FTX founder Sam Bankman-Fried acknowledges in court that customers were hurt but denies fraud

FTX founder Sam Bankman-Fried testified at his New York trial Friday, denying that he defrauded anyone but acknowledging that the innovative business he had hoped would move the cryptocurrency ecosystem forward ended up hurting customers instead.

The onetime cryptocurrency golden boy lost his businesses and his reputation as a pioneering entrepreneur in an emerging facet of finance when a rush of customers withdrew their money last year, exposing that billions of dollars were missing.

Bankman-Fried, 31, acknowledged some of his failures early in his testimony in federal court in Manhattan, saying he made mistakes, large and small.

“We thought we might be able to build the best product on the market” and move the cryptocurrency system forward, he said.

“It turned out basically the opposite of that,” and a lot of customers and others got hurt, Bankman-Fried said.

Asked by his lawyer, Mark Cohen, whether he defrauded anyone or took customers’ funds, Bankman-Fried answered, “No, I did not.”

Sam Bankman-Fried got a test run at testifying at his criminal trial when a judge sent jurors home but let him demonstrate portions of his testimony.

Mostly unemotional on the witness stand, Bankman-Fried noted at one point in his testimony: “I don’t tend to show a lot of freakoutness.”

As the day wore on, the testimony focused more on what happened as Bankman-Fried’s businesses sank deeper into debt, even as he spent hundreds of millions of dollars on marketing that included a 2022 Super Bowl commercial featuring comedian Larry David, a partnership with quarterback Tom Brady and a firm that linked him to celebrities.

Bankman-Fried said he was “very surprised” when he learned that debts at Alameda were much larger than he had assumed.

Cohen said after testimony concluded for the day that he expected to continue questioning his client until midday Monday. A prosecutor said cross-examination would probably continue into Tuesday and the judge suggested that the jury might not get the case until next Friday or the following Monday.

The California entrepreneur has pleaded not guilty to conspiracy charges accusing him of diverting billions of dollars from his clients and investors to make risky investments, buy luxury housing, engage in a star-studded publicity campaign and make large political and charitable donations.

His much-anticipated testimony became the centerpiece of a defense that has tried to convey that Bankman-Fried had no criminal intent as he took actions that prosecutors say were directly to blame for the collapse last November of businesses Bankman-Fried began creating in 2017 and eventually ran from the Bahamas.

During more than five hours of testimony Friday, Bankman-Fried told the jury that when he started his first company, Alameda Research, in 2017, he knew almost nothing about cryptocurrency beyond what a bitcoin was.

Most of the testimony focused on the explosive growth and collapse of FTX and Alameda, but Cohen occasionally strayed into asking about his client’s personal life and quirks, including his penchant for wearing casual clothing and letting his hair grow long.

Bankman-Fried also blamed himself for the breakdown of his on-and-off romantic relationship with Caroline Ellison, Alameda’s chief executive, saying, “I didn’t have the time or the energy to put in what I think she wanted from a relationship.”

“It’s not something I’ve been great at, being able to sustain a romantic relationship for a long period,” he said.

When the jury was shown a photograph of Bankman-Fried with a deck of cards, he explained that he used them to satisfy his urge to “compulsively fidget with things” — a habit from his college years that grew so severe that he said he’d wear out a deck in a week. He has since switched to fidget spinners.

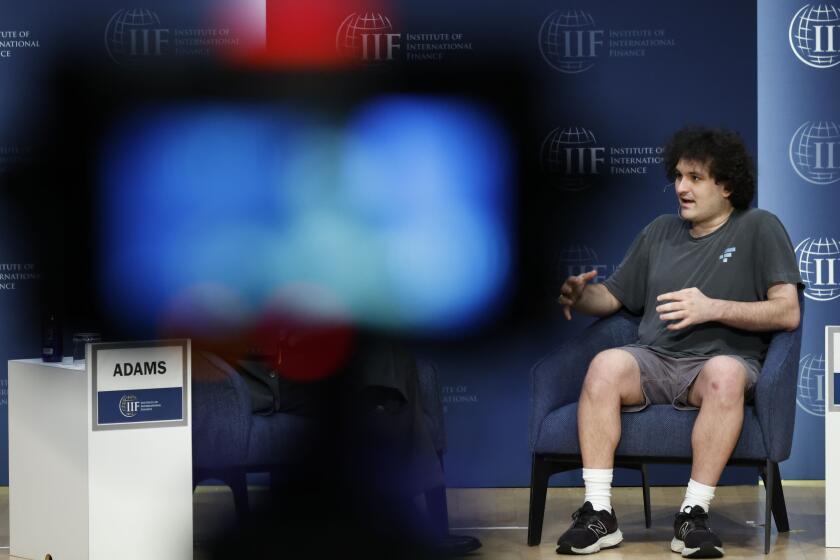

He described himself as “somewhat introverted naturally,” but explained that he accidentally became the face of FTX when several interviews “ended up going better than I thought they would.”

He said he testified three times before Congress in an effort to persuade legislators to create cryptocurrency regulations that would allow products to be marketed directly to Americans.

As requests for interviews became overwhelming, “It was too late to find a new public face for the company. I was the public face,” he said.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

As to why he so frequently wore shorts and T-shirts, Bankman-Fried, wearing a suit and tie in court, said he found them comfortable. As for his scattered long hair, he said: “I was busy and lazy and didn’t bother getting haircuts for long periods of time.”

Before Bankman-Fried began testifying Friday, Judge Lewis A. Kaplan mostly shut down his lawyers’ attempts to suggest to jurors that Bankman-Fried made many decisions about his businesses after consulting with lawyers.

After the jury was sent home Thursday, Bankman-Fried testified in front of the judge about his communications with lawyers as he built his cryptocurrency empire.

“That evidence would, in my judgment, be confusing and highly prejudicial by falsely implying, given testimony yesterday, that lawyers with full knowledge of the facts — all of the facts — blessed what the defendant is alleged to have done. And I didn’t hear that at all yesterday,” Kaplan said.

He did, though, grant a defense request to permit testimony about the involvement of lawyers in data retention policies at Bankman-Fried’s businesses that required the frequent deletion of some communications.

Bankman-Fried was extradited from the Bahamas to New York in December to face fraud charges.

Though he was initially granted a $250-million personal recognizance bond and allowed to live with his parents in Palo Alto, the bond was revoked in August and he was jailed when Kaplan concluded that he had tried to influence potential witnesses at his upcoming trial.

Prosecutors built their case against Bankman-Fried for three weeks, relying largely on his former top executives, an inner circle of individuals who shared a penthouse apartment in the Bahamas with Bankman-Fried.

The executives testified that Bankman-Fried directed them to spend billions of dollars taken from the accounts of FTX customers and funneled through Alameda Research, a hedge fund he started two years before he created the FTX cryptocurrency exchange.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.