China’s airplane ambitions get a boost from Boeing fallout

One day after an Ethiopian Airlines Boeing 737 Max 8 crashed, killing all 157 people on board, China’s civil aviation administration issued an order to ground all Boeing 737 Max 8 airplanes.

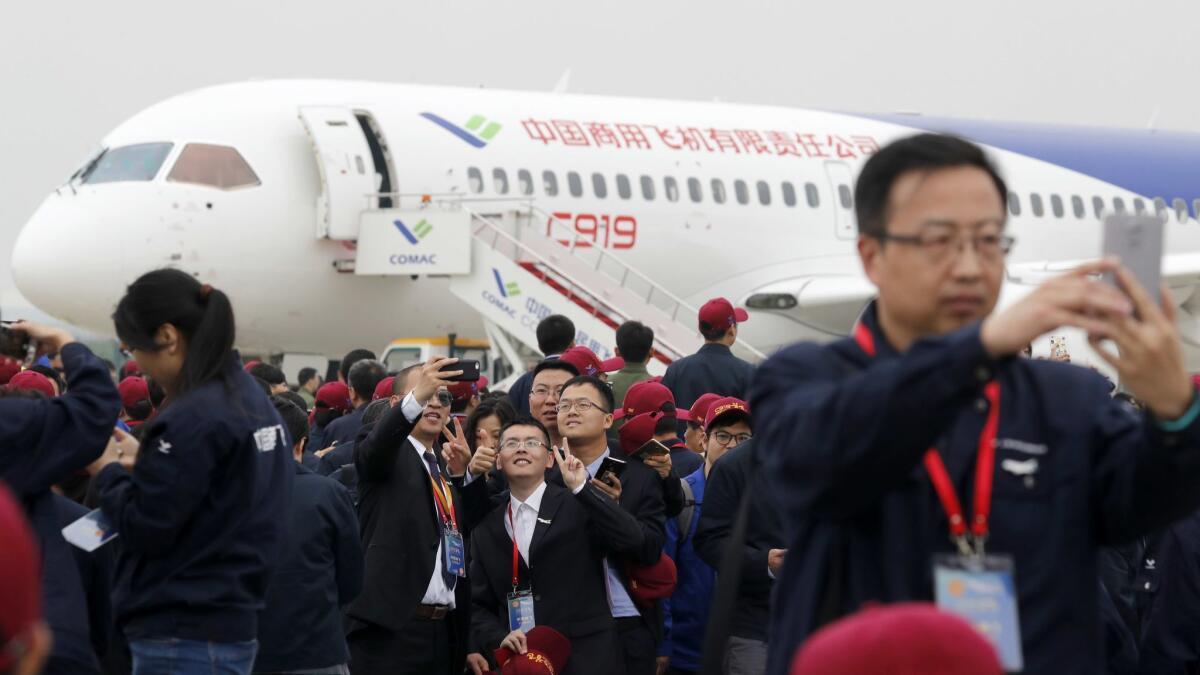

Seven days after the Ethiopian Airlines crash, the Ethiopian ambassador to China paid a visit to China’s state-owned airplane manufacturer in Shanghai. He tweeted photos of himself sitting in the cockpit of the Comac C919, a new Chinese-built plane aimed to compete with Boeing’s 737 Max 8 and Airbus’ A320neo.

“It will not be so long that we will see them in the blue sky,” the ambassador tweeted. “Even in my layman observations, I do not think they need 20 years and for sure they will not wait for 20 years.”

Adamu Assefa, the Ethiopian vice consul in Shanghai, said the visit had been planned two weeks prior, before the crash happened. No airplane orders were signed that day, despite the ambassador’s praise. “Ethiopian Airlines is its own company,” Assefa said. “It’s the company’s own right to purchase either Boeing or Airbus or Comac.”

The delayed response by the U.S. Federal Aviation Administration in grounding the 737 Max — and revelations that the FAA allowed Boeing engineers to certify their own aircraft — upended global trust in American aviation safety standards. China, which flies more Boeing 737 Max 8s than any other country and was quickest to ground the planes, looked like a safety leader in contrast.

Whether the Boeing fiasco hastens the takeoff of China’s state-manufactured planes, though, is less certain.

Scrutiny of Boeing already has given China a leg up in the trade war. Just three days before the Ethiopian Airlines crash, Boeing’s chief executive said at an aviation summit in Washington that Chinese purchases of Boeing aircraft could be part of a deal to shrink the trade deficit and end the U.S.-China trade war.

Those purchases are now under pressure. During a visit by President Xi Jinping to France this week, China agreed to purchase 300 Airbus aircraft worth $34 billion, according to French officials.

“That’s Boeing’s worst nightmare,” said Neil Thomas, a research associate at the Paulson Institute. China can now frame any potential Boeing purchase as a concession, he said, giving Beijing an upper hand in pressuring Washington for concessions to China in return.

China has traditionally divided its aircraft purchases between Boeing and Airbus. That gives China more political and business flexibility, said Clayton Dube, director of the USC U.S.-China Institute.

“China uses access to its market definitely to reward friends, to punish those whose behaviors, policies and practices they don’t like and they have not been bashful about that,” he said.

The Airbus deal strikes at a particularly sensitive U.S. export category. Last year, the U.S. exported $130 billion in civilian aircraft, engines, equipment and parts, according to data from the federal government’s International Trade Commission. China was the top export location, purchasing $18.2 billion. Boeing makes up the lion’s share of both those figures.

“It’s a high-ticket item,” Dube said of aircraft exports. “And it’s not just the jets themselves. It’s the replacement parts, it’s the services, it’s all of those things that are all bound up.”

China is expected to overtake the U.S. as the world’s largest aviation market by 2022. Boeing has predicted that China will need to buy 7,000 more planes worth $1.1 trillion by 2036. While Boeing and Airbus jostle to supply those planes, China has also been trying to build its own models, the latest of which is the Comac C919.

Though China’s leadership has stopped talking about the “Made in China 2025” industrial development plan, one of its targets was to supply more than 10% of the domestic market with Chinese planes by 2025.

Experts say China’s aircraft are still a far cry from American and European competitors’. But Boeing’s recent struggles and China’s quick action in response to the crashes have boosted China’s image.

The Ethiopian Airlines crash was the second fatal crash of Boeing’s new 737 Max 8 within 22 months of the model’s launch. Within hours of the crash, China’s civil aviation administration issued a brief statement pointing out the two crashes’ similarities — same airplane model, similar crash timing soon after takeoff — and ordered a grounding on the basis of “zero tolerance for safety hazards.”

China’s move led a wave of similar decisions by aviation authorities across the world. The FAA, usually the gold standard for worldwide aviation safety, was the last to ground the planes.

A federal investigation of Boeing and the FAA is now underway, as reports from within the aviation industry reveal problems with insufficient training, additional charges for crucial safety features, and the FAA outsourcing aircraft certification to Boeing itself.

“The main thing that Airbus and Boeing sell is trust in their brand. Boeing has just destroyed that trust,” said Edward J. Rehfeldt III, chairman of Lai Fu, a trading company that has sold military and commercial aircraft to Taiwan.

Usually, China and the rest of the world follow FAA standards, but now that could change.

China’s aviation safety record is as strong as American and European records, according to Arnold Barnett, an MIT statistics professor who specializes in mathematical modeling of health and safety issues. The chance of being killed on a Chinese scheduled flight is 1 in 50 million or 60 million, he said, on par with flying anywhere in the developed world.

“U.S. aviation in general is extraordinarily safe. Historically, the FAA has had a lot to do with that,” he said. “But like a lot of things about America these days, we’re no longer the world’s leaders.”

An employee of the Chinese civil aviation administration, the CAAC, who asked not to use his name said that Chinese standards are stricter than international ones, partially because China is trying to prove itself on the global stage.

“China has to meet international standards. With the C919 airplane, they want to get European and American certifications. So the demands are really high,” he said. “In America, the Boeing company is checking their own standards. Is that appropriate?”

China’s safety record is partially derived from China’s political structure, which gives the CAAC authority to intervene with airlines as it wants without threat of legal backlash.

“The FAA is not going to ground a thousand airplanes when they don’t have really good proof or reason to do that. There’s a standard in the industry that you don’t do things unless the investigation tells you it’s warranted. Otherwise, in the U.S., people are going to sue you,” said Kevin Parker, an engineer and pilot who’s worked in the Chinese aviation industry since 2004, including as director of flight training for China Southern airlines.

“The CAAC can just say, ‘We’re doing it,’ and nobody’s going to question it, because they are the government,” he said.

But that authoritarian heavy-handedness is also a stumbling block to China’s global aviation ambitions, especially in an industry where transparency and accountability are paramount.

“We can have a conversation about whether Boeing should be less incestuous with the FAA. You can’t have that conversation in China,” said aviation analyst Richard Aboulafia. While the CAAC has a strong record regulating airlines flying foreign aircraft, he said, it can’t be trusted when it comes to regulating Chinese-made airplanes.

China exported some 60 models of an earlier state-produced model, the Xi’an MA-60, for example — only to have half of them withdrawn from use after numerous breakdowns and crashes, including fatal ones.

“It’s a government-owned aircraft manufacturer talking with a government agency that has no independence,” Aboulafia said. “The CAAC has done an awesome job in making Chinese airlines safe, in part ironically because they don’t have to use Chinese aircraft.”

“People in the aviation industry know that the Chinese government can order manufacturers to do or not do something,” Rehfeldt said. Rule of law and free press are crucial to upholding accountability processes, he said, which are what Boeing and the FAA are undergoing at the moment.

“It’s all coming out in the press. That doesn’t happen in China. Stuff gets buried, because they don’t want it to come out. That’s not good for the aviation industry,” Rehfeldt said. “Where there’s no free press to expose the stakes, you don’t have a good environment for real certification on real controls.”

In addition to transparency concerns, China’s aircraft are technologically far behind. The Comac C919 may not enter service until 2022 at the earliest, said Scott Hamilton, founder of aviation consulting firm Leeham Co.

When it was conceived, the C919 could have had a good cost advantage over Boeing and Airbus, but those plane manufacturers have since re-engined their respective planes, he said.

“It’s going to take them 10, 15 years to catch up with the metallurgy and all that stuff needed to build the engines properly,” Parker said.

Speaking of his time working in the Chinese aviation industry, he said, “I spent most of my time here explaining concepts 10 to 15 years old to people who have never heard about them.” Chinese designers struggle to design new planes because they’re only familiar with old models, Parker said.

That’s intentional from Boeing and Airbus, which are careful not to share their most recent technology with Chinese manufacturers. The U.S. Department of Justice has indicted Chinese intelligence forces and hackers on charges of trying to steal aircraft technology from French and American companies, likely the same ones that supply turbofan engines for the Comac C919.

Another challenge for Chinese aviation is the global network of logistics, maintenance, and customer service required to support commercial aircraft.

If China wants to compete with Boeing and Airbus, it needs to build depots all over the world, supply extra parts and provide multicultural, multilingual technicians who can service planes in remote environments. That kind of network can take decades to build.

“Making the airplane is only half the battle. The other half is supporting it,” Parker said.

If China wants to make it globally, it will also have to get state-produced airplanes certified with international authorities, particularly the American and European regulators. That’s where geopolitical interests could come into play.

“The aerospace industry is one of the major industries of America. So you have a president like Trump, and Boeing goes crying that the Chinese are going to damage their industry, you may find they’ll have a problem getting things done in America,” Rehfeldt said.

Times staff writers Samantha Masunaga, Jim Puzzanghera and Don Lee contributed to this report.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.