Op-Ed: The GOP healthcare bill would be good for small business

Eight years ago, the Obama administration promised that the Affordable Care Act would drive down costs. Small business owners, in particular, were told that they could take advantage of new tax credits, and that new exchanges would give owners and employees alike new options to purchase coverage. But by the time President Obama signed the bill, it was abundantly clear that the law would do more to harm small businesses than help them.

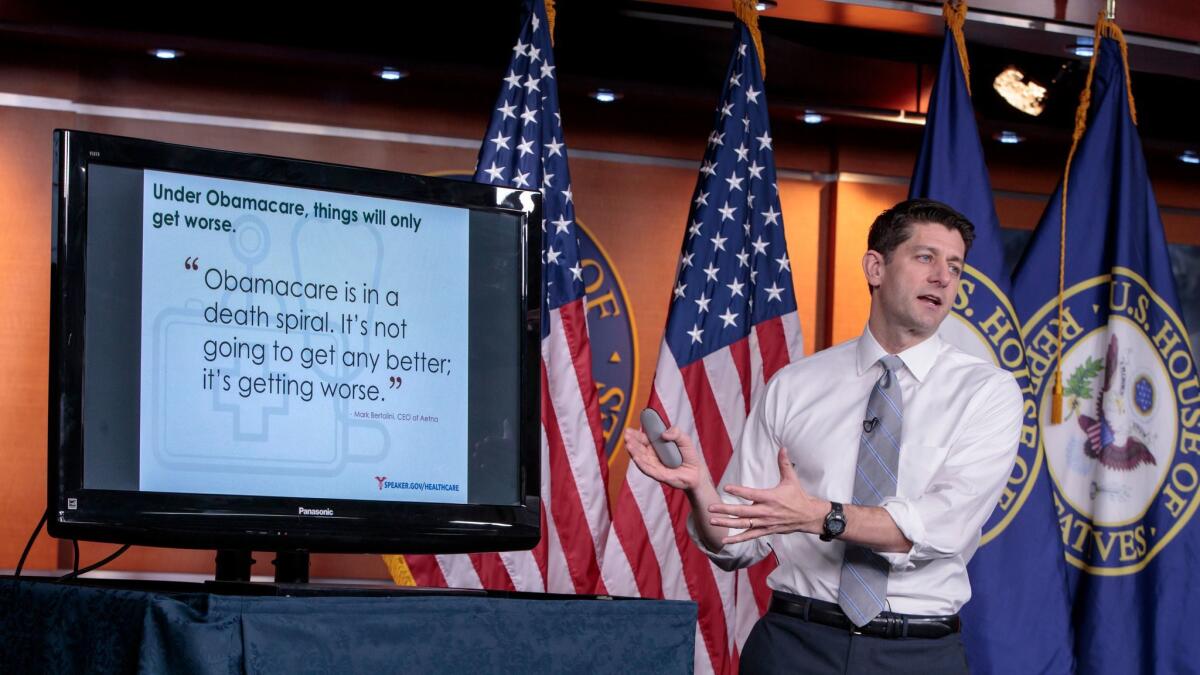

The Affordable Care Act, or Obamacare, was perfectly misnamed. It failed entirely to make insurance affordable for small business owners and millions of other Americans. On the contrary, Obamacare has driven up costs for small business owners, who are hit with higher payroll taxes, taxes on health insurance products, the employer and individual mandate penalties, and the so-called Cadillac tax on expensive health insurance plans.

Small business owners, through the National Federation of Independent Business, fought the law on constitutional grounds, taking the case all the way to the Supreme Court in NFIB vs. Sebelius. Unfortunately, a narrow majority on the court rescued the law and its punishing mandates.

Most small businesses run on tight margins. When their expenses rise, owners have limited options to keep their business open.

Health insurance costs remain the No. 1 concern of small-business owners in NFIB’s Problem and Priorities survey, the same place they’ve occupied in that survey for 30 years. We’re long overdue for a do-over — for Congress to repeal and then replace the Affordable Care Act. Small businesses need affordability, flexibility and predictability in the health insurance market. The bill introduced in Congress, the American Health Care Act, or AHCA, is a good first step that we believe makes progress on all three of those fronts.

Affordability

The AHCA eliminates most of the ACA’s taxes and delays the implementation of the Cadillac tax for a number of years. That’s good news for employers, especially here in California, where 99.8% percent of all employers are small businesses.

Flexibility

The ACA created the Small Business Health Options Program, or SHOP. These exchanges were supposed to be a way for small businesses to give their employees options in purchasing insurance. It was estimated that 1 million Americans would get coverage through this method.

In reality, very few states set up SHOP exchanges. In fact, the last time the government published a figure for SHOP enrollment — in 2015 — it was only 85,000 nationwide. The law, moreover, penalized small businesses that contributed to their employees’ health insurance on the individual market. It took bipartisan legislation last year to remove the fines small businesses faced for helping in this way.

The AHCA, in contrast, improves flexibility in healthcare arrangements by boosting health savings accounts, nearly doubling current contribution thresholds. Small businesses have long appreciated this method of saving for future healthcare expenses.

Predictability

Under Obamacare, many NFIB members had their plans canceled. Some have been forced to switch plans multiple times since the law was signed. Small-business owners don’t want to go through another period of uncertainty. The AHCA sets up a stabilization fund that should help insurance companies navigate changes in the markets and ensure that businesses and individuals can maintain coverage.

The AHCA is not perfect. Congressional leaders, however, have promised additional reforms aimed at creating more options, more competition, fewer mandates and lower costs. Those reforms will come in phases. Passing any of them will be nearly impossible unless the AHCA is passed first.

Most small businesses run on tight margins. When their expenses rise, owners have limited options to keep their business open. Our members tell us that the high cost of healthcare keeps them from hiring and expanding their business. And the ACA’s employer mandate, which starts at 50 employees, disincentivizes them from turning a successful small business into a larger operation.

Small-business optimism soared after the election because owners believed Washington would act on their priorities. If lawmakers in Washington want to see small businesses thrive, they need to repeal a huge impediment to growth and make real progress on healthcare reform.

Tom Scott is the state executive director for NFIB California, which represents 22,000 dues-paying small-business owners across the state, and 325,000 members nationally.

Follow the Opinion section on Twitter @latimesopinion or Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.