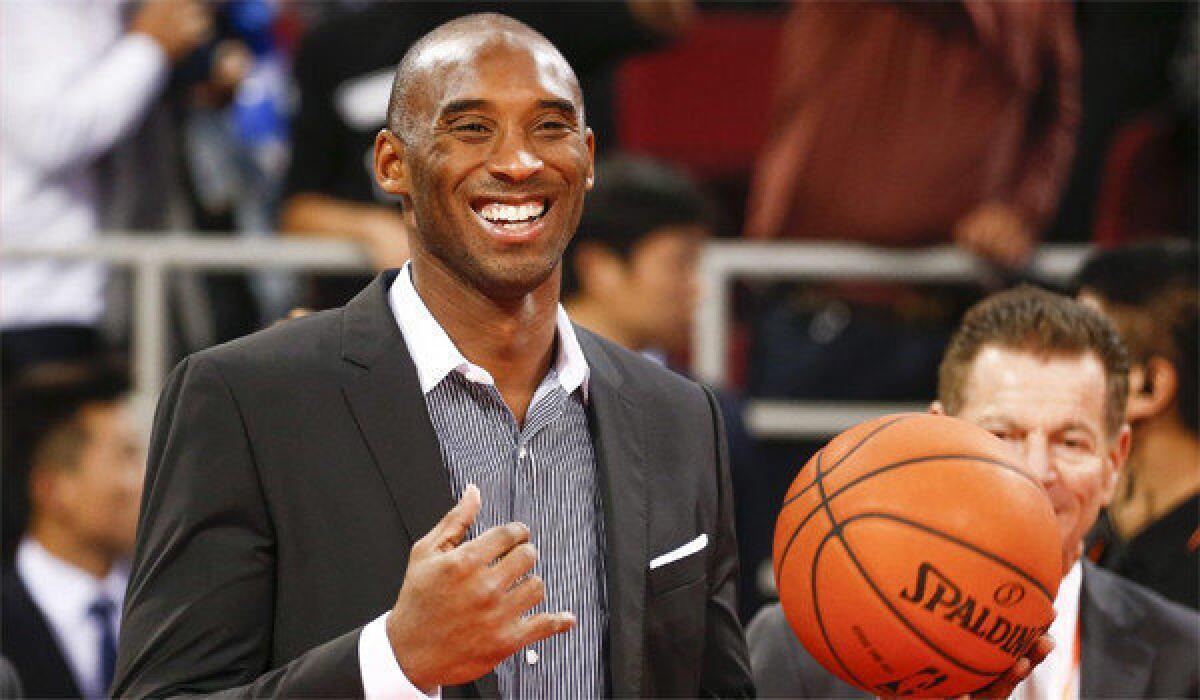

Kobe Bryant’s payday, taking into account future value

As reported by The Times, Kobe Bryant was to receive 80% of his 2013-14 salary on Friday, a gross of $24.4 million.

While Bryant could end up paying 50% to 60% in combined taxes and agent fees, even if his take-home was $12 million -- that’s a sizable figure.

Why exactly would Bryant have his contract structured with such a large lump sum up front?

The easy answer -- because he can. At least under the rules of the NBA’s collective bargaining agreement when Bryant signed his contract in April 2010.

While Bryant may have his own unique reasons, the economic principle of future value takes into account how much $12 million is worth in Bryant’s possession -- not just in November, but over the course of the entire year.

The sooner Bryant is in possession of his salary, even after the government gets a hefty share in taxes, the quicker he can invest that money.

Should the Lakers All-Star invest $12 million with a slim 1% return, in a year’s time that amount would grow to $12.12 million.

If he can bring back 5% on a $12-million investment, he’ll have more than $12.6 million in a year. And 10% would grow it to $13.3 million.

If that money is in the possession of the Lakers, doled out to Bryant twice a month (as the remaining $6.1 million of his salary will be paid), it’s the organization that is gaining the benefit of cash on hand.

Investments, taxes, economics, etc. -- the general rule of thumb is it’s better to get as much money as possible up front.

ALSO:

Kobe Bryant to get $24,363,044 from Lakers on Friday

DeAndre Jordan’s foul on Nick Young downgraded from flagrant

Carmelo Anthony says he wants to retire in New York

Email Eric Pincus at [email protected] and follow him on Twitter @EricPincus.

More to Read

All things Lakers, all the time.

Get all the Lakers news you need in Dan Woike's weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.