House sends $1.9-trillion COVID-19 economic relief bill to Biden’s desk

The House passed a $1.9-trillion COVID-19 economic aid package Wednesday, sending to President Biden a sweeping measure that includes not only pandemic-related $1,400 checks and expanded unemployment benefits, but also the biggest expansion of Obamacare and hefty new tax credits to combat child poverty.

The House passed a $1.9-trillion COVID-19 economic aid package Wednesday, sending to President Biden a sweeping measure that includes not only pandemic-related $1,400 checks and expanded unemployment benefits, but also the biggest-ever expansion of Obamacare and hefty new tax credits to combat child poverty.

Biden is expected to sign what is likely to become a definitive achievement of his presidency on Friday, days before unemployment insurance expires for more than 10 million Americans on Sunday.

House Speaker Nancy Pelosi (D-San Francisco) called the American Rescue Plan one of the most important measures she has worked on in her 33-year legislative career, on par with the landmark Affordable Care Act of 2009. Tens of millions of Californians are expected to receive a direct financial benefit from the bill.

“The American Rescue Plan ... is a force for fairness and justice in America. This legislation is one of the most transformative and historic bills any of us will ever have the opportunity to support,” Pelosi said on the House floor.

In the end, not a single Republican in the House or Senate voted for the package, guaranteeing it will become a political football in next year’s midterm election and perhaps for years to come. Biden and Democrats are embracing what they say is delivering on their 2020 campaign promise to help struggling Americans. Republicans are betting that the currently soaring popularity of the bill will wane and that they’ll be able to hang its costs on Democrats.

The Senate passed the bill Saturday 50 to 49, but only after stripping a provision that would have increased the federal minimum wage to $15 an hour, trimming the weekly federal unemployment supplement from $400 to $300, and reducing the number of Americans who will qualify for direct payments.

The package, which passed the House 220 to 211, could be Congress’ last major response to the pandemic. It includes mortgage and rental assistance; targeted aid to the restaurant, child-care and airline industries; funding for vaccines and testing; aid to small businesses, schools and tribal governments; and billions of dollars to help state and local governments deal with the economic fallout of COVID-19-related closures.

“This legislation is about giving the backbone of this nation — the essential workers, the working people who built this country, the people who keep this country going — a fighting chance,” Biden said in a statement.

It was the most partisan of the total $5.5 trillion in COVID-19 bills passed by Congress in the last year to fight the disease and prop up the economy. It is the only one of the five bills passed to have no Republican support. Only one Democrat — Rep. Jared Golden of Maine — voted against the plan.

Democrats used the budget reconciliation process to speed it through the Senate, denying Republicans the ability to filibuster. That meant it took just a majority to pass the bill, rather than 60 votes. But it also meant Democrats had to scale back the bill to make it more palatable to centrists in their own party.

Progressive representatives weren’t happy with the Senate’s changes, but agreed to support it.

“While I will continue to pressure my party to live up to its banner as the party of the people, I cannot ignore the immediate need for relief,” said Rep. Bonnie Watson Coleman (D-N.J.).

L.A.’s budget crisis could soon be over, thanks to passage of the federal stimulus package.

Both parties are primed to use the bill against the other in the 2022 midterm election that will decide whether Democrats continue to control the House and Senate.

Republicans have lambasted the bill as too broad at a moment when the economy is beginning to rebound and vaccinations are speeding along.

They say it doesn’t prioritize getting people back to work and school.

“The most insidious part of this bill is [that] the economy is already improving,” Rep. Guy Reschenthaler (R-Pa.) said.

Democrats, meanwhile, aren’t running away from Republican criticism that the bill is full of progressive priorities, pointing to multiple national polls showing the bill is supported by the vast majority of Americans.

A poll released Tuesday by the nonpartisan Pew Research Center found 70% of Americans favor the package, with 28% opposed. Despite the unanimous opposition of GOP members of Congress, 41% of Republicans surveyed favored the bill and 57% opposed it, Pew found.

“We have come together as a party in the Congress to do something monumental, but something that also clearly reflects our values as a party and commitment to using government to improve the lives of as many people as possible,” House Budget Committee Chairman Rep. John Yarmuth (D-Ky.) said.

Biden plans a prime-time address Thursday to mark a year since much of the country shut down and to promote the relief package. He’ll travel with the same message in coming days. Vice President Kamala Harris announced Wednesday that she’d go to Las Vegas on Monday and Denver on Tuesday, her first official trips since taking office.

The bill includes $300 a week in supplemental federal unemployment through Sept. 6, a lifeline for the millions of Americans currently claiming unemployment due to the pandemic. And it provides tax relief for people who received unemployment in 2020. Workers with annual incomes under $150,000 will not be required to pay taxes on up to $10,200 of 2020 unemployment benefits they received.

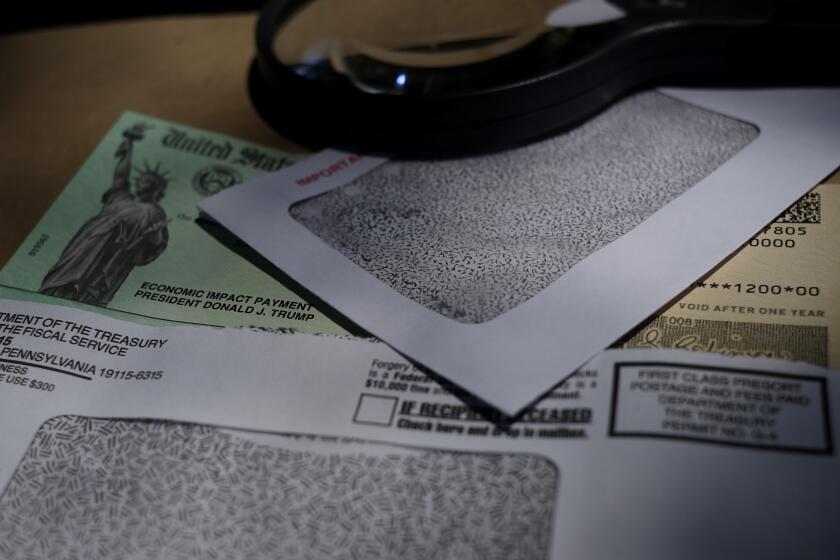

It also includes a $1,400 payment that the IRS could issue in the next two weeks to individuals whose annual income is less than $75,000; joint filers who make less than $150,000; and heads of household who earn less than $112,500. Those filing jointly would receive $2,800. Dependents, including adult child dependents, are eligible for $1,400 as well.

A closer look at what’s in the COVID-19 economic relief bill, including when the $1,400 checks would arrive and who would get unemployment.

The checks are phased out quickly for higher earners compared with the two previous payments Congress approved last year. Individuals with annual incomes of $80,000 or more, joint filers with annual incomes of $160,000 or more and heads of households earning $120,000 or more will not receive checks.

The Institute on Taxation and Economic Policy, a progressive research group, estimates that 31.5 million Californians will be eligible to receive a check.

The bill also temporarily expands the child tax credit to $3,000 from $2,000 — and to $3,600 for children under 6 — and expands the Child and Dependent Care Tax Credit up to $4,000 for the child-care expenses of one child, and up to $8,000 for two or more. Though the change is temporary, Democrats herald raising the child tax credit as an avenue to lift millions of children above the poverty line, and are already indicating they hope it will be difficult to undo.

House Ways and Means Committee Chairman Rep. Richard E. Neal (D-Mass.) said at a news conference Tuesday that he was weighing how to make child tax credit increase permanent. “Getting something out of the code is oftentimes harder than getting something in the code,” he said. “What we did is unlikely to go away.”

The bill also includes billions for food aid programs, extends the 15% Supplemental Nutrition Assistance Program (SNAP) increase through September and sets aside $45 billion for rental, mortgage and utility assistance.

It also will provide billions to help schools and colleges upgrade ventilation systems, retain teachers and address student mental health or education delays.

To directly address the coronavirus, the bill includes $14 billion for vaccine distribution; $49 billion for testing, tracing and genomic sequencing; and $8 billion to expand the public health workforce. Another provision will expand the number of middle-class Americans who can get help with the cost of health insurance under the Affordable Care Act if premiums cost more than 8.5% of their incomes.

The bill also includes $350 billion for states, counties and cities dealing with a drop in tax revenue because of the economic effects of pandemic shutdowns. California is expected to receive $42.6 billion, with $26 billion going to the state government.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.