Editorial: Migrants who pay taxes should get stimulus checks — even if they’re undocumented

The federal government this week began distributing stimulus checks to most people in the country who have a Social Security number. For many, it will be a welcome if inadequate lifeline at a time when large segments of this consumer-driven economy have stalled — retail sales plunged 8.7% in March, the worst slump on record. Job losses, too, have reached staggering levels, with some economists arguing that the collapse has been sharper than the relatively slow crumble of the Great Depression. People are fearful, people are suddenly unemployed, and people are broke.

The large circle of the affected includes not just U.S. citizens, green card holders and other foreign nationals living and sometimes working in the country with permission. Congress made sure that only those individuals could receive stimulus checks by tying the payments to people’s Social Security numbers. If you don’t have one, you don’t get stimulus money.

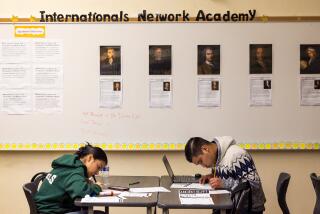

Who doesn’t have a Social Security number? Some 8 million people living and working here without permission, mostly in low-wage jobs in the farming, construction, production and service industries. And many of those workers have lost jobs or hours as a result of the economic crisis. Many of those workers also pay taxes using an individual taxpayer identification number, which the government issues to people working without permission but who are still required to pay income taxes (the Internal Revenue Service is barred from sharing that information with immigration officials). How many people? That’s unclear, but the IRS announced last year that nearly 2 million of those ID numbers would expire at the end of 2019 if they were not renewed. So it’s a sizable group.

And they ought to receive stimulus checks, too. Conservatives and immigration hard-liners may scoff at the notion of the federal government offering cash to people living here illegally, but if one of the points of the stimulus checks is to keep some semblance of the consumer economy going during the downturn — and it is — immigration status should be irrelevant.

Gov. Gavin Newsom on Wednesday announced a program using $75 million in tax dollars and $50 million from donors to send up to $1,000 per household to undocumented immigrants whose incomes are affected by the crisis but who are ineligible for unemployment benefits and other support. That’s a welcome move to help fill in the gap created by Congress, but Congress itself ought to pass H.R. 6438 by Rep. Lou Correa (D-Santa Ana) to make holders of IRS-issued taxpayer ID numbers eligible for the stimulus payments. Remember, many of the ineligible have U.S. citizen children who are also not covered under the law.

At the same time, Congress needs to address another problem. People ages 17 to 24 who are claimed as a deduction on someone else’s income taxes — usually college students who remain reliant on their parents — are ineligible for a stimulus check, nor are their parents eligible for the $500 checks for dependents. That ought to get fixed, too.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.