California government will spend more than ever before under the new budget

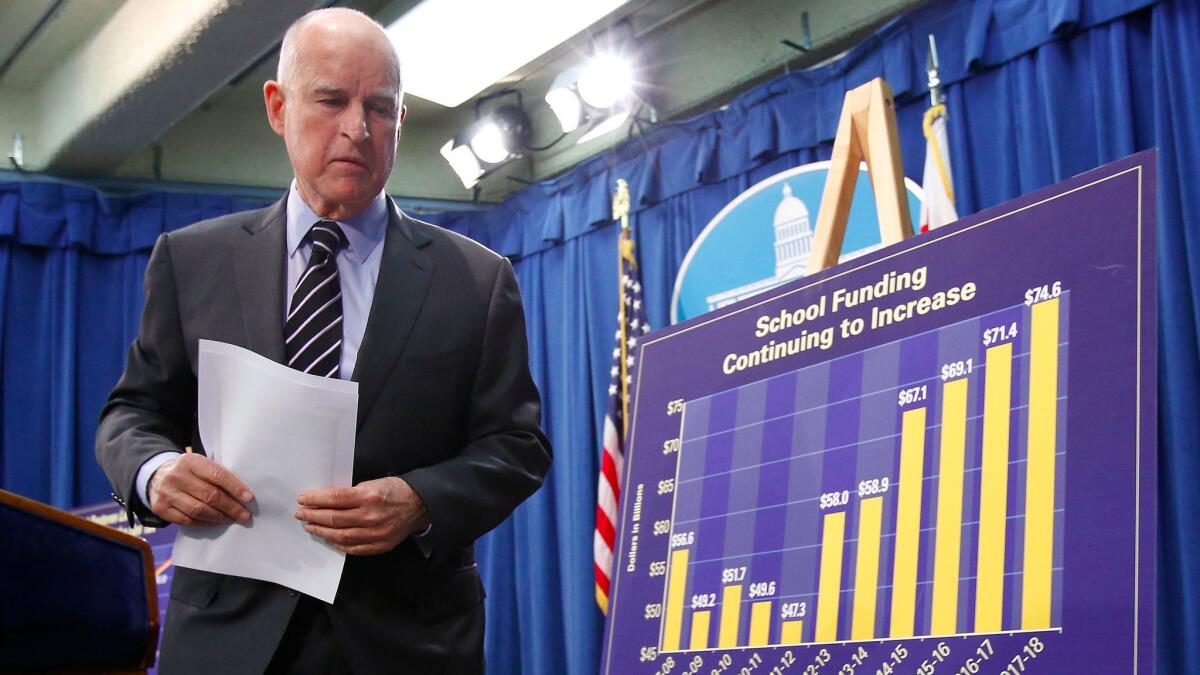

Gov.

The budget is the first crafted since President Trump’s election and includes money for a few programs that Democrats insisted were a necessary response to the changing political times. Most notably, it includes $50 million to provide legal services for immigrants facing deportation.

But it is silent on the biggest potential effect from Republican control of the White House and Congress — a major rollback of federal dollars for Medi-Cal, the state’s healthcare program for the poor. Brown and legislative leaders said it would be premature to act while the fate of the Affordable Care Act remains unknown.

The plan for California’s new fiscal year is balanced, in part, by the continued strength of income tax revenue. It also relies on a staggered start date for some of the spending demands made by the Legislature.

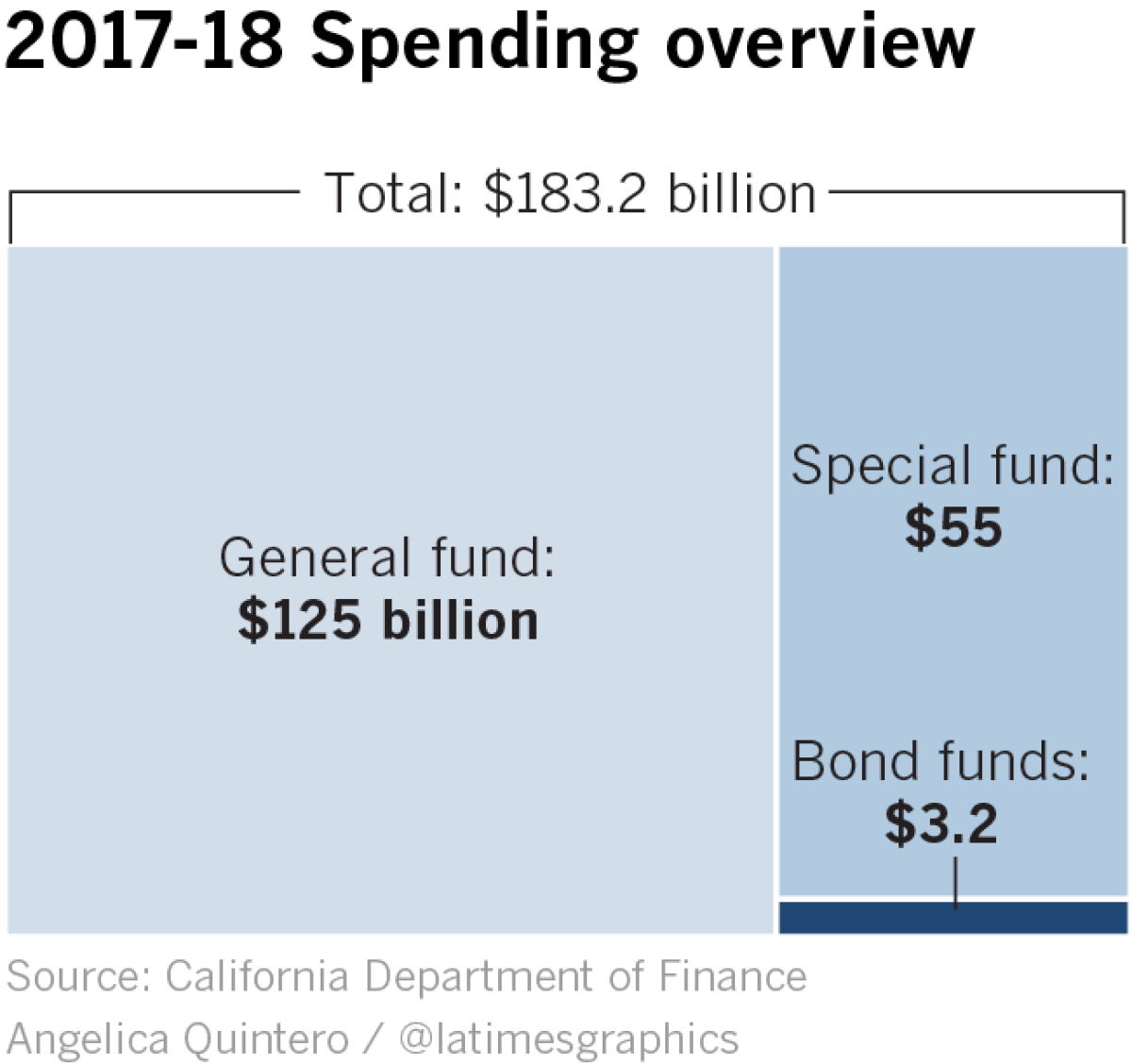

$183.2 billion in total state funds spent

California government spending will hit a record high in the budget that begins July 1, up some $12 billion in just a single year.

Budgets are composed of three spending categories for state dollars: general funds, special funds and bond funds. In each of those, next year’s budget raises the bar.

The general fund, formed by most personal income and sales tax revenues, is the state’s main checking account. It accounts for 68% of all spending in the new budget. Special funds are made up of a variety of fees and taxes divvied up to unique operations — such as motor vehicle taxes and professional licensing fees. Bond funds are dollars borrowed, usually with voter approval, for projects including flood protection, schools and construction.

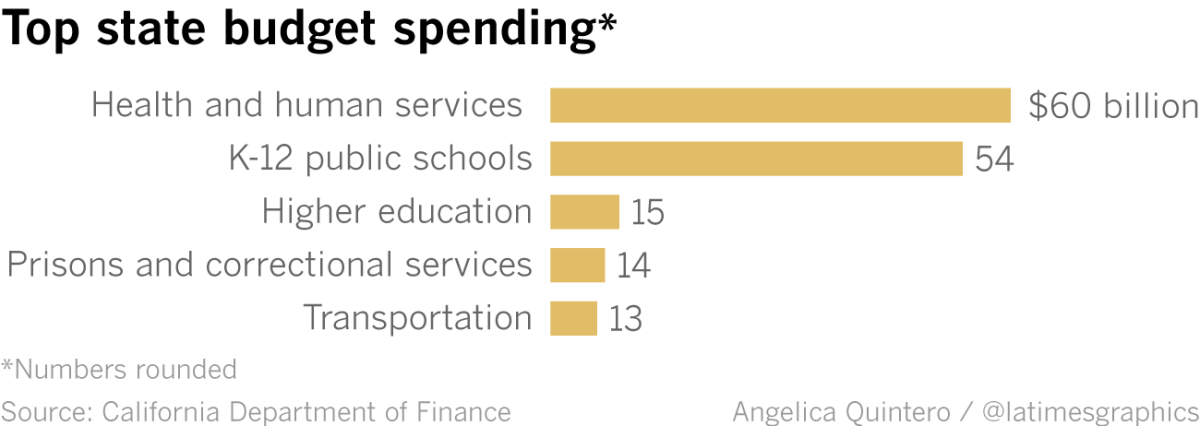

85 cents of every state dollar is spent in five budget categories

State government spends money on hundreds of services and programs. But from a bird’s-eye view, five budget priorities outpace all others in the new plan signed into law.

Top spending priorities will cost California taxpayers $156 billion:

- Health and human services: $60.2 billion, including Medi-Cal healthcare coverage and social safety net programs.

- K-12 public schools: $54.2 billion for K-12, which averages to about $11,000 per pupil — a sharp increase from just a few years earlier.

- Prisons: $13.7 billion for prisons and correctional services, which include operations at 35 state prisons.

- Higher education: $15.3 billion, including the University of California, Cal State University and community college operations.

- Transportation: $12.8 billion, funding for operations including Caltrans, the Department of Motor Vehicles and the California Highway Patrol.

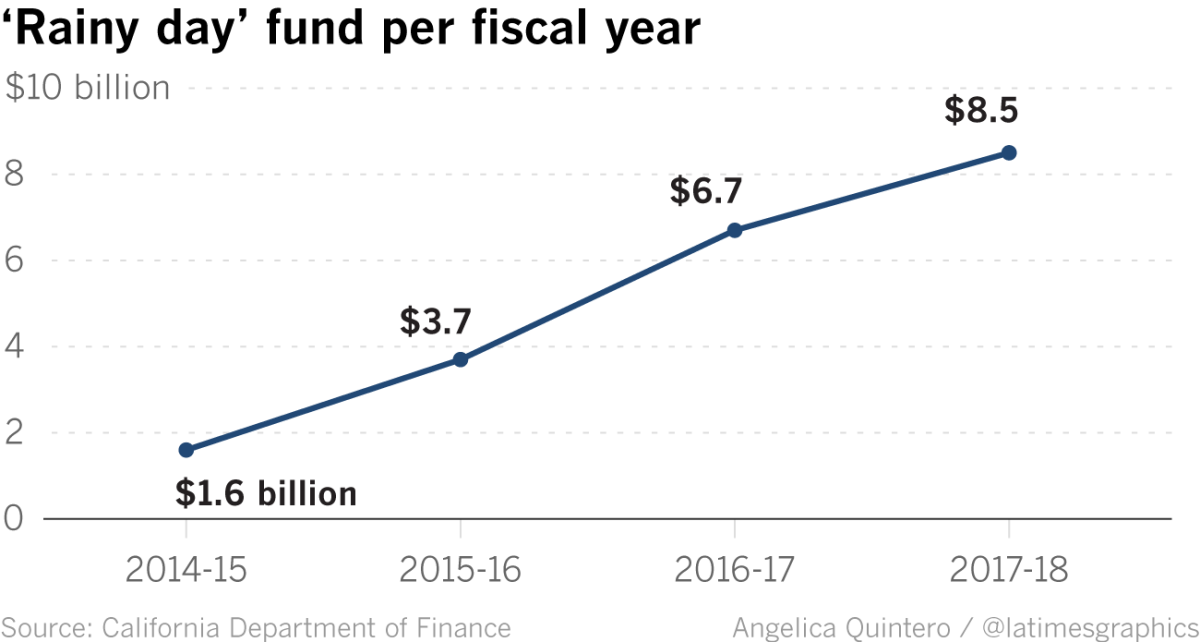

An $8.5-billion ‘rainy day’ cash reserve, enough to weather a mild recession

In 2014, California voters strengthened the rules for setting aside a portion of tax revenues. That amendment to the state’s Constitution automatically triggers money set aside in the fiscal year beginning July 1 — a fund that will, by next summer, total $8.5 billion.

Most of that money comes from windfalls of investment income earned by California’s most wealthy taxpayers, the kind of profits that quickly disappear during an economic downturn. That volatility has been a major contributor to the state budget’s boom-and-bust cycles of the past.

Combined with a separate short-term cash reserve fund, the independent Legislative Analyst’s Office noted on Thursday that the state has the largest cash reserve at any time in more than 35 years. Last fall, the analysts predicted that California’s budget has enough saved cash to ride out a mild recession over the next three years — without major tax increases or program cuts.

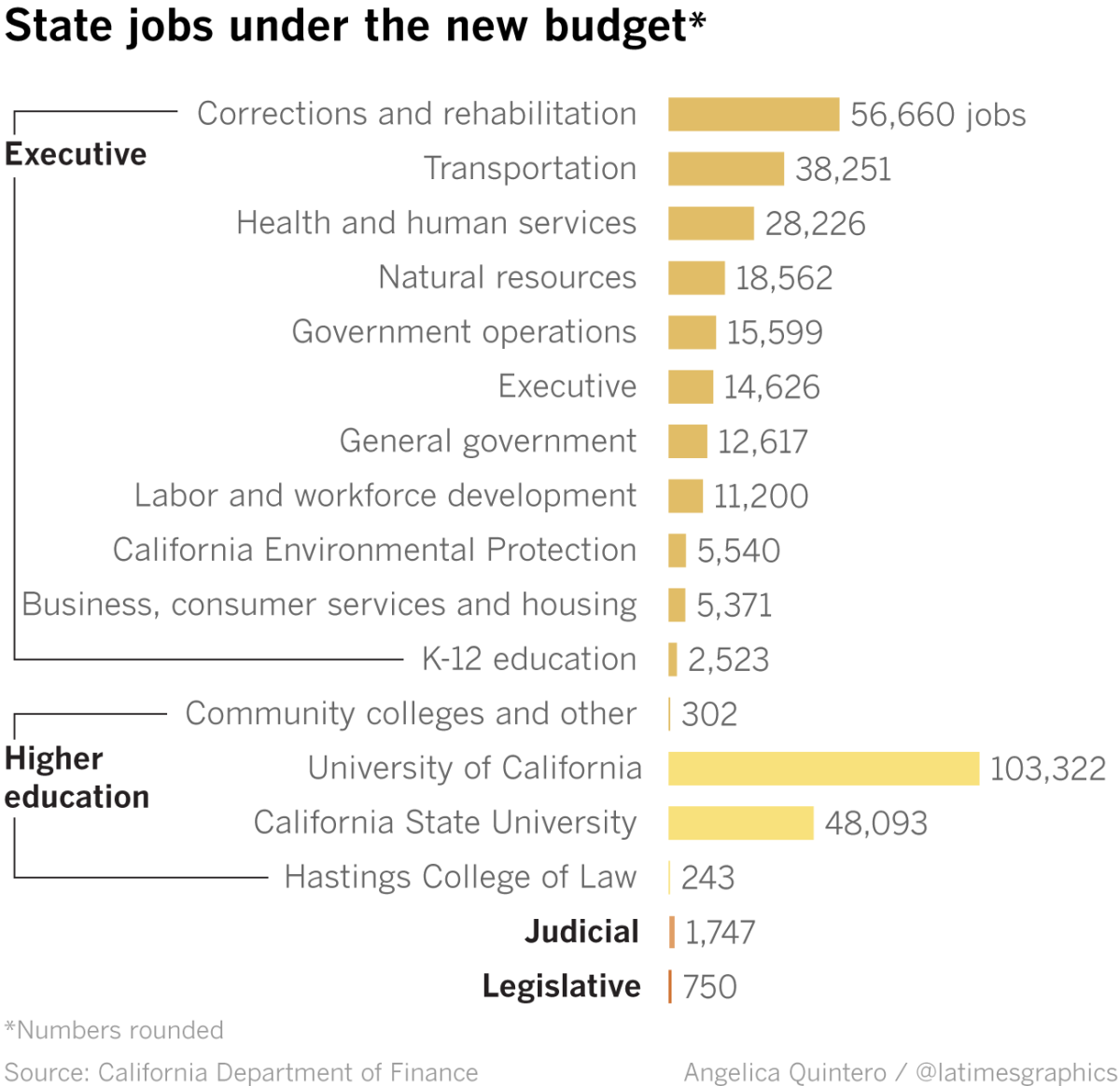

More than 363,000 people now earn a state government paycheck

The size of California’s state government workforce isn’t shaped directly by an enacted budget, but the plan does have to provide money for their salaries and their retirement benefits.

So where are the 363,630 state jobs funded under this budget? Almost 42% of them are in higher education. The state Department of Corrections and Rehabilitation comes in a distant second at almost 15.6% of the workforce.

The growth in the state government workforce has been small in recent years. The state Department of Finance estimates there are now roughly 9 state employees for every 1,000 Californians — the same number as there were in 1970. (The highest in the last half-century, 10 workers per 1,000 Californians, was in 2010-11).

The state budget signed Tuesday allocates $11.2 billion in payments to the California Public Employees’ Retirement System — a combination of the regular payment and an extra $6-billion contribution — and $2.8 billion to the California State Teachers Retirement System.

------------

FOR THE RECORD

10:20 p.m.: A previous version of this article said the state operates 22 prisons. It operates 35.

------------

Follow @johnmyers on Twitter, sign up for our daily Essential Politics newsletter and listen to the weekly California Politics Podcast

ALSO:

Here’s how $183 billion in taxpayer dollars will be spent in California’s new budget

Nearly $50 million in the new state budget will go toward expanded legal services for immigrants

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.