Op-Ed: What happens when Donald Trump runs out of campaign cash? We’re about to find out

One of Donald Trump’s most compelling arguments to voters is that by self-financing his campaign, he isn’t beholden to “the special interests, the lobbyists and the donors” as he puts it. Essentially, Trump gets to run on a platform of “What you see is what you get.”

“I don’t need money,” the billionaire boasted in July. “I don’t want anybody’s money.”

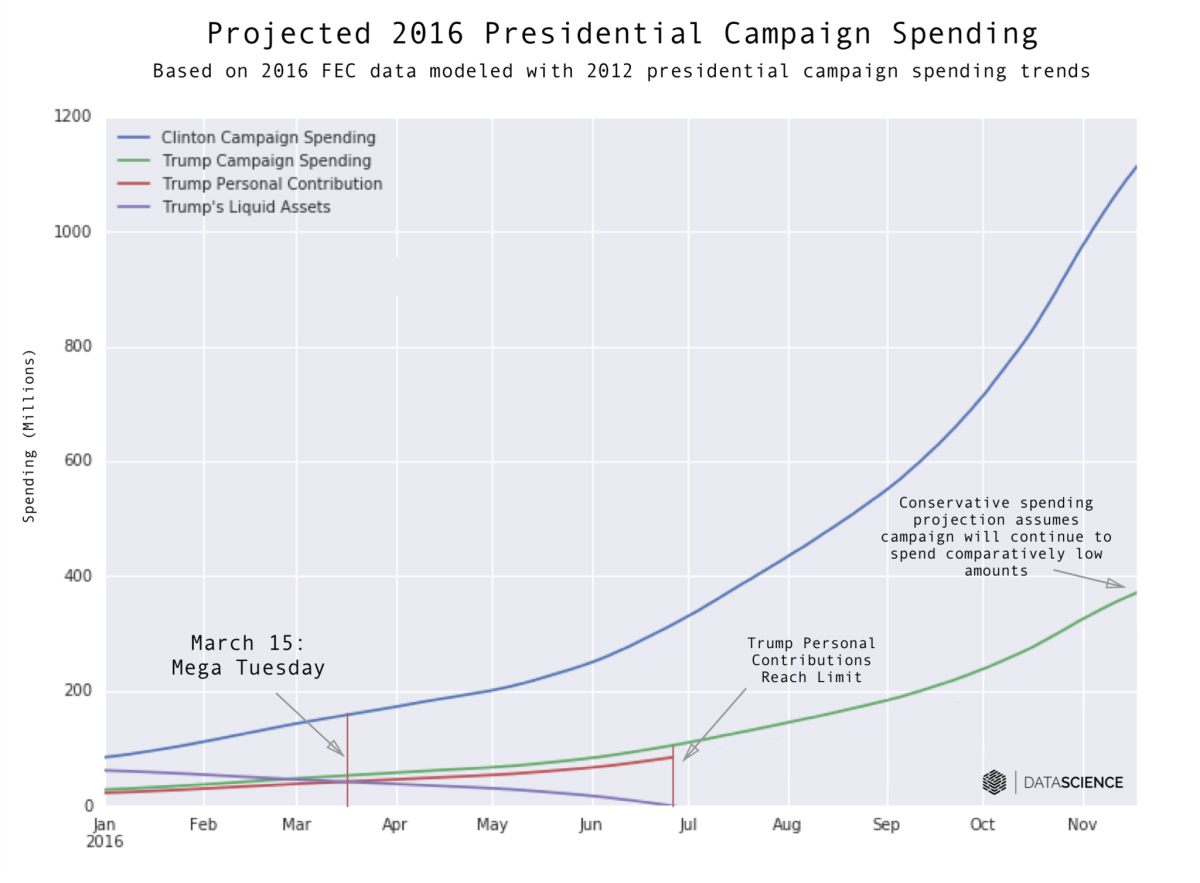

How much longer will he be able to make similar claims? We figure less than three months.

In July, Bloomberg News estimated that Trump's personal liquid assets hovered around $70 million. The most recent Federal Election Commission funding reports showed that Trump had contributed $18 million to his campaign through Jan. 31.

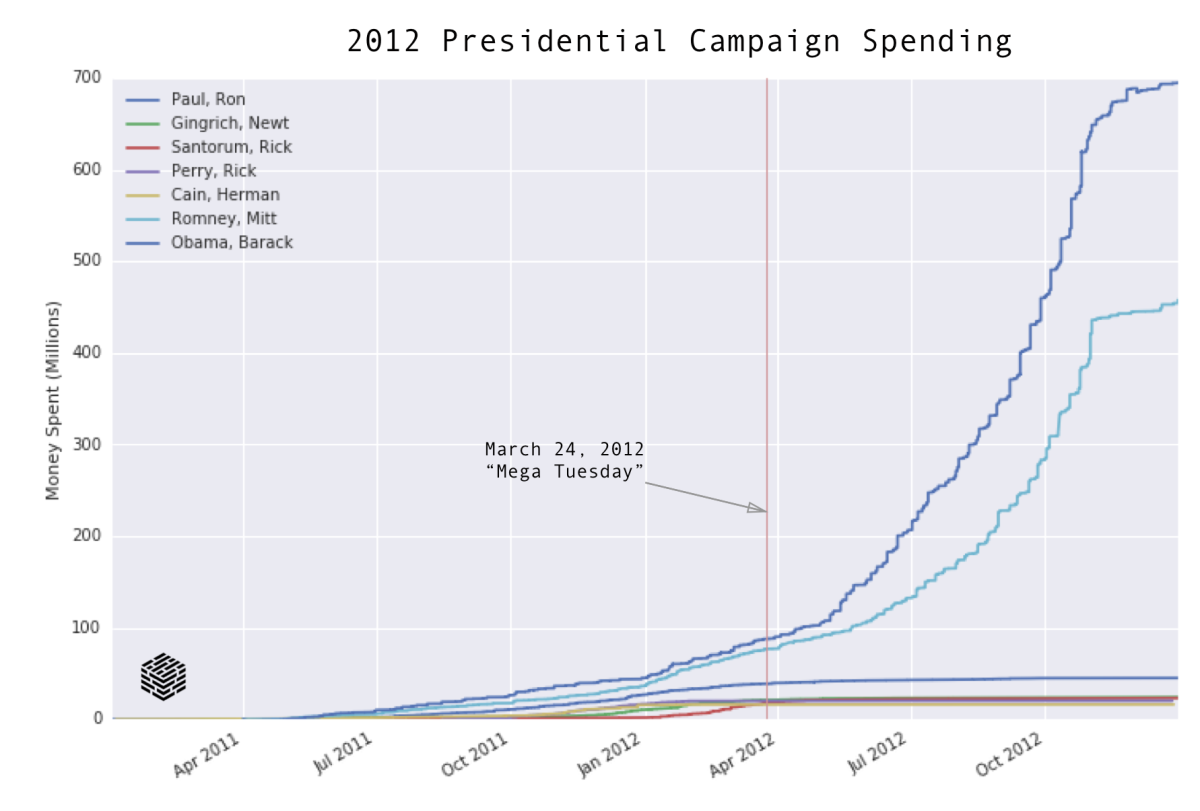

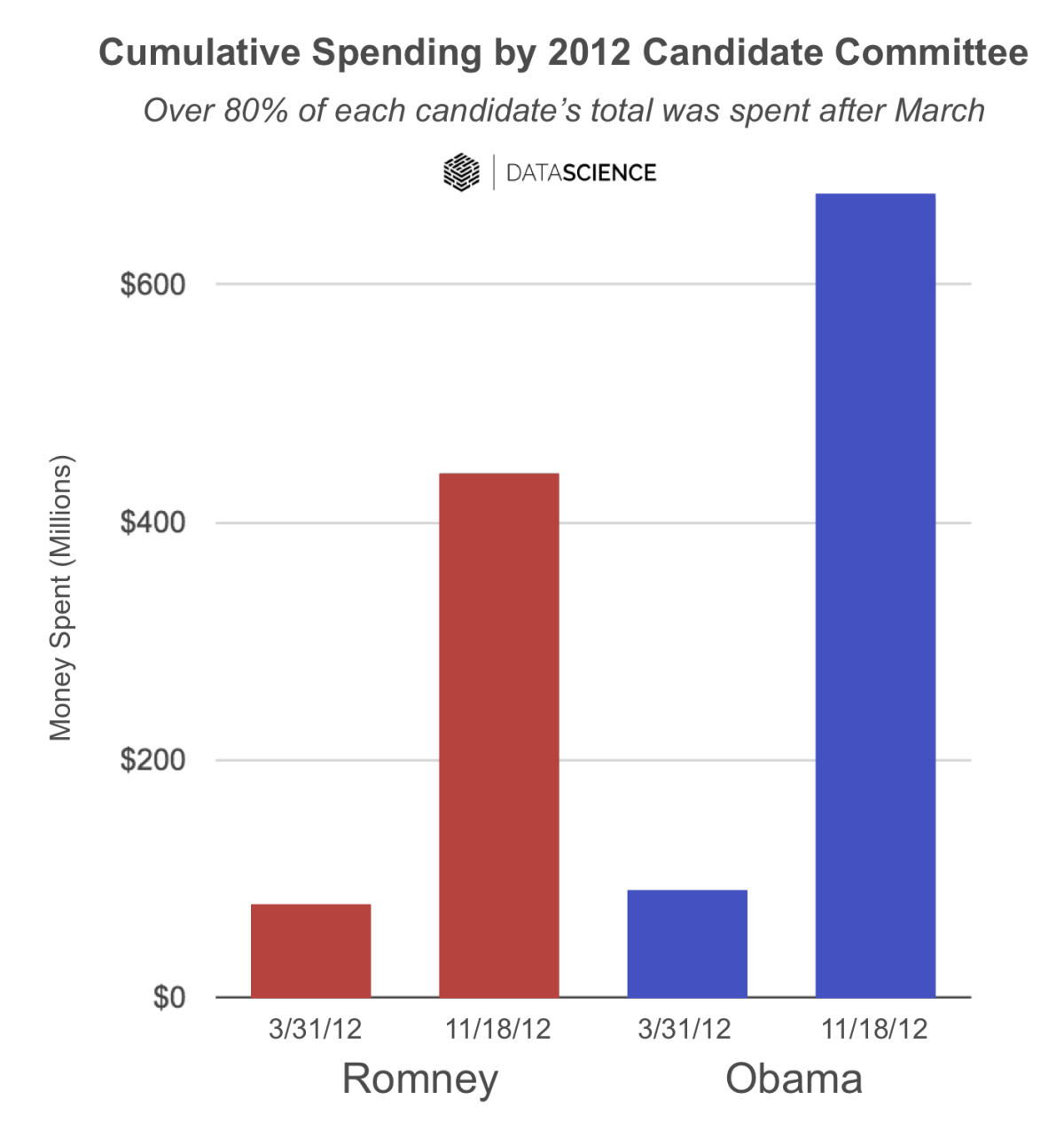

If we use the 2012 election as a guide, campaign spending will begin to surge after the March primary season. Both Mitt Romney and President Obama's campaigns spent over 80% of their respective $442-million and $674-million totals after the March primaries. Overall, spending reached upward of $1 billion per candidate, if we were to include amounts contributed by the Republican and Democratic parties and legally unaffiliated super PACs.

This campaign season, Hillary Clinton's already large coffers suggest a projected spend of over $800 million through Nov. 18. Even if Trump stays on the relatively spendthrift track he's on, his campaign is still projected to cost an additional $300 million. Both presumptive nominees will rely heavily on additional spending by their respective parties. If 2012 is an indication, more than a quarter of additional total spending will come from super PACs.

Even a conservative model – one that allows Trump to spend barely a third as much as his primary competitors, on average – still shows Trump's liquid assets running out entirely by June 1.

While Trump will then have the option of selling securities and property to increase his cash on hand, it’s likely he’ll dramatically increase the proportion of outside funding he’s willing to accept well before that date.

What happens then is anyone’s guess.

Dave Goodsmith is a data scientist at DataScience, Inc.. You can find him on the DataScience blog and @thegoodsmith.

Follow the Opinion section on Twitter @latimesopinion and Facebook

MORE FROM OPINION

SeaWorld's watershed change of heart on orcas

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.