Westfield malls go up for sale as U.S. shoppers find other places to buy

The owner of Westfield malls, familiar to passersby for decades for their bright-red logo signs, plans to sell all its properties in the U.S. as pandemic fears have sped changes to how people shop.

Among the company’s malls in the Los Angeles area are such high-profile properties as Westfield Century City, Westfield Santa Anita in Arcadia and Westfield Topanga & the Village in Warner Center.

Unibail-Rodamco bought Westfield Corp. for nearly $16 billion four years ago. Unibail-Rodamco-Westfield, as the Paris company is now known, intends to bet its future on Europe, where it is the largest owner of shopping centers.

All 24 U.S. malls are to be sold by 2023, Chief Executive Jean-Marie Tritant told investors last week. The company will become a “focused, European pure-play,” he said.

Tritant didn’t elaborate on whether the Westfield malls might be sold together or individually, and company representatives declined to comment further on the planned property divestment.

Unibail’s exit is not a complete surprise. In reporting its 2020 results, Unibail said it would “significantly reduce financial exposure” in the U.S. in the near future.

“We understood there was a desire to get out of the U.S.,” competing shopping center owner Sandy Sigal said, but “they could have kept a couple of trophy assets.”

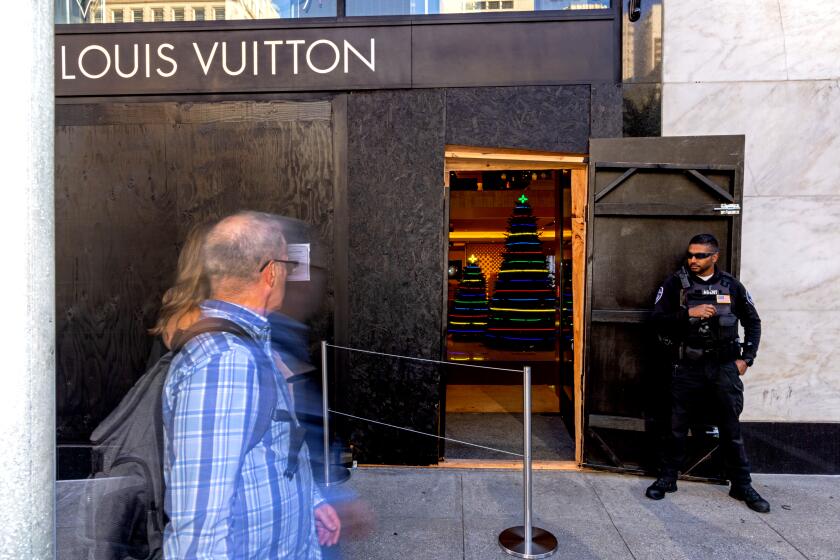

Industry groups and politicians are sounding alarms over the thefts. But in some cases, the statistics they cite are inflated or flat-out wrong.

New ownership might be good for shoppers at some malls, said Sigal, president of NewMark Merrill Cos., which is based in Woodland Hills.

“Real estate really is a local business,” he said, and with local owners “you wind up with tenants more relevant to that community” as well as malls that are physically and socially more reflective of their neighborhoods. “It’s much more on-point when you’re owned by a local.”

Unibail valued its U.S. malls at about $13.2 billion last year but has not said how much it hopes to get for them now. Real estate analyst Green Street valued them at more than $11.4 billion.

“They are top-quality malls” and should be sought after, said Dirk Aulabaugh, global head of advisory services at Green Street. The price of the entire portfolio might be too steep for a single buyer such as another mall company, though some may try.

“It’s doable,” he said of a portfolio sale, but “most likely they would break it into smaller chunks more digestible by the market.”

Shopping habits have been changing for decades, with conventional malls that sprang up across the country in the latter 20th century losing their once-firm grip on consumers.

Growing online sales have chipped away at mall profits for years, but the COVID-19 pandemic drove people out of public spaces and further increased their interest in grabbing many goods from home with clicks and taps, San Francisco Bay Area real estate consultant David Greensfelder said.

Therabody plans several Reset wellness centers with exotic physical treatments used by pro sports teams such as cryotherapy and hyperbaric chambers as more e-tailers head for malls.

The country has too many malls and the industry has “been in a tremendous period of consolidation,” he said. “COVID just sped that up.”

In general, people are shopping either for commodities that are widely available or for specialty items they put thought and care into acquiring, Greensfelder said.

“Commodity is everyday,” he said. “Specialty is the stuff you splurge on, with more of an emotional connection.”

Malls that sell mostly commodities, including many Westfield malls, are having a tough go, he said. Westfield does, however, have a handful of the country’s top specialty malls, including Valley Fair in Santa Clara and Century City, where the previous owner completed a $1-billion makeover in 2017.

“These are absolutely ‘A’ malls because they are able to differentiate themselves and have compelling tenant mixes,” he said. “All the rest are either treading water or slowly sinking.”

Those Westfield malls, however, offer “huge” opportunities to investors “because they are incredibly well-located,” he said. They could be repurposed for other uses or redeveloped into mixed-use complexes with stores, offices and apartments.

The Sherman Oaks Galleria, for instance, was a national icon of 1980s teenage mall culture, immortalized in the Frank and Moon Zappa song “Valley Girl” and films such as “Fast Times at Ridgemont High.” It shut down in 1999 because of flagging sales. A new owner redeveloped the once-vast mall in the early 2000s as a smaller open-air shopping and entertainment center with adjoining office space for rent.

Last month Unibail-Rodamco-Westfield said it had sold the former Promenade mall in Warner Center for $150 million to investors believed to be associated with the Rams. The team may build a practice facility there and set up other operations.

Unibail-Rodamco-Westfield’s U.S operation has value beyond its real estate, competitor Sigal said.

“They’re leaders in tech and marketing,” he said, “with very good people as an organization. My hope is that they would stay together in some fashion, owned by a domestic operator.”

If that happens, the brand’s familiar red logo may live on for years to come, he said. “You could still see those signs, I hope.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.