Shopping mall giant Westfield being sold to French real estate firm in $16-billion deal

Westfield Corp., which operates upscale shopping malls in Los Angeles and in dozens of other U.S. cities and in Britain, agreed to be acquired for nearly $16 billion by French commercial real estate giant Unibail-Rodamco, the companies said Tuesday.

The deal underlined how even operators of marquee malls are not immune from the seismic shift occurring in retail, where consumers worldwide are increasingly moving more of their shopping to online sites such as Amazon.com and away from physical stores in malls and elsewhere.

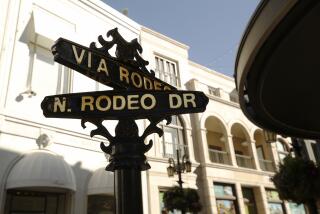

Westfield, based in Australia, owns 35 malls, including its Century City shopping center, which recently completed a $1-billion makeover.

Westfield’s other area properties include Topanga & the Village in Canoga Park, Fashion Square in Sherman Oaks, Westfield Culver City, Westfield Santa Anita in Arcadia, and malls in Santa Clarita and in the San Diego area.

Unibail-Rodamco operates 69 shopping centers in major European cities including Paris, Madrid, Stockholm, Amsterdam and Munich, Germany, and it’s developing malls in Brussels and Hamburg, Germany.

The new company will be based in Paris and Amsterdam, with regional headquarters in Los Angeles and London.

“The industry is under severe pressure from internet selling and particularly Amazon,” said John Colley, a professor at Britain’s Warwick Business School, in an email. “Clearly there are significant savings as the new enterprise will need only one head office, board, systems and functional management.”

Hundreds of bricks-and-mortar stores — especially department stores, apparel-heavy outlets and sporting goods stores — already have closed in the United States in the last year as foot traffic has fallen. That has put pressure on mall operators to fill the vacancies, especially for outlets that serve as anchor stores.

That pressure had resulted in Westfield’s shares falling about 9% this year before the merger announcement, and it has sparked the consolidation trend among mall operators seeking heft and cost efficiencies.

The proposed merger “creates a strong and attractive platform for future growth,” Unibail-Rodamco Chief Executive Christophe Cuvillier said in a statement.

The deal also is an opportunity for billionaire Frank Lowy, Westfield’s 87-year-old chairman, to turn over his company in order to cash out a major part of his family’s 9.5% ownership in Westfield.

Another major U.S. mall owner, GGP Inc. — whose holdings include the Glendale Galleria — last month received a $14.8-billion takeover bid from the real-estate property company Brookfield Property Partners for the roughly two-thirds of GGP it doesn’t already own. GGP has rejected the bid, Bloomberg reported this week.

And New York hedge fund Third Point Ventures disclosed last month that it had acquired a 1.3% stake in Macerich Co., a Santa Monica-based mall operator that owns more than 40 properties nationwide, including Santa Monica Place and the Westside Pavilion.

The hedge fund is run by activist investor Daniel Loeb, who pushes for shake-ups and sales at distressed companies. Macerich had seen its stock decline by almost a quarter this year before the stake was disclosed. Shares have since risen more than 10%.

The worldwide consolidation trend indicates “the shopping center industry is definitely coming to a different point in its maturity,” said David Gorelick, head of retail in the Americas for real estate brokerage Cushman & Wakefield.

“Institutions that are best in class are looking to acquire other shopping centers in different regions and leveraging their capabilities,” Gorelick said.

Shopping center magnate Rick Caruso, who operates the Grove, Americana at Brand and other outdoor retail centers in Los Angeles County, said indoor malls are often too formulaic and losing their appeal.

“The indoor mall is dying,” he said. “It’s antiseptic and cold. Smarter stores will no longer be in indoor malls.”

He said that the Lowy family recognized the challenges and that is why it decided to sell now, despite Westfield’s depressed stock price.

Unibail-Rodamco agreed to pay $7.55 in cash and stock for each share of Westfield. The deal was approved by both companies’ directors but remains subject to approval by the firms’ shareholders. The merger is expected to close in the first half of next year.

Westfield began in 1959 when Lowy and his partner John Saunders opened a shopping center in Sydney, Australia. The company’s Australian and New Zealand holdings were spun off into a separate company in 2014.

Lowy, a Holocaust survivor from Czechoslovakia, has a net worth of $5.9 billion, according to Forbes. He served as Westfield’s chief executive for more than 50 years before becoming nonexecutive chairman in 2011. He was knighted by Queen Elizabeth II this month for his contributions to the United Kingdom’s economy and for his philanthropy.

Lowy will retire as Westfield’s chairman after the merger, and his sons Peter and Steven will step down as Westfield’s co-chief executives. Frank Lowy will become chairman of a newly created advisory board and Peter Lowy, who is based in Los Angeles, will be appointed to the company’s ruling supervisory board.

The Lowys already had made substantial investments in Southern California that altered and elevated Westfield’s retail presence in the face of slumping mall traffic industrywide.

The upgrade at Westfield Century City, an outdoor mall, included more than 200 mostly new shops and restaurants, along with such touches as a VIP service offering private lounges and elevators to stores.

Only about half of the three-level mall is dedicated to fashion, with the other half split between eating and drinking and a range of other uses — such as a gym and a health clinic — that have little to do with shopping.

In the San Fernando Valley, Westfield plans a $1.5-billion project to replace its obsolete Promenade shopping mall at Warner Center with an expansive mixed-used complex with nearly 1,500 residences, shops, two hotels and a concert venue.

The development would be an extension of Westfield’s $350-million Village at Topanga “lifestyle center” that opened nearby last year.

And in Arcadia, Westfield Santa Anita has tried to evolve with its neighborhood by steadily bringing in retailers and restaurants that cater to the area’s well-heeled Asian community. That effort followed a $20-million face-lift to the mall that was completed in 2014.

Staff writer Jim Puzzanghera contributed to this story.

UPDATES:

5:18 p.m.: This article was updated with comments from Los Angeles shopping center developer Rich Caruso.

2:15 p.m.: This article was updated with comments from David Gorelick of Cushman & Wakefield and additional details about the deal and mall-operator consolidation.

11:35 a.m.: This article was updated with details about an activist investor’s interest in mall operator Macerich and details about Westfield’s revamping of several Southern California malls.

10:50 a.m.: This article was updated throughout with additional details about the merger, the state of retailing and consolidation among mall owners.

9:25 a.m.: This article was updated to include that the merger is being proposed and still subject to shareholder approval.

8:05 a.m.: This article was updated with additional background about the companies.

This article originally was published at 7 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.