Apple may have just lost big at the Supreme Court

The Supreme Court on Tuesday allowed a court order to take effect that could loosen Apple’s grip on its lucrative iPhone app store, potentially siphoning billions of dollars away from one of the world’s most profitable companies.

The justices rejected Apple’s appeal of lower-court rulings that found some of Apple’s app store rules for apps purchased on more than 1 billion iPhones constitute unfair competition under California law.

The appeal stemmed from an antitrust lawsuit filed in 2020 by Epic Games, maker of the popular “Fortnite” video game. Epic lost its broader claim that Cupertino, Calif.-based Apple was violating federal antitrust law, and the justices also rejected Epic’s appeal Tuesday.

But in turning away Apple’s effort to maintain exclusive control over in-app payments, the court lifted a hold on an order to allow app developers throughout the U.S. to insert links to other payment options besides Apple’s own within iPhone apps. That change would make it easier for developers to avoid paying Apple’s commissions ranging from 15% to 30%.

Those fees have turned into a significant part of Apple’s services division, which generated $85 billion in revenue during the company’s last fiscal year that ended in September. The specter of consumers being able to defect to other payment channels for in-app transactions is one of several factors that has been weighing on Apple’s stock, which has declined 5% so far this year.

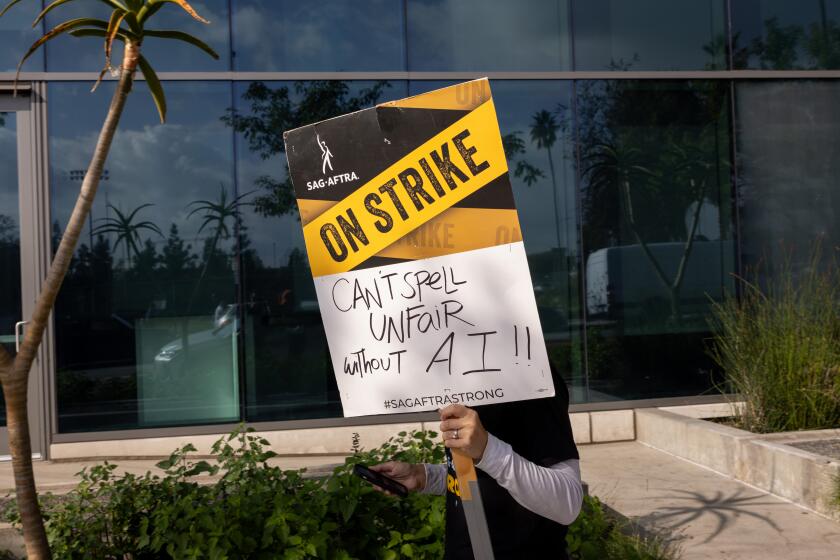

A new deal between the actors’ union and an AI startup opens the door for performers to make and license “clones” of their voices for video games and other digital projects.

The drop has enabled longtime rival Microsoft to eclipse Apple as the world’s most valuable company. Apple’s shares dipped 1% on Tuesday, leaving the company with a market value of slightly more than $2.8 trillion. Microsoft, whose stock has edged up 4% so far this year, is valued at $2.9 trillion.

Besides the possibility of the Supreme Court refusing to consider the payment issue in the Epic case, investors also have been fretting about new European regulations scheduled to take effect in March that also could force Apple to allow alternate payment methods inside iPhone apps. Apple has staunchly resisted taking down the barriers, saying doing so would weaken iPhone security.

Epic, based in Cary, N.C., had claimed that Apple’s app store — which was launched in 2008, a year after the first iPhone went on sale — had turned into an illegal monopoly that stifles innovation and competition while generating billions of dollars in profit for Apple. Although a federal judge rejected the assertion that Apple had a monopoly on mobile apps, she concluded consumers should have more discretion in how to pay inside apps.

Apple didn’t immediately respond for comment on the Supreme Court’s rebuff or how it would adopt the September 2021 ruling handed down by U.S. District Judge Yvonne Gonzalez Rogers.

In a series of posts Tuesday on the X social media platform, Epic Chief Executive Tim Sweeney called the Supreme Court’s denial a “sad outcome for developers” while also applauding the prospect of enabling consumers to see “better prices on the web.”

ChatGPT and other generative AI applications rely on copyrighted material to do what they do. But rather than compensate creators, the companies are turning to one of Silicon Valley’s most reliable playbooks.

Back in August 2020, Epic tried to offer an alternative way to get its mobile app, attempting to evade Apple’s commissions charged when digital goods were purchased by players on “Fortnite” and other games.

Apple ousted Epic from its app store after it tried to get around Apple’s restrictions.

Although it lost most of its claims in the Apple case, Epic last month won a jury trial against Google and its Play Store for apps on Android phones in a lawsuit mirroring its action against Apple. A federal judge still must determine what changes Google will have to make to its Play Store.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.