Opinion: The college tuition system is broken. FAFSA headaches are the latest proof

Thanks to delays in the Free Application for Federal Student Aid process, millions of potential college students and their families will have to wait longer than usual to learn what their financial aid packages will look like.

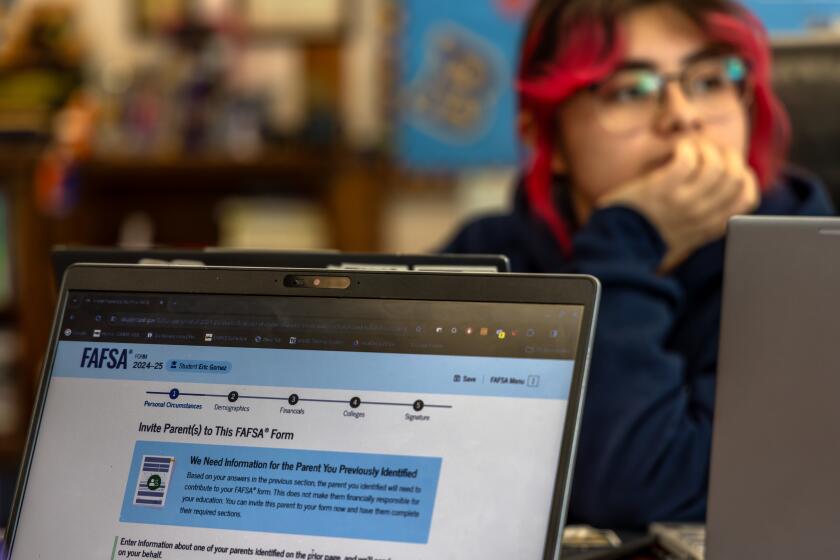

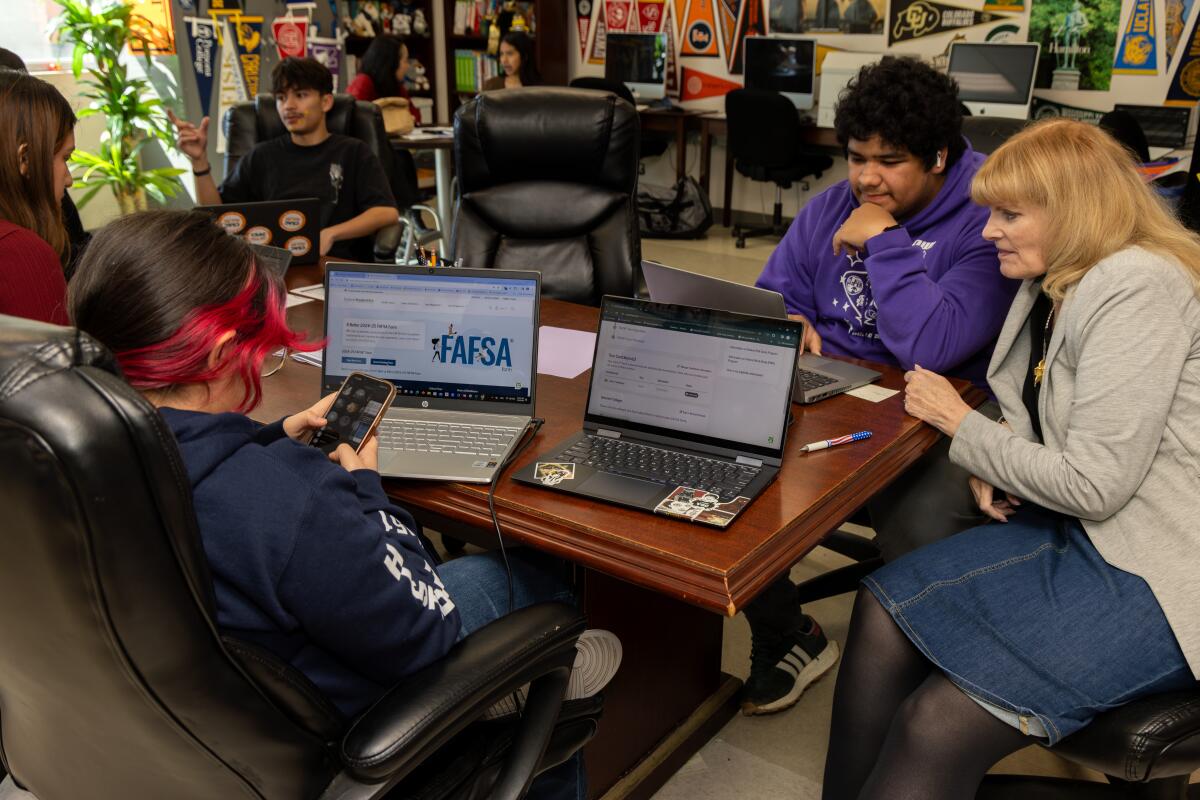

Filling out the FAFSA is how potential college students prove their financial eligibility for aid that will help them cover tuition — Pell Grants, federal work-study, state-based financial aid and federal loans. The bureaucratic, confusing and often frustrating process adds to the anxiety many students and families feel in figuring out how to pay for college.

The rollout of the new, ‘simpler’ FAFSA application is unacceptably chaotic. There’s plenty of blame to go around.

The FAFSA Simplification Act, which passed in 2020 and is being implemented for the coming academic year, aimed to support more low- and middle-income families by simplifying the process — a laudable goal. The new system aims to expand eligibility for Pell Grants and it imports all participants’ information straight from the IRS to shorten the forms, among other changes. But the rollout was botched. Parents and students reported various problems with the website. Many gave up; applications were down as of January, almost by half.

The glitches in the system will hopefully be fixed, and last week the Department of Education announced temporary measures to reduce the backlog. But the uncertainty and instability faced by low-income students hoping to attend college aren’t going anywhere. We need a more straightforward system of funding higher education that decreases instability and unpredictability in students’ lives rather than adding to it.

Like most other policies in the United States, FAFSA prioritizes only those who “need” the funds. But in crafting policy, there is a trade-off between narrowly targeting aid and making it simple or even possible for people to get help.

Proving that you‘re worthy of aid for college requires elaborate means-testing, or a demonstration of financial hardship comparable to what families have to do to qualify for welfare. Even if this approach is well-intended to protect resources for those who most depend on them, these complex and demanding vetting systems impose great mental costs on recipients. Many people living in poverty and in need of financial support are already cognitively and emotionally taxed. They are more likely to experience unstable housing and precarious employment. A health crisis or a car accident can be enough to lead them to lose one or both.

A chaotic rollout of a new federal financial aid form is roiling high schools and upending college admissions, impeding students from filling out the all-important FAFSA form.

Some students from families in poverty don’t even apply for college, sure that they cannot afford it. Those who do are often uncertain about how they will pay for it until they hear back about their FAFSA. And that’s on top of the uncertainty they already face about where they will live, how they will pay for food and whether their families can actually afford to have them in college rather than working.

Students who are the first in their families to attend college and those from low-income families tend to have complicated financial situations. I know this firsthand: When I applied for college, my financial support was being cobbled together from multiple family members in a situation that would have been a nightmare to prove to FAFSA. The only reason I dodged that hurdle was because as an international student, I qualified for a need-blind aid package that ultimately made it possible for me to attend college and changed my life.

The child tax credit many Americans received during the COVID-19 pandemic wasn’t entirely need-blind, but it similarly prioritized access over targeting: Most families with children got a monthly check in the mail. Some viewed the policy as wasteful because well-off people with children got checks too. However, it was one of the most effective measures this country has ever undertaken in reducing child poverty.

Given the enormity of the college affordability crisis, it seems worth seriously pursuing solutions that would also prioritize accessibility — for example, baby bonds, vouchers for higher education or, even better, free public college.

Many have rejected free college as wasteful and regressive, disproportionately benefiting affluent families. But that is because we are not accounting for society-wide benefits of universal programs, such as the economic gains that come from investing in human capital and the reduction of student debt. Middle-class families will undoubtedly benefit; so will families in poverty who are already jumping through many hoops to try to get the assistance for which they are eligible.

When we prioritize creating stability in people’s lives, we give them the scaffold to plan and aspire toward a better future. We should want all college students to enjoy that freedom.

Jennifer Morton is an associate professor of philosophy and education at the University of Pennsylvania and a Sara Miller McCune Fellow at the Center for Advanced Study in the Behavioral Sciences at Stanford University.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.