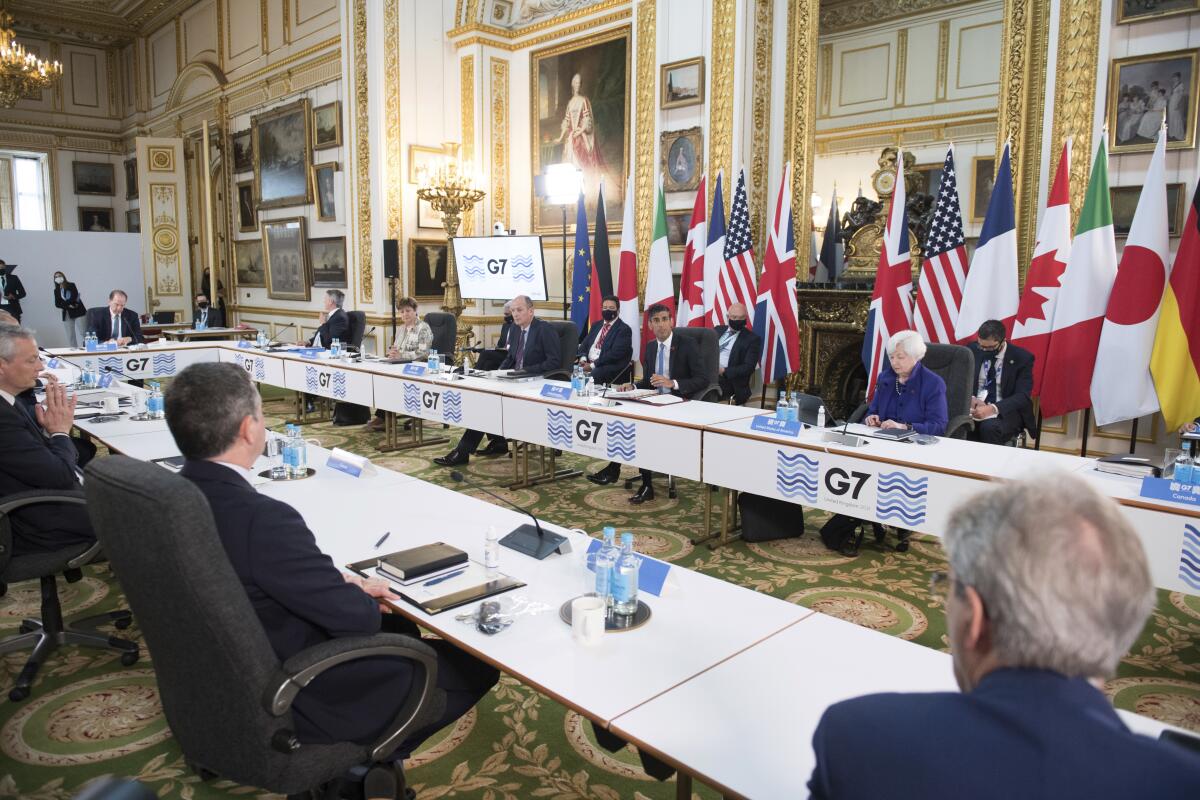

G-7 pledges to move forward with a cap on the price of Russia oil

BERLIN — Finance ministers from the Group of 7 industrial powers Friday pledged to impose a cap on the price of Russian oil in a bid to limit the Kremlin’s revenues and ability to fund its war in Ukraine, while also curtailing the war’s impact on energy prices and inflation.

The ministers said they would impose the cap by barring insurance or shipping companies from helping Russia sell oil at prices above the set limit.

The decision follows discussions at the group’s summit earlier this year and aims at solving one of the vexing problems with sanctions against Russia: Global oil prices have risen on fears of restricted supply, which has only fattened the Kremlin’s take.

Meanwhile, skyrocketing energy prices have fed inflation that is squeezing consumers in rich and poor countries alike and threatens to push Europe into recession.

In a statement issued by Germany, which chairs the G-7 this year, the ministers said they “confirm our joint political intention to finalize and implement a comprehensive prohibition of services which enable maritime transportation of Russian-origin crude oil and petroleum products globally.”

Providing those services “would only be allowed if the oil and petroleum products are purchased at or below a price (‘the price cap’) determined by the broad coalition of countries adhering to and implementing the price cap,” they added.

In Southern California and much of the rest of the state, gas prices are at historic highs for a Labor Day weekend.

The statement did not give any proposed figure for the price cap nor specify when the G-7 aims to finalize the plan. It said that “we invite all countries to provide input on the price cap’s design and to implement this important measure,” calling for a “broad coalition in order to maximize effectiveness.”

The G-7 is made up of the United States, Germany, France, Britain, Italy, Canada and Japan.

When they met in June in Germany, G-7 leaders agreed to explore a price cap but said the idea needed further discussion, a testimony to the complexity of implementing it.

The measure — pushed by President Biden — could work because the service providers are mostly in the European Union or Britain and thus within reach of sanctions. To be effective, however, it would have to involve as many importing countries as possible, including India, in particular, where refiners have been snapping up cheap Russian oil shunned by Western traders.

India and China are becoming an increasingly vital source of oil revenues for Moscow as Western sanctions on Russian energy imports start to bite.

The U.S. has already blocked Russian oil imports, which were small in any case. The European Union has decided to impose a ban on the 90% of Russian oil that comes by sea, but that does not take effect until the end of the year.

U.S. Treasury Secretary Janet Yellen said that the G-7 had taken “a critical step forward” and that “today’s action will help deliver a major blow [to] Russian finances and will both hinder Russia’s ability to fight its unprovoked war in Ukraine and hasten the deterioration of the Russian economy. ...

“We have already begun to see the impact of the price cap through Russia’s hurried attempts to negotiate bilateral oil trades at massive discounts,” Yellen said in a statement.

Friday’s G-7 statement said the group encourages other oil-producing countries to increase production in order to decrease volatility in energy markets.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.