‘This is just the biggest fiasco.’ College admissions upended by financial aid form glitches

Esmeralda Bernal is the valedictorian of Downtown Magnets High School this year, the daughter of Mexican immigrants who never went to college. She’s taken 18 college-level classes and aced them with a cumulative 4.5 GPA while taking on leadership roles in her school’s robotics and math clubs. She dreams of becoming a civil engineer.

Yet the brainy senior couldn’t get past glitches to submit her federal financial aid form for more than a month. A new form designed to be simpler was just the opposite for her: impenetrable.

She had been trying to reach the U.S. Department of Education’s help line since early January, to no avail. Finally, after calling 13 times one day last week, she got someone on the line who could help. She submitted her form and is anxiously waiting for the federal information to be sent to colleges, which use the all-important FAFSA form, the Free Application for Federal Student Aid, to craft aid packages that let students know whether they can afford their dream schools. For Esmeralda, it’s MIT, Smith College and UC Berkeley.

“It was really frustrating,” said Esmeralda. “It didn’t feel simpler to me.”

As tens of thousands of California students struggle through one of the most stressful times of their high school journeys — the wait for college acceptance letters — their anxiety has been compounded this year by a chaotic and glitch-filled rollout of newly designed FAFSA forms. Panicked high school seniors and their counselors describe the situation as a fiasco, chaos and scary.

The online form, which was previously opened in late October, did not become fully accessible until mid-January. That delay and numerous reported snags have resulted in a steep drop in the number of financial aid forms submitted. As of late January, about 700,000 seniors nationwide had submitted applications, declining from about 1.5 million applicants the same time last year, according to the National College Attainment Network, which analyzed data from the U.S. Department of Education.

In California, only 16.1% of seniors had submitted a FAFSA through Feb. 2, a drop of more than 57% from that same date the previous year, according to the network’s data.

The numbers at local schools show alarming drops in completions.

At Downtown Magnets, which often wins honors from L.A. Unified for high rates of FAFSA completion, only one-third as many seniors had completed the form as of Jan. 26 compared with last year, according to federal data. And fewer than five forms had been successfully processed, leaving virtually all of that school’s students in financial aid limbo.

As of late last week, Pasadena High would normally have about 75% of FAFSA applications submitted for seniors. Instead, the number is about 17%, counselors said. Other Pasadena Unified schools reported similar numbers. For Muir High, it was 14% instead of 80%. For Marshall Fundamental High, it was 28% instead of 75%.

The two university systems will extend their May 1 deadline for students to accept admission offers, citing delays in financial aid applications known as FAFSA.

The delays prompted the University of California and California State University to announce last week they would extend their May 1 deadline for first-year students to accept their admission offers for fall 2024. Both systems announced extensions until at least May 15. The state, which provides Cal Grants through the California Student Aid Commission, also extended the priority deadline to submit financial aid applications by one month, to April 2.

U.S. Secretary of Education Miguel Cardona has acknowledged the problems, saying officials are “determined to get this right.” His department last week pledged to provide additional personnel, funding, technology and other resources to students, high schools and colleges.

But on the ground, in high schools across the state, confusion reigns.

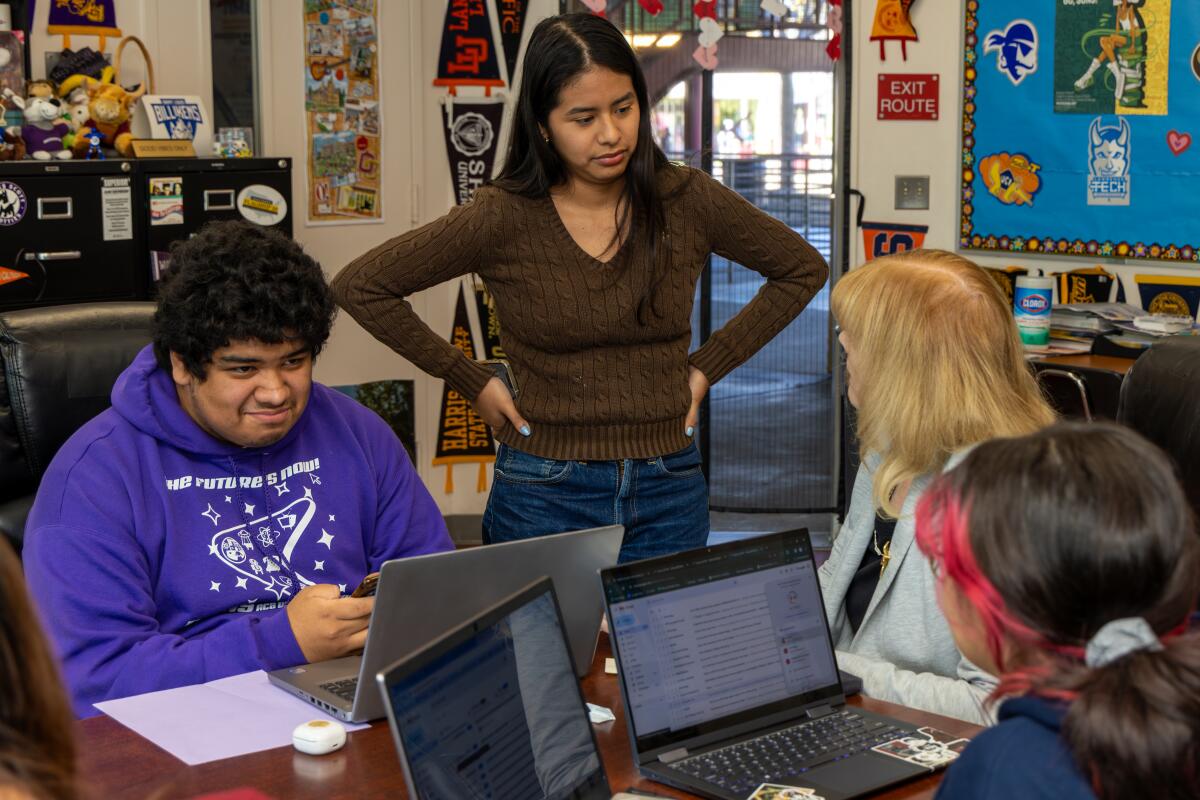

“This is just the biggest fiasco,” said Lynda McGee, a counselor at Downtown Magnets for 24 years. “I’ve never seen anything in all the years I’ve been a counselor that even begins to compare to this level of dysfunction.”

At their monthly meeting last Thursday, counselors in Pasadena Unified described a cascade of problems.

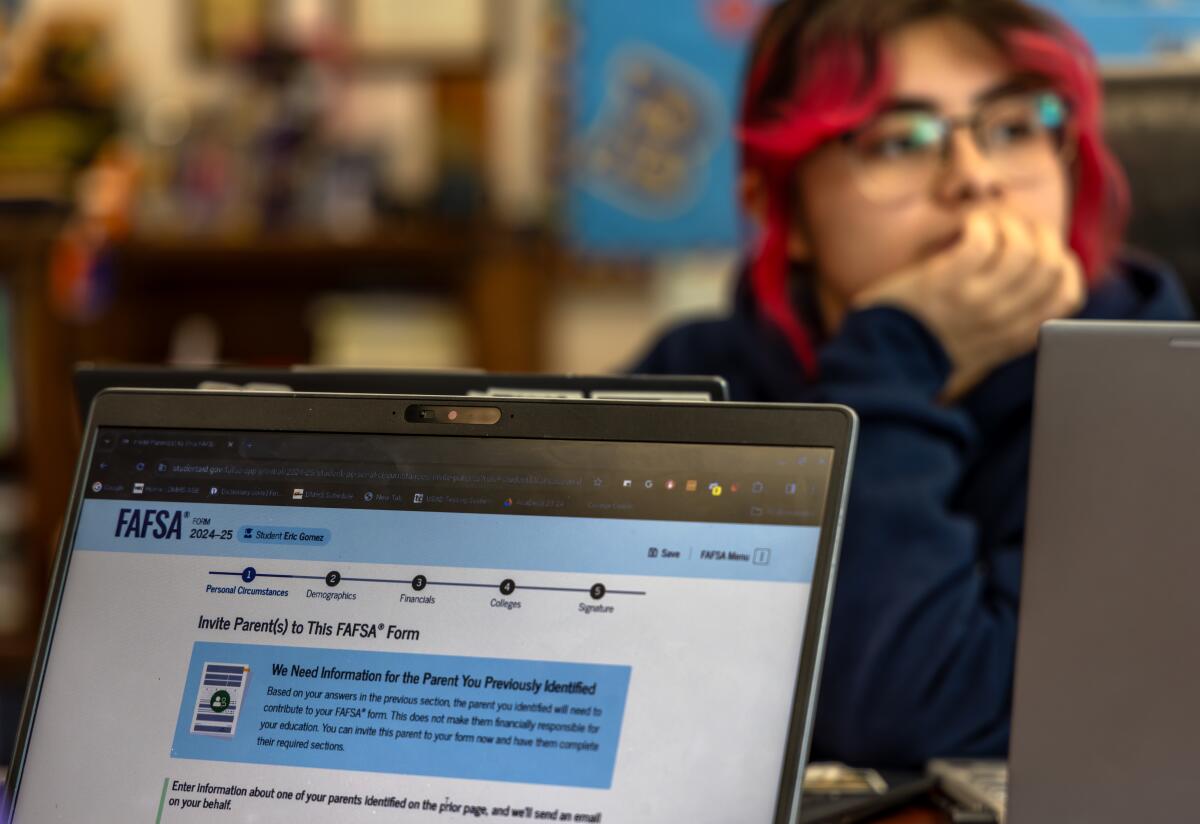

Sometimes parents and students got to the end of the form, but the system would not let them create the account, saying there was an error but not explaining what it was. Some who didn’t finish the form on the first try or needed to correct a mistake were locked out.

After waiting four weeks, one family was finally able to get a “case number,” meaning they were in line for help with FAFSA problems. But the student’s parent did not speak English — and federal FAFSA advisors speak almost exclusively English. In her confusion, the student made an inadvertent mistake and the system canceled her case number. She had to fill out another form to get a new case number — and wait another month as a result, said Renee Cruz, a college counselor at Muir High School.

The University of California enrolled a record number of California undergraduates in fall 2023 and cut out-of-state students to accommodate surging local demand for seats.

Students also have been caught in feedback loops, with the system telling them they have a FAFSA account when they don’t. When they try to access it by changing the password, they’re told to create an account. For one Muir High family, the computer system combined the information for twins into one account as one person — and the mother could not create two accounts no matter what she tried.

Frustrated counselors report turning to Facebook counselor groups and even Reddit — which have no connection to the FAFSA system — for tips.

Krystal Rodas, a college and career advisor at Pasadena High, could find no solution to mysterious error messages on the website. When she got through on the phone, “they kept saying that there was no solution. It was an ongoing issue.”

Particularly damaging to students with immigrant parents, the system appears to be especially troublesome when parents do not have a Social Security number. Maria Torres, a Marshall Fundamental High counselor, learned that leaving blank the address section for parents without Social Security numbers might work. It did for two people but none of the others, she said.

Financial aid submissions that the federal government typically processed in five to seven days are being pushed off till March, the counselors reported. That means colleges will be jammed as well — even if they push back their own deadlines.

Filling out the FAFSA has become something of a universal experience for high school seniors and their families. Only the most prosperous families can afford to forgo all financial aid — with the average total cost of attending a four-year college, including loan repayment and lost wages, often surpassing half a million dollars.

At Calabasas High, senior Ella Shapiro has no expectation of qualifying for a federal Pell Grant for low-income students, as her father is a physician and her mother works in fashion. But she understands that colleges typically require the FAFSA for their own institutional grants and supplemental aid, including federally subsidized loans and work opportunities.

She said the software was “hard to get on and stay on the website. ” For about two weeks, she also kept getting messages saying the system was down and to try again later. Counselors held meetings and tried to troubleshoot issues.

After two weeks of problems, she thinks she has successfully submitted her form: “I’m crossing my fingers at this point.”

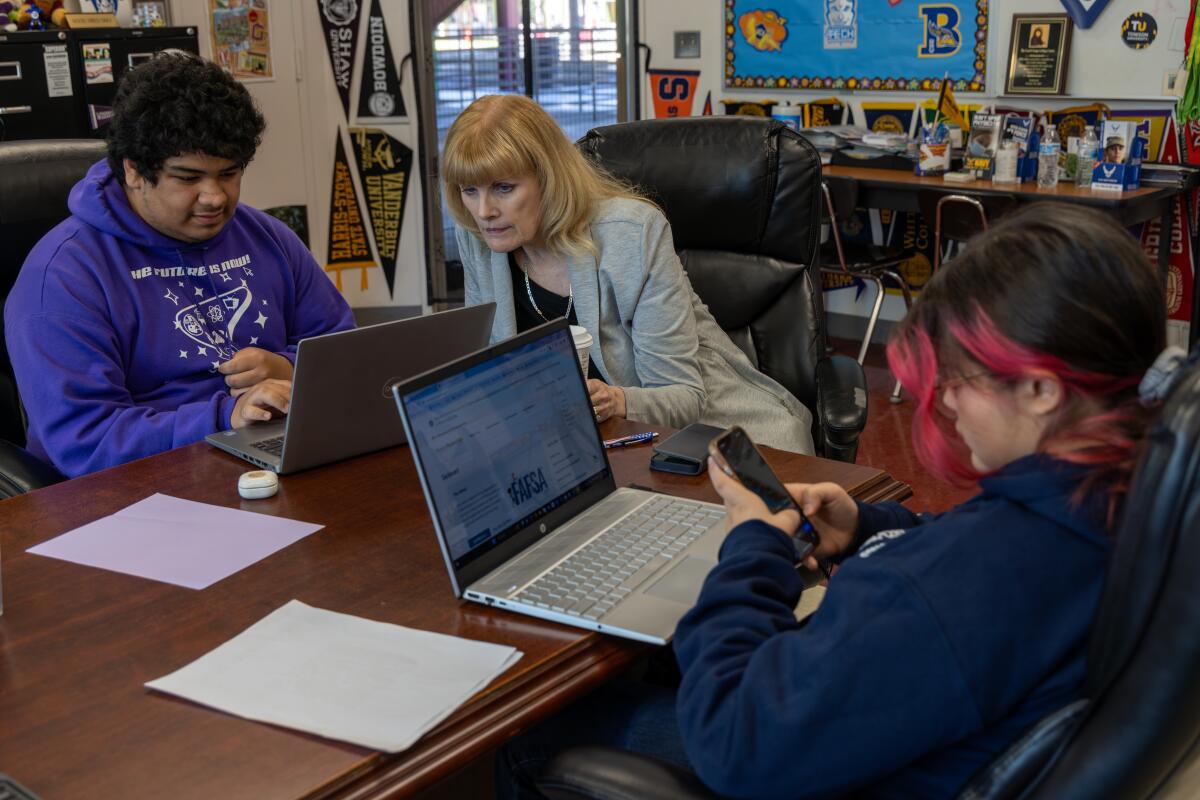

At Downtown Magnets High School, Hero Khun is the son of Cambodian immigrants without college degrees who opened a doughnut shop in 2019. When the pandemic hit and campuses closed, he would wake up at 4 a.m. and help them until online classes started at about 8 a.m. He still works on weekends while juggling a rigorous course load of Advanced Placement classes; he currently has a 4.0 GPA and dreams of becoming a physical therapist.

Hero said he misunderstood one question and wrongly reported that his parents were unwilling to share financial information. But he can’t get back into his account to fix the error until mid-March, when the FAFSA portal will accept corrections. He worries that might be too late to position him for a strong financial aid package should he be admitted to his top choices — USC and Occidental.

“It’s kind of worrying because a lot of schools wanted the FAFSA information early on, and I can’t do anything about it now; I just have to wait,” he said.

For Zoe Jeronimo, a senior at Blair High in Pasadena, financial aid will be crucial to attending college at all. Her father is a gardener; her mother a homemaker who raises three children and finds some work as a housekeeper.

Neither of her immigrant parents attended college or speaks fluent English, leaving Zoe to navigate the college-application process on her own, with help from counselors.

She’s spent parts of about 15 days attempting to complete the form, but the system still won’t let her complete the form on behalf of her father. A high-achieving student with a passion for biology — and an internship at Huntington Hospital Medical Research Institutes under her belt — Zoe worries that the delay could crush her college dreams.

“Filling out the FAFSA has been like a really scary thing and worrisome because my father and my mother and I keep thinking: What if I got accepted to a school I really wanted, like UCLA, but can’t afford it?”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.