Op-Ed: Founding Fathers as Founding Debtors: How some of them used slaves as collateral

Americans remain largely unaware that many of the famous Founding Fathers were deeply in debt. Some of them, including Thomas Jefferson, attempted to forestall foreclosure by using their slaves as collateral. Using human beings to back debt was refined in the years following 1776 — and it helped jump-start our American financial system.

Slave-backed debt was a depravity that treated Black men and women as fodder whose only worth was the wealth they generated for others. In honor of Independence Day, let’s look at the founders as debtors, especially at a time when so many Americans are in debt from a pandemic that has left them unable to pay their rent, mortgage and credit card bills.

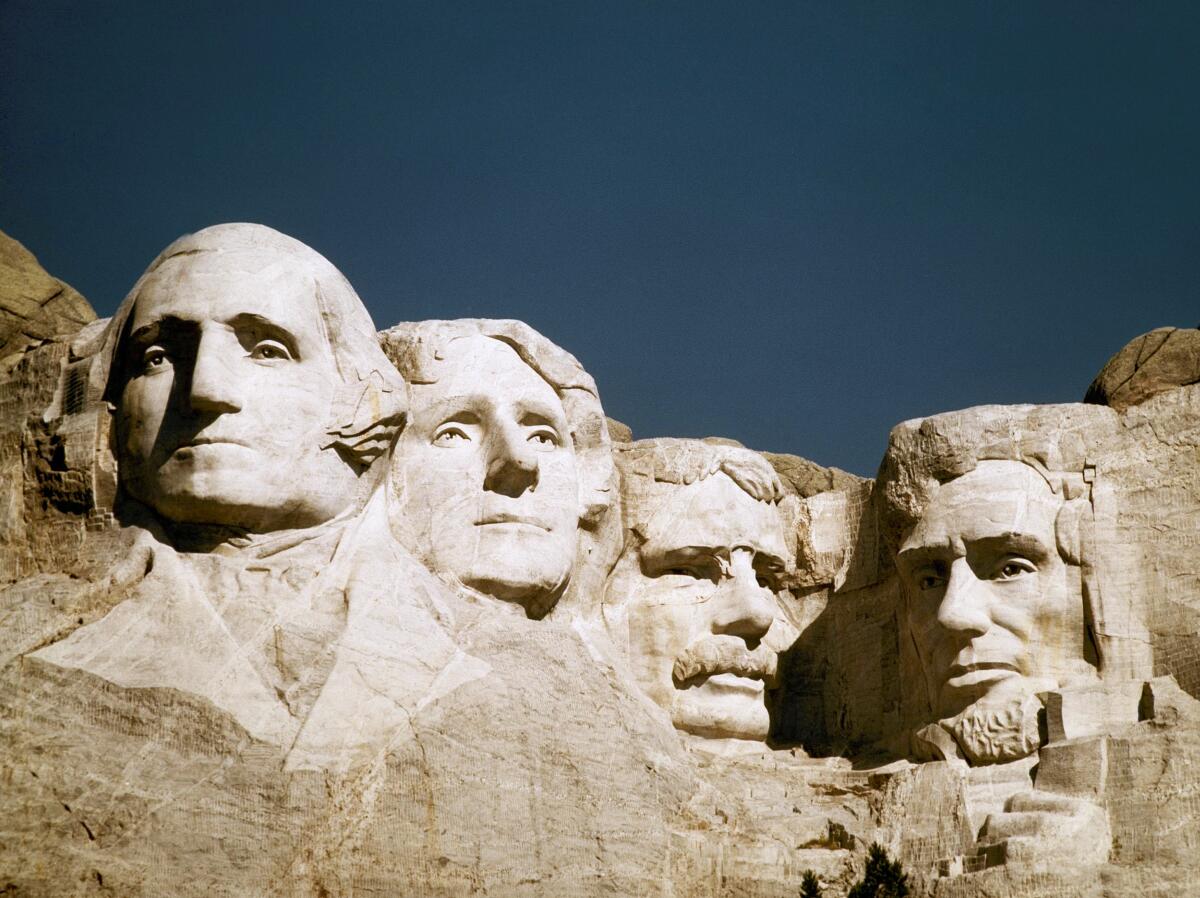

Thomas Jefferson died July 4, 1826, nearly $2 million in debt in today’s dollars. Mount Vernon, George Washington’s tobacco-based estate, failed to keep Washington out of debt, so he switched to wheat in the 1760s, though his debt lingered throughout the Revolutionary War and his presidency.

How the founders got into debt was simple. Each year they sold their tobacco to European merchants (mainly British), primarily in exchange for the goods that supported their lavish lifestyles. As tobacco prices fell, but their desire for material comforts remained, they paid for that lifestyle on credit extended by many of the same merchants.

Before the Revolutionary War, economic conditions in Europe squeezed British merchants, who in turn squeezed American planters for debt repayment. This pushed some American planters into financial collapse and others, like Jefferson and Washington, to the brink of financial ruin. Some slaveholding planters even complained of enslavement to British creditors.

The patricians of July 4 bristled at their independence being clipped by British creditors — and that independence being so deeply predicated on tobacco, their main way of raising the money owed to those creditors. Tobacco was demanding to grow, and without slaves to raise their crops, Jefferson, Washington and other planters would have been far too busy farming to have had the leisure to contemplate the lofty ideals of liberty.

In this way, liberty was tied directly to slavery. Although it would be incorrect to say that the founders went to war with Britain just to get out from under debt, their mounting debt predisposed them to be open to the idea of separating from Britain, resulting in the Declaration of Independence and the Revolutionary War.

In the years following America’s victory in that war, deep debt continued to hang over Jefferson. He sought repayment plans with his European creditors and used his slaves, whom he listed by name, as collateral against that repayment. In this regard, Jefferson was at the leading edge of a blossoming trend. Although tobacco eventually yielded to cotton, an entire financial services industry emerged from slaved-backed loans before the Civil War — through what one economic historian called an “orgy of bank-creation.”

For much of American history the founding generation, often mythologized and capitalized as the Founding Fathers, served as the gold standard against which we measured the debased currency that came after them.

Citizens’ Bank and Canal Bank of Louisiana, which both ultimately merged into J.P. Morgan, accepted approximately 13,000 slaves as collateral for loans between 1831 and 1865. When some of those loans defaulted, the bank ended up owning approximately 1,300 slaves. The Bank of Charleston, which eventually became part of Wells Fargo, also accepted slaves as collateral on loans. So did the Commonwealth Bank of Kentucky, which still exists today.

Planters opened new Southern banks. They drew up lists of slaves as collateral, then had those banks issue loans to members to buy more land and more slaves. Capital for these loans was raised by selling bonds to investors worldwide, in London, New York, Amsterdam and Paris — many places where slavery was illegal.

But investors didn’t own individual slaves, they owned bonds backed by the slaves’ value. Of course, then insurance was needed on the slaves who backed the bonds that investors purchased to provide loans for planters to buy more land and slaves. Aetna, AIG, New York Life and many others stepped up to provide that insurance.

“The infant American financial industry,” wrote historians Edward E. Baptist and Louis Hyman, “nourished itself on profits taken from financing slave traders, cotton brokers and underwriting slave-backed bonds.” Black Americans, and their descendants, never recouped anything from a financial system built on their bodies.

Today, many white Americans claim no hand in slavery or the brutalization of Black Americans. Their forebears immigrated to this country well after slavery ended, they say, and they worked hard, accruing no privilege or wealth. Yet, anyone who’s ever bought a home on a mortgage, a car on installment, invested in the stock market, bought insurance or opened a savings account has enjoyed systemic privilege.

The institutions used in these transactions were built on the bodies of Black men and women who never accrued anything from the enormous wealth they generated. Family wealth is accrued over many generations, and most Black families were never afforded an opportunity to build it, even though they helped build wealth for many others. This makes a strong case for reparations.

Before that can happen — and in the name of the Founding Debtors — the federal government should at least extend the eviction moratorium and provide debt relief for the millions behind on rent and mortgage until well after the pandemic is over and a full recovery is underway.

Clyde W. Ford is the author of the forthcoming “Of Blood and Sweat: Black Lives, and the Making of White Power and Wealth.” He is a contributing writer to Opinion.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.