

Six in 10 Republicans fault the 2010 healthcare law, often called Obamacare.

The law, for the first time, guaranteed Americans could get insurance if they’re sick.

It also gave millions of very poor working Americans access to Medicaid, which does not have deductibles. The expansion produced a historic drop in the number of Americans without health insurance.

But many health plans being sold on the law’s insurance marketplaces have very high deductibles, mirroring the run-up that has happened with job-based benefits.

And although the expansion of Medicaid is broadly popular, it has highlighted the strains on U.S. workers and their families.

Two groups of workers — those with high incomes and those with low deductibles — are more likely to believe they have better coverage than Medicaid enrollees, who typically have to make less than $17,000 a year to qualify, The Times/KFF poll found.

But workers in households making less than $40,000 a year and those with the highest deductibles are more likely to say the health insurance system works better for people on Medicaid.

That includes people with deductibles of more than $3,000 for individual coverage and $5,000 for a family plan.

As deductibles and premiums have surged, a growing number of low-income workers who have job-based health benefits are enrolling their children in Medicaid and the related Children’s Health Insurance Program, research shows.

But many workers cannot get the same cost-free government coverage for themselves.

Stevens, the Home Depot worker, said he doesn’t begrudge those who need government assistance, recalling that when he was a child, his family was poor enough to qualify for Medicaid. But he said he missed the security that coverage offered.

“There was no fear,” he said. “You didn’t have to be afraid to go to the doctor.”

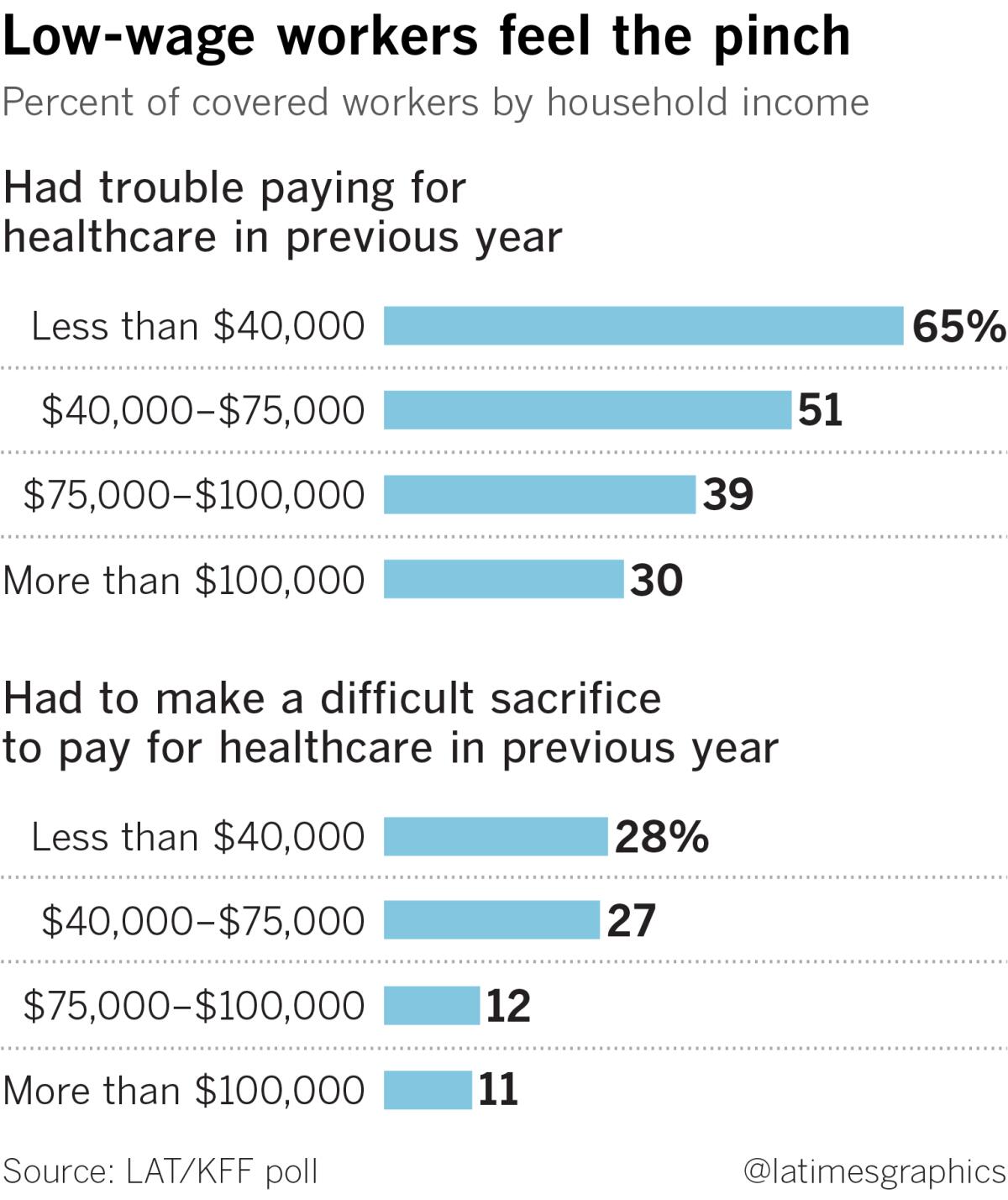

Overall, four in 10 American workers said they had trouble affording healthcare in the last year, despite having job-based health coverage, The Times/KFF survey found.

That number, however, masks a large disparity in Americans’ experiences.

Two-thirds of workers in households making less than $40,000 a year said they struggled to pay for healthcare in the previous year.

By comparison, fewer than one-third of workers with incomes of at least $100,000 said they had difficulty affording care, according to the poll.

This income divide is baked into the way employers provide coverage to workers in America: Companies with better-paying jobs have long offered more generous benefits.

In 2018, for example, workers at firms with higher wages had to pick up about a quarter of the cost of a family health plan, according to an annual employer survey KFF has been conducting for years. The employer paid the remaining three-quarters.

Americans who work for low-wage employers, by comparison, had to pay nearly 40% of the cost of a family health plan.

That meant workers at firms that pay less also got hit with an average of some $1,700 more in insurance premiums than their counterparts at better-paying employers.

That pay-based disparity didn’t matter as much when deductibles were lower, giving low-wage workers some protections against large medical bills if they became ill.

As recently as 2006, the average deductible for individual coverage in job-based plan was just $379, adjusted for inflation, according to KFF.

But since the early 2000s, employers have rapidly shifted costs onto workers as they’ve scrambled to control their own healthcare spending.

The average deductible has more than tripled, to $1,350. More than a quarter of workers have plans with a deductible of at least $2,500.

With healthcare costs topping the list of Americans’ anxieties, the Times undertook a comprehensive examination of the nation’s affordability crisis and the toll it’s taking on working Americans and their families.

Companies often didn’t pay full attention to the extra burden on workers, said Michael Critelli, the former head of global technology firm Pitney Bowes.

“The average chief executive couldn’t put themselves in the shoes of a worker trading off healthcare with paying a bill to stay in a home or an apartment,” Critelli said. Pitney Bowes was among a handful of large employers that tailored health benefits to make it easier and more affordable for workers to get recommended care and prescription drugs.

Most top wage-earners, who already have more savings, are better positioned to adjust to higher deductibles.

But they got additional help from a change in tax law that accelerated the shift in health insurance, data show.

In 2003, President George W. Bush signed legislation allowing workers in high-deductible plans to put aside money in tax-free accounts that could be used to pay medical bills.

Conservative politicians and health economists touted Health Savings Accounts, or HSAs, and high deductibles as a way to give patients “skin in the game” and an incentive to shop for lower-priced medical care.

Shortly after the 2003 law was enacted, former House Speaker Newt Gingrich, a leading GOP booster of the accounts, predicted in a joint op-ed the law would “inevitably lead to lower prices, more affordability and more consumer choices.”

None of that happened.

Middle- and low-income workers, whose incomes and savings have barely budged in recent decades, hardly use HSAs, even as their deductibles have soared.

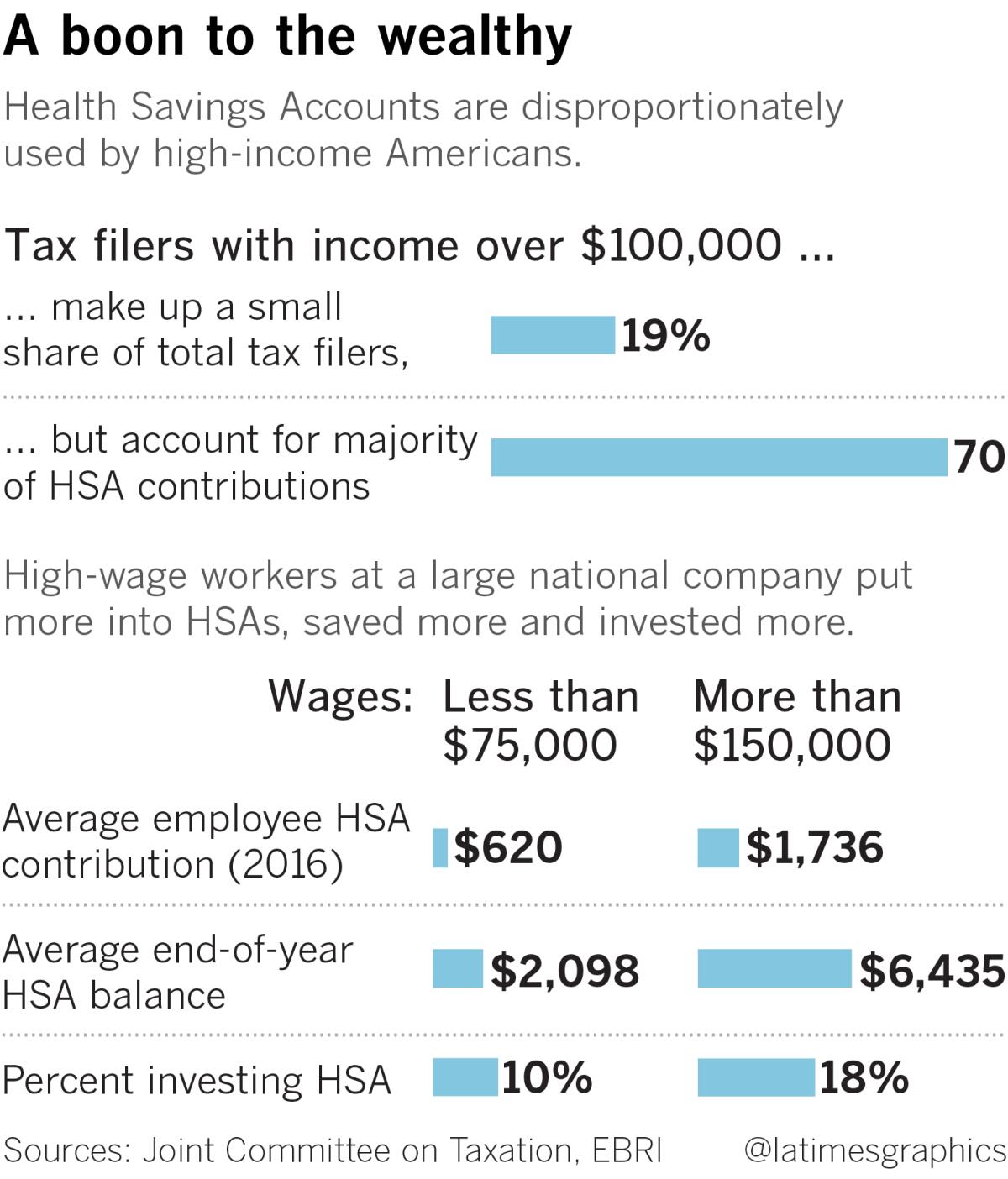

For wealthier Americans, by contrast, the accounts have become a generous savings and investment tool.

In 2013, for example, people with income greater than $100,000 accounted for less than 20% of tax filers, but 70% of total contributions made to HSAs that year, according to tax data analyzed by the congressional Joint Committee on Taxation.

By contrast, Americans with incomes below $40,000 made up nearly 50% of tax filers but made less than 6% of HSA contributions.

“There’s no doubt that these accounts have been far more valuable to higher-income people,” said Paul Fronstin, who directs the health research program at the Employee Benefit Research Institute, a Washington, D.C.-based think tank.

New research conducted by the institute in partnership with The Times shows just how much greater these advantages have been for the wealthiest workers.

Analyzing wage and insurance data from a large national corporation with an HSA plan, Fronstin and his colleagues found that employees with individual coverage who earned more than $150,000 in 2016 put more than $1,700 on average into their HSAs that year.

That was nearly three times as much as workers earning less than $75,000.

By the end of 2016, the high-income workers also had more than three times as much saved, averaging almost $6,500 in their accounts.

The higher-income employees also were nearly twice as likely to invest their accounts, a recommended strategy for maximizing the tax benefits of HSAs.

Related research by Fronstin indicates that workers with higher HSA balances use more healthcare, even accounting for differences in workers’ ages.

“All around, they are getting more bang for their buck,” he said.

Brittany Robb, 24, who recently began her first job at an architectural firm in St. Paul, Minn., said she dreams of building savings in the HSA that comes with her $2,000-deductible plan.

Even with a salary of $48,500, however, Robb can afford to put only $80 in the account every month.

“It doesn’t get me a lot,” she said, noting that bills for seeing a therapist and filling prescriptions quickly deplete the HSA and force her to ration her care.

“I feel pretty stressed about health insurance all the time.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.