Gov. Jerry Brown’s budget helps schools and the poor -- and saves a lot for a rainy day

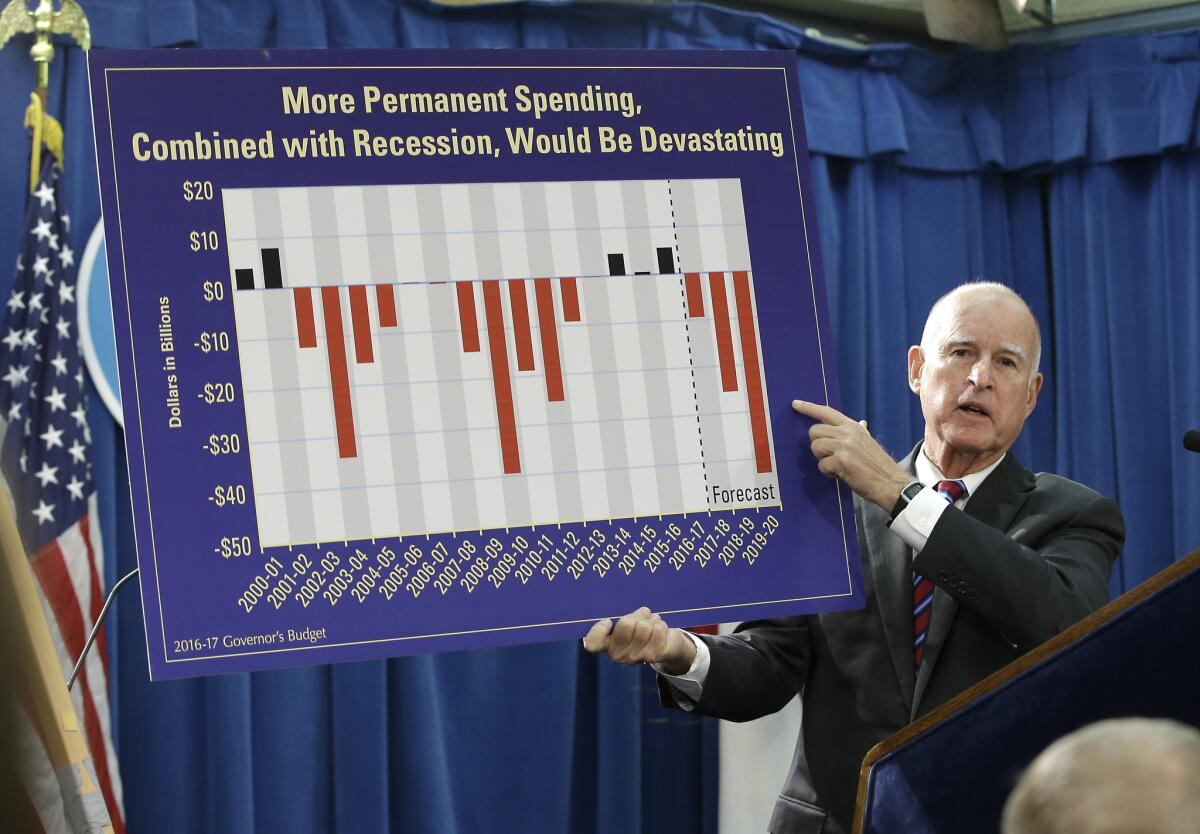

Gov. Jerry Brown gestures to a chart as he discusses his proposed 2016-17 state budget Thursday in Sacramento.

Reporting From Sacramento — By now, it could easily be called Gov. Jerry Brown’s budget doctrine — an insistence on only modest expansions in state services but liberal payments for one-time expenses and accumulated government debt.

In his new $170.7-billion budget proposal to legislators, Brown is again staying consistent with his creed.

“It’s just a matter of balance,” the governor said at a Capitol news conference Thursday morning where he released the spending plan for the fiscal year that begins in July.

Join the conversation on Facebook >>

The plan provides a sizeable boost to public education and only modest help to low-income families, but its most important component may be how much money would be stashed away for future budget deficits.

Brown proposes making an additional $2-billion payment into the state’s rainy-day fund, growing the size of the reserve account by next summer to almost two-thirds of its legally mandated goal. That would be significantly ahead of schedule, but a decision the governor insisted is essential.

“If you don’t remember anything else, just remember, everything that goes up comes down,” Brown said, standing next to a chart illustrating the state’s spiking revenues off of the capital gains of the state’s richest residents.

Brandishing a marker, he drew a line descending from the graph’s current peak, predicting a future plunge.

“You’ve got to plan for the down,” he said.

In fact, the governor’s spending plan goes so far as to crunch the numbers under a doomsday deficit scenario: a $55-billion drop in revenues by the end of the decade if the economy stops growing, with an accumulated deficit of as much as $14 billion if legislators insist on increases in government program spending.

“Everybody thinks when we’re up here, it’s all wonderful,” said Brown, alluding to the state’s currently rosy fiscal outlook. “That’s what they thought before the dotcom [bust] and that’s what they thought before the mortgage meltdown. And so here we are again.”

Whether legislative leaders are willing to go along with that aggressive plan is unclear.

“While I appreciate the Governor’s continued conservative approach reflected in his budget, we must discuss the needs of Californians still impacted by the deep cuts of the recession,” state Sen. Mark Leno (D-San Francisco) said in a written statement.

Battles with liberal Democrats in the Legislature have been a recurring theme in Sacramento during the veteran governor’s most recent stint in office, but even those battles have been generally tepid.

And the criticism on Thursday was decidedly mild, as Brown ceded ground on some additional funding for the most needy.

Advocates for the poor cheered the governor’s proposed increases to cash aid for the aged, blind and disabled — the first time such grants would go up in ten years.

“This will be a huge help to 1.3 million people with disabilities and seniors around the state who are struggling to pay the rent and get enough food to eat,” said Frank Tamborello, executive director of Hunger Action LA, adding that the increases should be even greater to account for cost of living.

Meantime, anti-poverty advocates said they were disappointed that there was no proposed increase to CalWorks, which provides cash payments to the working poor.

Nor was there an effort to repeal a long-standing rule that denies CalWorks grants for children born while their parents are receiving welfare, a policy that critics say is discriminatory and invasive.

“To allow that kind of policy to remain on the books is offensive,” said state Sen. Holly Mitchell (D-Los Angeles).

In the areas where the governor’s new budget really opens up the state’s checkbook, it’s largely to dole out dollars linked to decisions made years, even decades, earlier. That would be an additional $1.4-billion more for the Medi-Cal program that provides healthcare for low-income Californians to cover expansion sparked by the Affordable Care Act; $3.1-billion in proceeds from the sale of greenhouse gas pollution credits; and $8 billion in mandatory payments to the pension funds of government workers and teachers.

That’s also true of the large amount of tax revenue earmarked for public schools. The budget estimates $71.6 billion for K-12 schools and community colleges, and enough new money for both the University of California and California State University systems to keep student tuition rates unchanged.

“It is safe to say this will be the second best year for schools in a decade,” said Kevin Gordon, an education lobbyist.

See the most-read stories this hour >>

As lawmakers begin to haggle over the budget blueprint, the heaviest political lift may be Brown’s insistence on extending a key tax imposed on health insurance companies. The Obama administration has said California must overhaul its tax on managed care organizations or lose federal funds for Medi-Cal, which would leave a $1.1 billion hole in the state’s healthcare program for the poor. The state’s current tax expires on June 30.

The reworked tax proposed by Brown would generate a net $1.35 billion, according to the state Dept. of Health Care Services. Health plans would be taxed at varying rates based on enrollment. But those new taxes would be offset by tax breaks. Overall, the health plans as a whole would gain around $90 million with this budget.

The California Assn. of Health Plans said in a statement that it is “analyzing and crunching the numbers on the latest proposal.”

Brown conceded there is not yet a deal struck with insurers, but sounded optimistic the health plans were on board.

He directed most of his politicking on Thursday toward Republicans, presenting the plan as “tax reform” to appeal to GOP members who have so far resisted such a new levy.

But Republicans bristled at the governor linking more funding for the developmentally disabled to the approval of the new tax.

“I think it’s a bit unconscionable that one would tie the funding for the developmentally disabled community to a tax that has nothing to do with them,” said Asm. Melissa Melendez (R-Lake Elsinore).

All things considered, Brown’s most important political ally continues to be the stock market. Even with recent efforts to mitigate the impact of boom-and-bust cycles, the rapid rise in the personal fortunes of California’s most wealthy has given the governor the flexibility in reshaping state spending priorities.

That Brown has been able to instill his vision of state government budgeting is due to another year’s worth of rapid growth in the personal income of California’s wealthiest taxpayers. His new plan assumes $19 billion in unexpected capital gains tax revenues from 2015.

But Brown insisted again in his budget news conference that several years of good fortune do not justify the increased spending that some, most notably liberal Democrats and advocates for California’s most needy.

“This is not a candy store where you can pick out whatever you want,” Brown told reporters. “You’ve got to choose, and that’s what we’re going to do.”

Sign up for our daily Essential Politics newsletter

ALSO:

Follow along with live updates from Sacramento

By 2017, California could have $7.2 billion socked away in rainy-day fund

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.