Column: Did drug makers really stand up to Trump over those ‘Trump card’ discounts? Doubtful

Few industries have a harder time securing positive PR than America’s drug makers. So you should take with a heap of salt the recent report about how they took a moral stand against President Trump.

According to the report in the New York Times the industry was on the verge of agreeing to reduce consumer drug costs by $150 billion until the Trump White House went a step too far.

The White House, it says, insisted that the industry pay for $100 cash discount cards to be mailed to Medicare enrollees ahead of the November election.

We could not agree to the Administration’s plan to issue one-time savings cards right before a presidential election.

— Priscilla VanderVeer, spokeswoman for the drug lobby Phrma

But the drug companies, sensitive as they are to the enduring principles of democracy, weren’t about to lend their credibility to a shabby partisan stunt. That’s their story, anyway.

“We could not agree to the Administration’s plan to issue one-time savings cards right before a presidential election,” Priscilla VanderVeer, spokeswoman for the drug industry lobby Phrma, told me by email. Some were even labeling the savings cards “Trump cards.”

Should you buy this narrative? Probably not.

Kevin Drum of Mother Jones, who is second to none among economic commentators in deconstructing suspect math in official declarations, subjected the report to painstaking analysis and makes a compelling case that too much of it fails to pass the smell test.

As Drum points out, the Times description of this supposed agreement is rather murky. It doesn’t specify, for example, the period over which the $150 billion in savings was to occur. If the savings were to take place in a year, that would be more than twice the industry’s estimated annual profits in the U.S., which generally fall in the neighborhood of $60 billion.

Despite Trump’s claims, prescription drug prices are still rising.

Would Big Pharma really eradicate more than two years of U.S. profits just to make a deal with Trump? Doubtful. And why, he asks, would the industry balk at a Rose Garden event celebrating the $100 discount cards, which would come to $6 billion if all 60 million Medicare enrollees used them, but not balk at a ceremony celebrating a $150-billion deal?

“A Rose Garden event sounds pretty good!” Drum writes. “Does anyone really believe that it was because they were squeamish about helping the president shortly before an election? That doesn’t seem much like the pharma industry we all know and hate, does it?”

Based on the negotiations over drug pricing that supposedly went on between the industry and the White House over the last year or so, it’s more likely that the deal would have yielded $150 billion over 10 years — that’s how the savings in previous iterations of the talks were calculated.

In any event, no one should buy the idea that even a $150-billion agreement would have yielded close to that figure even over time. The drug industry has been painstakingly adept at fighting efforts to impose price reductions on its products, and it’s unlikely that it would capitulate now under any circumstances, especially with a president whose grip on his office may end Jan. 20.

The New York Times didn’t reveal its sourcing on its story, but based on the time-honored principle of “who benefits,” it’s not hard to glean that the leak came from the industry.

The giant drug company Pfizer seemed to hand President Trump a big win Tuesday when it announced it would roll back a slate of price increases that took effect July 1.

The story makes the industry look good at the expense of the White House. It’s reasonable to conjecture that the drug makers knew these talks were going nowhere and that Trump would try to blame them for any breakdown, so they stole a march on the White House by putting out their own version first.

Now let’s look at the broader context.

First, by all previous accounts, talks between the industry and the White House aimed at cutting prescription costs had reached an impasse in July. The last mentions of any meetings between Trump and pharmaceutical industry executives ended in late July.

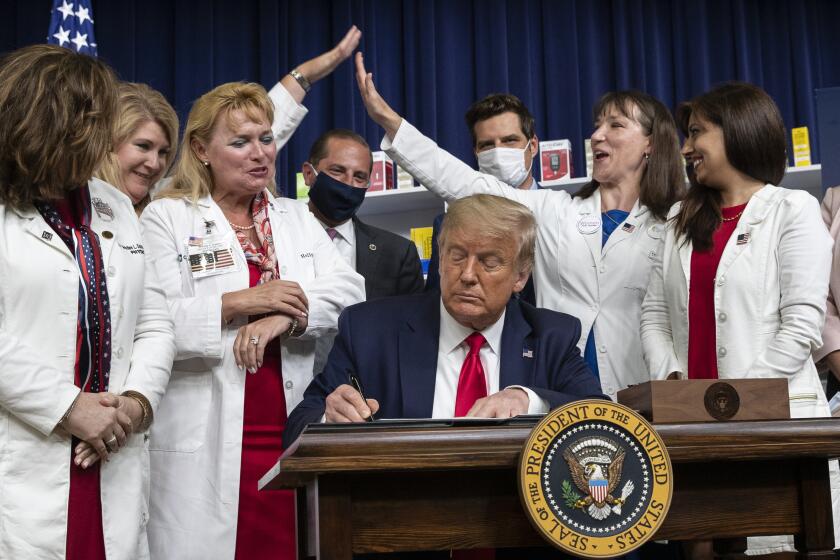

Trump had signed four executive orders regarding drug prices July 24, but withheld details about one, which would base U.S. prices on the best prices obtainable in a roster of foreign countries — a concept known as “most favored nation.” Trump said at the executive order signing that he was looking ahead to a meeting with industry executives scheduled for July 28.

But that meeting never happened. Trump issued the order Sept. 13, drawing an instant broadside from Phrma President Stephen J. Ubl. He called it “an irresponsible and unworkable policy that will give foreign governments a say in how America provides access to treatments and cures for seniors and people struggling with devastating diseases.”

Ubl blamed pricing issues in the U.S. on “misaligned incentives in the pharmaceutical supply chain.” His reference was to middlemen such as pharmacy benefit managers, a common target of the manufacturers. Instead of pursuing reforms in the supply chain, Ubl said, “the White House has doubled down on a reckless attack on the very companies working around the clock to beat COVID-19.”

For a time, at least, the administration and industry had spoken with a single voice about the supposed depredations of the middlemen. In a speech in February 2019, Health and Human Services Secretary Alex Azar had assailed “pharmacy benefit managers who receive tens of billions of dollars in rebates without patients ever knowing where the money goes.”

The big drug company Merck, scurrying to get on President Trump’s good side on drug prices, announced Thursday a raft of initiatives aimed at showing its “commitment to responsible pricing.”

Azar was vague about the magnitude of this diversion. He said that each year, more than $150 billion in rebates was sloshing around that system — there’s that $150-billion figure — but also that the rebates in Medicare Part D, which covers prescription drugs administered at home rather than a doctor’s office, came to $29 billion a year.

At the time of Azar’s speech, the administration had just proposed a rule that would effectively eliminate the rebates to middlemen, but allow them to be passed directly to consumers through upfront discounts for prescription drugs.

That closely resembles the plan described by the New York Times, including the up-front $100 discount cards. The Congressional Budget Office, however, helped put the kibosh on the proposal by calculating that it would drive up federal spending on Medicare by about $177 billion — over 10 years.

In other words, this mysterious $150-billion savings program closely resembles something the administration had proposed, with at least the industry’s implicit approval, in 2019. But that idea appeared to have been dropped, only to be resurrected in Trump’s executive order.

What about the idea that the drug industry was loath to appear in sync with Trump on the rebate cards? This depiction of an industry sensitive to appearing too close to Trump doesn’t deserve even an ounce of your credulity.

Let’s recall how sedulously the drug makers kowtowed to Trump in 2018, when several announced they had rolled back price increases already imposed on popular drugs. Those steps handed Trump a big talking point — “Great news for the American people,” he tweeted.

Of course, these rollbacks were nothing of the kind. The price reductions were rolled right back up the moment no one was paying attention, about six months later. In doing so, the companies cited loopholes that had been gaping in plain sight from the start.

Pfizer, which had been the first to announce the rollbacks, pointed out that it never said it would cut drug prices, but only that it would “defer” price increases it had scheduled for July 1 until either Trump’s “blueprint to lower drug prices” went into effect or the end of the year, whichever came sooner.

The “blueprint” mentioned by Pfizer was a roster of modest administrative nudges Trump announced May 11, which industry experts generally found too limited to produce significant lowering of prices. Because the blueprint hasn’t gone into effect, Jan. 1 is the operative deadline. (Pfizer’s actual implementation date for the increases is Jan. 15.)

It’s hard to believe that anyone was taken in this summer when a handful of drug companies announced rollbacks of price increases or price freezes on some of their drugs, ostensibly in response to jawboning by President Trump.

Pfizer’s Nov. 16 announcement of the restored price increases made note of the fact prices on 90% of its medicines “will remain unchanged,” which is a bit like observing after a plane crash that most planes land safely.

Merck, which had announced its price cuts on July 20, 2018, had said it would not increase the average net price of its entire portfolio of drugs by more than inflation annually. It dressed up the announcement by lowering the price of Zepatier, a hepatitis C treatment, by 60% and of six other drugs by 10%.

Zepatier, however, was a distant also-ran in the market for hepatitis C cures, hopelessly outdistanced by Gilead Sciences’ Harvoni and Sovaldi. The Merck drug’s sales had fallen so low that they were recorded as zero in the company’s quarterly reports.

The drug industry, then, was not above handing Trump a PR victory. Where’s the evidence that the industry’s willingness to deliver more sops to Trump has changed?

As Drum observes, the industry’s real objection to the $100 discount cards was probably not the partisan optics of the arrangement, but the fact that the cards would represent cold, hard cash. “There would be no way to wiggle out of it,” he wrote. “It’s concrete money that has to be paid out before the rest of the deal is even finalized.”

And the rest of the deal would probably never be finalized — it would be festooned with so many loopholes that it would be a nullity.

So, no. The chances that Big Pharma was about to hand Trump a $150-billion talking point, but balked at a $6-billion payout because it would violate principles of electoral fair play are almost certainly nil.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.