Biden will cancel up to $20,000 of student debt for many borrowers

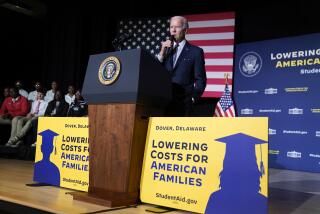

President Biden announced Wednesday that he is canceling $10,000 in student debt for individuals earning less than $125,000 annually.

WASHINGTON — President Biden moved Wednesday to cancel $10,000 in student debt for individuals earning less than $125,000 annually and extend a pause on loan repayments for all borrowers through the end of the year. People who received Pell Grants to help cover the cost of college will be eligible for up to $20,000 in loan relief under Biden’s plan.

Together with a newly proposed rule that would limit many borrowers’ payments on their undergraduate student loans to 5% of their monthly income, the measures amount to a major restructuring of the federal educational finance system.

If they survive likely court challenges and are implemented in full, the reforms would eliminate millions of Americans’ student debt, ease burdens on those with higher debt loads, and slash monthly payments for many future borrowers. More than 40 million Americans owe a collective$1.6 trillion in federal student loans.

Lamenting that “an entire generation is now saddled with unsustainable debt” because the cost of higher education has skyrocketed in recent years, Biden described his action as a matter of economic fairness that will “provide more breathing room for people” and boost America’s competitiveness.

“My plan is responsible and fair. It focuses the benefit on middle-class and working families. It helps both current and future borrowers, and it will fix a badly broken system,” he said.

The overall package, which Biden said will benefit 43 million Americans, is a win for activists who had pushed for loan forgiveness. But the amount of debt Biden has decided to erase is less than many activists had sought, complicating an issue the White House hopes will boost Democrats in the midterm election and drawing criticism from both parties.

Republicans and some moderate Democrats bristled at the price tag of the new measures, asserting that spending an estimated $400 billion to $600 billion to cover the forgiven loans would exacerbate inflation.

“This announcement is gallingly reckless — with the national debt approaching record levels and inflation surging, it will make both worse,” said Maya McGuinness, president of the Committee for a Responsible Federal Budget, a Washington organization that opposes the student loan forgiveness program.

Biden, who returned from a two-week vacation Wednesday morning, had vowed to act before Aug. 31, when the latest pandemic-driven moratorium on federal student loan payments runs out.

President Trump first suspended payments in March 2020, and Biden previously granted four extensions. So far, the suspensions have cost the federal government more than

$100 billion. This extension will be the last, and borrowers will have to resume payments in January, Biden said. “It’s time for the payments to resume,” he said.

Although many prominent progressives pressured Biden to go further than he did, most of them celebrated his announcement. Colorado Sen. Michael Bennet was one of the few Democrats who voiced any consternation, saying that the White House “should have further targeted the relief and proposed a way to pay for this plan.”

Republicans almost uniformly attacked Biden’s move. The president’s “actions are unfair to everyone who didn’t take on student loans or made sacrifices to pay their loans,” Rep. Kevin McCarthy (R-Bakersfield), the top Republican in the House, said in a statement.

Any protracted political fight over student loans could affect Democrats’ recent momentum and threaten their coalition’s cohesion. The president and his party have seen their poll numbers rise in recent months, buoyed by a series of events that have altered the political landscape in their favor.

The Supreme Court’s late June decision overturning Roe vs. Wade alienated women across political lines. High-profile congressional hearings further illuminating Trump’s key role inciting the Jan. 6, 2021, Capitol insurrection received broad television coverage and hardened perceptions of Republicans as the more extreme party. And Democrats’ recent passage of three major bills — a climate, prescription drug and tax overhaul; new funding to boost domestic manufacturing of microchips; and enhanced healthcare for veterans exposed to toxic chemicals on the battlefield — has shown the public that Biden is far from a do-nothing president.

President Biden signed a bill that seeks to boost manufacturing of semiconductors and reduce the U.S. tech sector’s reliance on Asian companies.

Before the abortion decision, the Jan. 6 hearings and the flurry of new legislation, some senior Biden aides believed significant student loan debt forgiveness was one of the few measures that could excite the Democratic base and help the party survive a tough election cycle. Despite public and private pressure from Senate Majority Leader Charles E. Schumer (D-N.Y.) and Sens. Elizabeth Warren (D-Mass.), Bernie Sanders (I-Vt.) and Raphael Warnock (D-Ga.), Biden has long questioned whether forgiving as much as $50,000 in debt would be prudent.

Schumer spoke by phone with Biden on Tuesday night “to make a final push to the president to cancel as much student loan debt as he can,” according to a Democrat familiar with the conversation. On Wednesday, Schumer and Warren sought to quell criticism from the left, issuing a statement heralding Biden’s decision as a historic first step.

“No president or Congress has done more to relieve the burden of student debt and help millions of Americans make ends meet,” their statement said. “Make no mistake, the work — our work — will continue as we pursue every available path to address the student debt crisis, help close the racial wealth gap for borrowers, and keep our economy growing.”

Some activists also cheered the announcement. “Today, with President Biden’s announcement, 12 million American borrowers have had their educational debts erased,” said Melissa Byrne, executive director of We the 45 Million, a group that advocates for student debt forgiveness. “This is a historic first step — establishing the clear authority that the president has to cancel student debt — but this should just be the beginning.”

But key Democratic constituencies, including young voters, Black Americans and civil rights groups such as the National Assn. for the Advancement of Colored People, had pushed hard for more debt forgiveness.

Derrick Johnson, president of the NAACP, blasted Biden in a statement Tuesday, saying that if reports of the president having settled on $10,000 in debt forgiveness were correct, “we’ve got a problem,” likening the decision to past federal policies that have been detrimental to Black people.

“Tragically, we’ve experienced this so many times before,” he said. “This is not how you treat the 90% of Black voters who turned out in record numbers to once again save democracy in 2020.”

An administration official, speaking to reporters about the plan Wednesday on condition of anonymity, said that Biden’s debt forgiveness reflects a clear awareness of the disproportionate impact of loan debt on Black borrowers. The additional loan forgiveness for recipients of Pell Grants, which Black Americans are twice as likely as whites to utilize, was an effort to get the relief “to the people who need it most,” the official said.

Johnson was much more conciliatory in his statement Wednesday after the additional Pell Grant forgiveness was announced, saying that Biden’s action “takes us one step closer to the NAACP’s ultimate goal of alleviating the burden of student debt,” expressing pride that “we were able to push President Biden to exceed $10,000,” and emphasizing the positive impact of the decision. “Americans across the country, including millions of HBCU attendees, will benefit from this decision,” he said, referring to historically Black colleges and universities.

Biden, in his remarks, said the loan forgiveness would not increase the deficit or inflation. He pointed to this year’s record deficit reduction and said the resumption of loan payments in January after a lengthy pause will bring in enough revenue to cover the loan forgiveness “many times over.”

“I will never apologize for helping working Americans and the middle class, especially not to the same folks who voted for a $2-trillion tax cut that mainly benefited the wealthiest Americans and the biggest corporations,” he said, referring to the GOP’s 2017 tax law that lowered rates for those groups and ballooned the deficit.

Federal student loan payments were paused in 2020, giving borrowers breathing room amid the pandemic. A plan to forgive $10,000 in debt may be coming.

Lawrence H. Summers and Jason Furman, prominent economists who served in prior Democratic administrations, have publicly warned Biden about going too far with student loan forgiveness, which, Summers tweeted Monday, “is spending that raises demand and increases inflation. It consumes resources that could be better used helping those who did not, for whatever reason, have the chance to attend college. It will also tend to be inflationary by raising tuitions.”

Furman blasted Biden’s move as “reckless” in a tweet Wednesday, noting that the president went beyond his campaign promise even amid record inflation.

Even as some Democrats faulted Biden’s plan as insufficient, Republicans remained eager to criticize any loan forgiveness at all.

Senate Minority Leader Mitch McConnell (R-Ky.) bashed the move as “a slap in the face” to working families, and one that will worsen inflation. “Inflation is crushing working families,” he said, “and his answer is to give away even more money to elites with higher salaries.”

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.