How to roll over your 401(k) into an IRA

Dear Liz: My question relates to 401(k) rollovers. Are there different tax implications when it comes to rolling the money into a traditional IRA versus a traditional IRA brokerage fund? I’ve always associated the word “brokerage” with after-tax dollars.

Answer: Financial terms can get confusing, so let’s start with the basics. Both 401(k)s and IRAs are tax-advantaged accounts that allow you to save for retirement. Employers offer 401(k)s, but you can open an IRA at a brokerage, bank, credit union, mutual fund company or robo advisor, among other providers. Some people liken 401(k)s and IRAs to buckets that receive your retirement funds, while the providers are where you store the bucket.

If you leave the employer that offers your 401(k), you have the option to roll your account into an IRA so your money can continue to grow tax-deferred. (You often have other options, such as leaving the money in your former employer’s plan or rolling it into a new employer’s plan.)

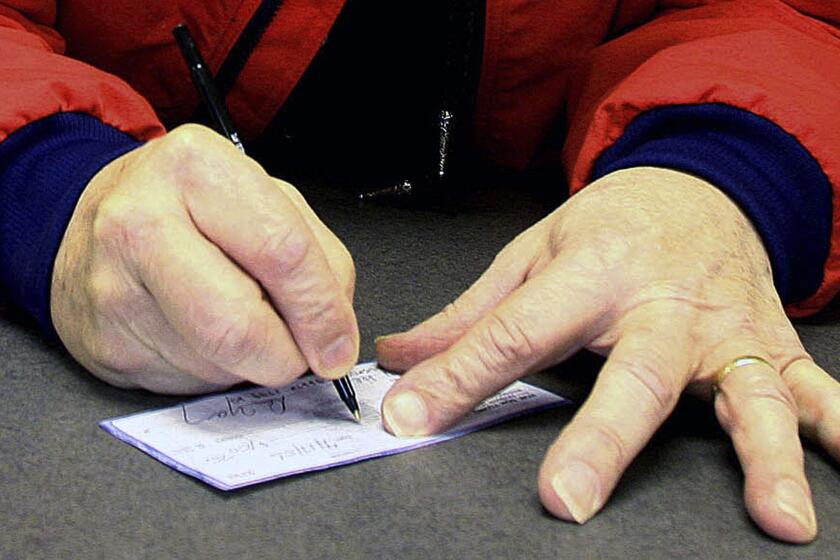

When you arrange a direct rollover, the money goes straight from the 401(k) to the IRA provider and no taxes will be withheld or charged. By contrast, if you opt to have a check sent to you rather than the IRA provider — something known as an indirect rollover — 20% of your funds will be withheld for federal taxes.

If you want to avoid those taxes and have your money continue to grow tax deferred, you’d have to deposit the check into the IRA within 60 days and come up with that 20% out of your own pocket. You’d get the money back in the form of a tax credit once you file the tax return for that year, but clearly the simpler, better way is to make the rollover a direct one.

If you report check fraud to your bank promptly — typically within 30 to 60 days of your statement date, depending on state law — then you should be made whole.

About those annoying online payment fees

Dear Liz: In a recent column you wrote about the importance of paying online and the dangers of writing checks. Why does paying online come with a fee? Is it really justified to pay a “technology fee” of $12 to pay my insurance bill online? It seems to me that it should be faster and easier for the recipient if I pay online, and that NO fee is the correct amount.

Answer: Agreed. “Pay to pay” fees are annoying. It’s one thing if an entity is passing on a small transaction cost, like the 2% or 3% that payment networks may charge to process your credit or debit card payment. It’s quite another when a company charges “convenience fees” simply for accepting online payments, when such payments are far safer and more secure than sending checks through the mail. To be clear, most companies don’t charge such fees but some insurers have been slow to join the 21st century.

You may have other options. Your insurer’s site may allow you to set up automatic payments that come directly from your checking account. Or your bank’s online bill pay may have an option to send electronic payments directly to the insurer from your account.

If not, and your only safe option is to incur the fee, it’s probably time to shop for a better insurer.

We’re talking taxes. We know, please hear us out.

Dear Liz: I’m a CPA and your answer about paying taxes electronically was spot-on. But there’s a pro tip you might share: I advise all my clients to establish accounts with the IRS and their state tax authority. That allows my clients to schedule payments more easily with a single log-on (rather than having to validate each time with prior year tax information). Such accounts also provide ready access to payment history, making it easier to share that information with me at tax time.

Answer: That’s an excellent suggestion. The IRS’ Direct Pay service offers a free, secure way for people to pay annual and estimated taxes from their bank accounts without having to register in advance. The IRS also provides an option to pay with credit or debit cards, for a fee.

Creating an IRS online account allows you to see amounts you owe, past payments and any scheduled payments, plus you can make a same-day payment from your bank account. You can view details of your most recent tax return, get instant access to tax transcripts and authorize your tax pro to represent you if there’s a problem. In fact, many tax pros recommend setting up an account just in case you get audited or run into other problems, rather than waiting to do it while under duress.

You’ll need a valid email address, a mobile phone number, identification such as a passport or driver’s license and your Social Security or tax identification number. The process typically takes 15 to 30 minutes to complete.

Liz Weston, Certified Financial Planner, is a personal finance columnist. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.