Forty-three million Americans owe a collective $1.6 trillion in federal student loan debt. About $85,400 of that belongs to Eric Swalwell.

His debt has followed him from law school to the Alameda County district attorney’s office and the Dublin City Council. It was looming in the background a decade ago when he ran for Congress at 31, defeating a 20-term incumbent to represent a Bay Area district, and it was at the forefront of his brief presidential campaign in 2019, when he made it clear he’d be paying off the loans in the White House if he won.

But when President Biden announced his plan last week to forgive up to $20,000 in federal student loan debt, Swalwell’s response echoed that of many borrowers who would trade forgiveness for a fighting chance at paying back what they owe: That’s great, but what about the interest?

For years, Swalwell, now 41, has been pitching a bill that would set the interest rate on new federal student loans at zero and forgive the interest borrowers currently owe.

“I’m not and never was a supporter of just a blanket cancellation. I knew what I was signing up [for],” Swalwell said in an interview with The Times in Pleasanton. “To me, it was an investment in my future, and I didn’t make that investment, or go into that investment, expecting that it would just be wiped.”

His approach has been shaped by his own experience as the first person in his family to graduate from college and his concerns that broad forgiveness would create resentment among people like his three younger brothers, who don’t have degrees. It’s also reflective of his own battle with a loan balance that was once nearly $200,000, and the interest it accrued: He’s paid $28,177 in interest over the last 10 years.

Depending on the size and number of loans a person holds, interest can increase a borrower’s overall debt by hundreds or thousands of dollars. For example, the average public school student borrows $32,880 to pay for an undergraduate degree. Under the fixed rate of 4.99% for undergraduate loans disbursed after July 1, that would average out to nearly $9,000 in interest over 10 years. But that assumes borrowers aren’t deferring their loan, delinquent on payments or on income-driven repayment plans. In those scenarios, interest often continues to accrue faster than borrowers can pay it, pushing repayment further out.

“It does seem to me that the easiest thing we could do is, essentially, to make permanent what the president has done during the pandemic, which is to just bring the interest rate to zero,” Swalwell said.

But his is one of dozens of proposals that’s languished in Congress, where a Senate evenly split between Democrats and Republicans and an intense focus on debt cancellation have made it difficult for significant education reforms to pass, or even gain traction. Congress has not passed a comprehensive reauthorization of the Higher Education Act of 1965, the landmark law that covers education policy and financial aid policies, since 2008. As a stand-alone bill, Swalwell’s No Student Loan Interest Act has just seven co-sponsors.

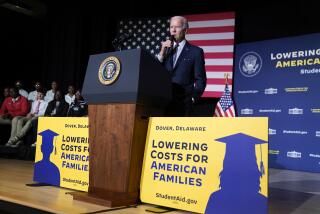

Biden announced Wednesday that his administration would forgive $10,000 in federal student loan debt for those making less than $125,000, with an additional $10,000 in forgiveness for those who went to college on Pell Grants, and extend the repayment pause through the end of the year.

And in a bid to prevent struggling borrowers from being crushed by large payments, the Education Department is proposing a new rule that would allow those with loans to cap monthly payments at 5% of their discretionary income. Unlike past income-driven repayment plans, this version would pay for the interest people owe, preventing their loan balances from growing as they make payments.

In a statement, Swalwell said he supports the plan but is concerned that it “fails to consider regional differences in the cost of living” or address the long-term burden of debt for future borrowers.

“Congress must tackle college affordability and debt in the long-term,” he said. “That includes drastically increasing Pell Grants, reforming our college accountability system to hold bad actors accountable, and eliminating federal interest for future borrowers (legislation I’ve already introduced).”

Growing up, Swalwell knew his parents, who worked as a police chief and a secretary, wouldn’t be able to pay for him to go to college.

“The best way to describe how I grew up was that we lived in about a dozen houses, and I went to 11 different schools before I graduated high school,” Swalwell said.

Swalwell received a soccer scholarship to Campbell University, a small Christian school 40 minutes south of Raleigh, N.C. But during the spring of his sophomore year in 2001, Swalwell broke his thumbs, a debilitating injury for a goalie. That summer, he went to Washington to work as an unpaid intern for a Bay Area congresswoman.

In between mornings working at the Washington Sports Club and evening shifts at a Tex-Mex restaurant, he realized he wanted to transfer to the University of Maryland to be close to the nation’s Capitol instead of returning to North Carolina, where he’d probably be unable to play soccer again.

“The easy part was getting into Maryland,” he said. “The hard part was calling [my parents] and saying, ‘OK, we’re gonna go from essentially having school paid for, to now I’m an out-of-state student.’”

His mother, Vicky Swalwell, said she and her husband, Eric Sr., would have done anything to help their eldest son graduate from college. The couple took out a loan in addition to what their son borrowed.

“We had a conversation with him like, ‘C’mon, Eric, free school or we pay’ — I think it was $25,000 a year at the time,” she said. “It wasn’t easy … but in the end we’re not sorry we did it.”

At the University of Maryland, Swalwell and his parents were constantly scrambling to pay tuition. It still stresses him out to think about paying for his last two years of his undergraduate degree and his law school, he said.

“But we knew, at the end of this journey, you have a law degree,” he said.

In 2015, Swalwell founded Future Forum, a congressional caucus aimed at addressing the issues important to young people, and started traveling around to speak to voters.

“He basically just opened up and everywhere he went, within the district and around the country, talked about how he had six figures in debt to pay his way through school and that he was one of the lucky ones because, obviously, he’s gainfully employed,” said Tim Sbranti, Swalwell’s former district director and high school economics teacher. “He wasn’t looking for sympathy. It was more to say, ‘If I had these careers … imagine how many people in so many other fields are having the issue.’”

At a recent Union City town hall in his district, Swalwell discussed his student loan legislation as a central part of a broad range of issues he’s focused on, including gun control, healthcare costs and defending democracy.

“Having the interest rate at zero or having targeted relief also puts more money in your pockets at the end of every month,” Swalwell told about 150 constituents gathered at a senior center.

The crowd — which included a mix of community activists, supporters, conservative constituents and Alison Hayden, the Republican running a long-shot bid to unseat him in November — spoke to some of the hurdles and benefits of pursuing a less-discussed policy to aid borrowers.

“It’s not like it just magically goes away,” Rob Kuipers, a 40-year-old lead operator at a brewing company, said of forgiven debt. “We’re asking the American people to pay for those loans.”

Kuipers said he attended the Union City town hall to hear from Swalwell, though he is a staunch conservative. Despite agreeing with his representative on very little, he is open to the idea of giving zero-interest loans to low-income families.

“If those are essentially the two choices, I do actually prefer that alternative, that proposal of zero-interest loans, to just complete forgiveness,” he said.

On the other end of the spectrum, Annie Koruga, an East Bay progressive activist and community college student who also attended the town hall, said they think both Swalwell’s plan and Biden’s strategy to forgive $10,000 for people who make a certain amount, are “piecemeal, drop-in-the-bucket solutions to a very, very, very large problem.”

“My mom did everything she was supposed to, got her degree and still, decades after she graduated, is still paying off student loans,” they said. “In my book it doesn’t make sense to have people do that.”

Canceling student debt hasn’t always been a primary goal of the Democratic Party. In 2014, Sen. Elizabeth Warren of Massachusetts sponsored a bill that would have allowed people with older federal student loans to refinance them at a lower rate — 3.86%, the rate set for undergraduate loans a year prior. Since 2013, Congress has tied the interest on student loans issued that year to the interest rate on 10-year Treasury notes. Many older loans have higher rates.

The bill failed in the Senate, where Republicans said it was a midterm election ploy that wouldn’t lower college costs or reduce spending. Conservative economists said lower interest rates would disproportionately benefit people who don’t need the help.

“The pushback from folks like myself was essentially that doing that would be a regressive transfer,” said Beth Akers, a senior fellow at the center-right American Enterprise Institute. “Statistically, we know that the people with the largest balances tend to be more well off, they’re high earners.”

Akers said Swalwell’s bill would cause similar problems, while also encouraging people to take out as much money as possible. But Akers agrees that interest accrual is a problem for borrowers, especially those in income-driven repayment programs that lower people’s monthly payments to what they can afford. Those lower payments don’t always keep up with the interest.

Among borrowers who started repaying their loans in 2010, 75% of those in income-driven repayment plans had higher loan balances, according to a 2020 Congressional Budget Office working paper.

“What I think is really interesting about [Swalwell’s bill] is it is actually cognizant, and reflective of, the fact that what has really burdened a lot of people is the interest rate,” said Elizabeth Tandy Shermer, a history professor at Loyola University Chicago and author of “Indentured Students: How Government-Guaranteed Loans Left Generations Drowning in College Debt.”

There are dozens of similar bills in Congress now that would create more transparency or tweak current programs that offer loan forgiveness to medical professionals or others in public service roles, and others that would overhaul some aspect of the current social safety net.

Some of those bills would also tackle interest rates. Sen. Sheldon Whitehouse (D-R.I.) and Rep. Joe Courtney (D-Conn.) introduced a bill this year that would allow people to refinance their student loans at zero percent. Another bill from Sen. Marco Rubio (R-Fla.) would replace the interest rate on new loans with a one-time loan origination fee. Unlike the Swalwell proposal, however, neither of those bills would cancel the interest people currently owe on existing loans.

Swalwell credits Rep. Anna Eshoo (D-Menlo Park), one of his co-sponsors, with inspiring the bill. During one of their treks between Washington and their districts, Swalwell shared his experience with loans and Eshoo said her constituents often ask her what she thought the interest rate should be. She suggested it could just be zero.

“She said … ‘Why are we quibbling about 2%? Or 3%? ...Why should the government make any money?’ She never wrote the bill, that was just her thought,” Swalwell said. “And as I thought about it, and then we started to game it out and what it would mean, it made a lot of sense.”

Swalwell and his small band of allies on the bill are still optimistic it could pass — someday. In an argument for patience, Eshoo said there’s a misconception that bills are frequently passed in the session of Congress in which they’re introduced.

“I have had legislation that has taken five Congresses, six Congresses to get it across the finish line,” she said. “Were they bad ideas? No, they weren’t bad ideas. It takes time for things to mature legislatively.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.