Letters to the Editor: Don’t judge me because I collect a pension. I earned that money

To the editor: I have a pension and sometimes encounter people who express deep resentment toward retirees like me. They seem to think we are freeloaders or worse. (“We loved our pensions. Then our employers took them away. How was that allowed to happen?” Opinion, May 19)

I have always thought of my pension as deferred compensation, since I worked in the public sector for less than I could have earned in the private sector. I feel no guilt about my pension, because I worked in an income-generating office where my personal projects brought between $80,000 and $100,000 per year.

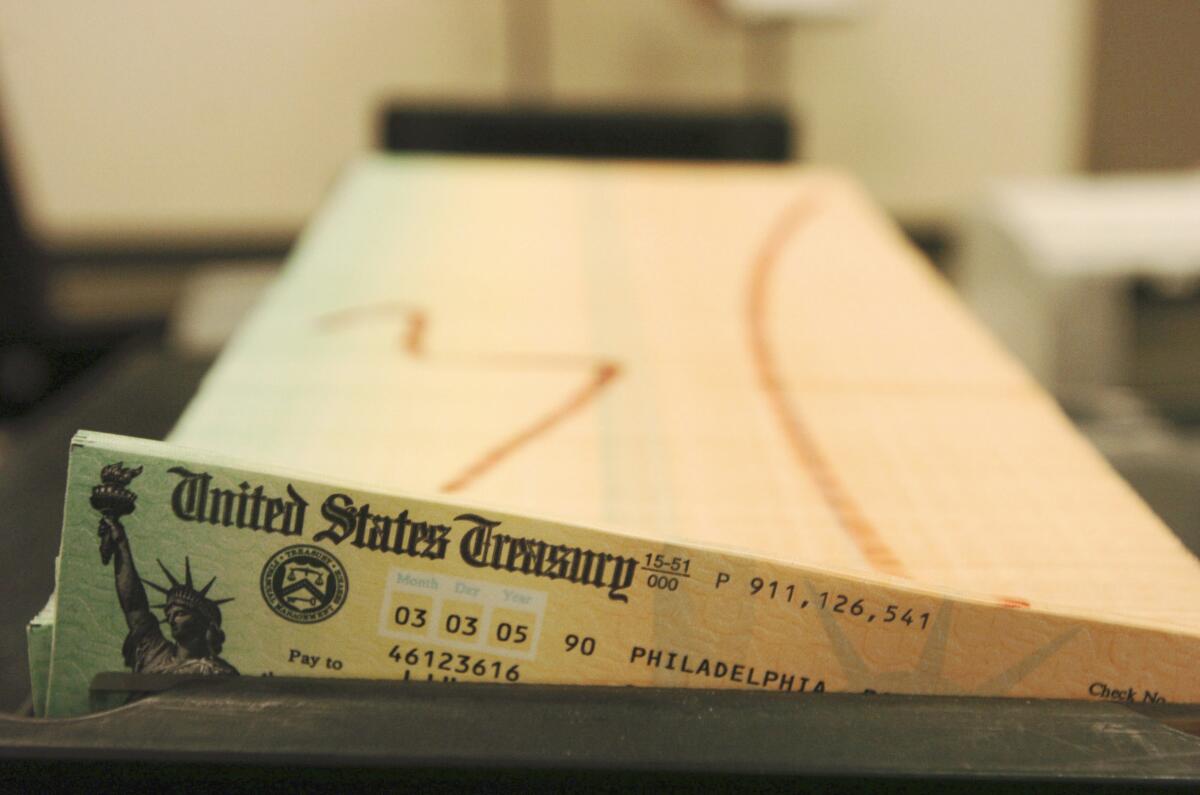

Because of a disability, I had to take an early retirement. Thanks to my pension and the so-called entitlement program of Social Security, I am able to live frugally and expect to die long before I become a burden on society.

Remember, folks: If you’re judging, you don’t have all the facts.

Margaret Hamilton, Portland

..

To the editor: Nicholas Goldberg is correct when he asserts one of the reasons for the collapse of the traditional defined-benefit plans was the financial risk to the companies due to the inherent challenge in determining the “projected benefit obligation.” An actuary can assist with this determination, but is unable to predict the frequency and amount of future raises and promotions.

In addition, the traditional plans are subject to “pension spiking,” which allows employees to artificially inflate their compensation just before they retire. As a result, traditional defined-benefit plans are much more expensive than modern 401(k)-type, defined-contribution plans.

These additional and unpredictable costs have led to the underfunding of public employee pension funds.

In short, the traditional plans have faded primarily due to their higher cost in an increasingly competitive global market.

Michael Roach, La Habra

..

To the editor: What about rescuing Social Security? It can invest only in low-yielding government securities. Let it copy the investment strategy of all other pension funds.

For instance, the California State Teachers Retirement System holds a modern diversified portfolio with bonds, stocks and commercial real estate. Because it puts its money to work better, its payout rate is much higher than Social Security’s.

Making this change would be like getting free money. And, from the greater cash flow received, the taxes funding Social Security could be lowered.

With the decline of private pensions, why has this obvious solution been ignored?

Raymond Freeman, Thousand Oaks

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.