Opinion: L.A. housing is expensive, sure. But are you paying too much for your rental?

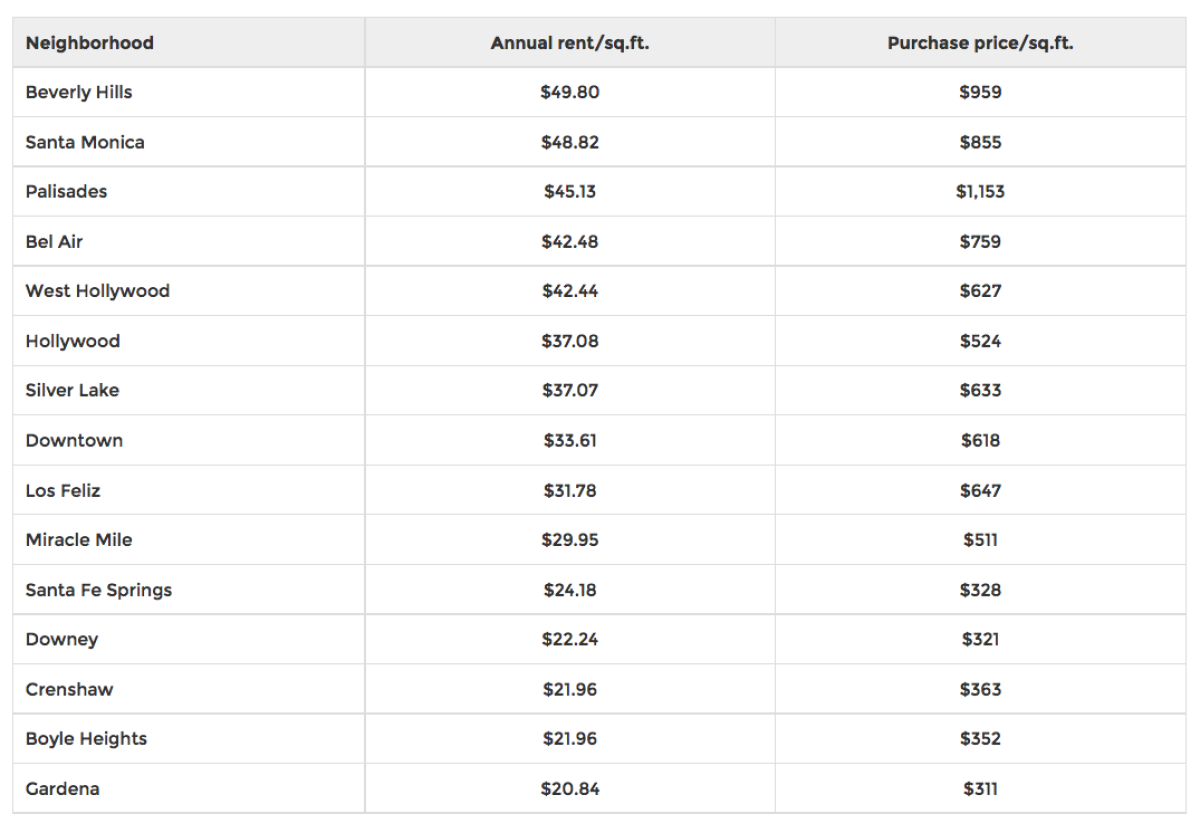

The Los Angeles area, as you may have heard, has arguably the least affordable housing market in the United States. What does that look like in real terms? The average purchase price of a home in Los Angeles is $507 per square foot, ranging from $311 in Gardena to $1,320 in Venice. Meanwhile, the average annual rent is roughly $34 per square foot, ranging from $21 in Gardena to almost $50 in Beverly Hills.

Leases typically run 12 months, so rental rates reflect the immediate desirability of a neighborhood — the dining, shopping, and quality of life that can be enjoyed during the year. By contrast, homeowners have a longer horizon to consider. Purchase prices reflect a mix of affordability, current desirability and the anticipation of future value. Many bargain buyers put up with the limited amenities of an emerging neighborhood for the promise of rising values and a better lifestyle in the future. Others pay a premium to own in a neighborhood with excellent amenities, safe streets (where the crimes draw the SEC rather than the LAPD), and good schools.

It would be reasonable to expect that the increases we’ve seen in rents and purchase prices in recent years would be roughly proportional throughout Los Angeles, but this is not the case. In actuality, purchase prices can soar while rents remain stable, and vice versa—even within the same neighborhood.

Read more from Livable City >>

In an analysis of 40 neighborhoods in the greater L.A. area—some affluent, some working class, some in the midst of heavy gentrification—the average purchase price per square foot is approximately 16.8 times the annual rent. This price/rent ratio ranges from 14.4x in Downey to over 19x in Beverly Hills. What this essentially means is that rents in some neighborhoods are far out of whack with purchase prices.

For example, while Hollywood and Silver Lake have nearly identical rents ($37 per square foot), it is significantly more expensive to buy in Silver Lake ($633/sq.ft.) than in Hollywood ($524/sq.ft.).

This raises some interesting questions.

Why are people willing to pay a premium to own in Silver Lake compared to Hollywood — and why is this premium not reflected in the rent? Are Silver Lake’s rents are too low, or are the sales prices a bit too high? Are renters overpaying to live in Hollywood?

(NeighborhoodX)

The chart above shows the individual prices and rents of different neighborhoods, while the interactive table below ranks the price/rent ratios.

Looking at the graphics above, a few things become immediately clear. The more expensive the neighborhood, by and large, the higher the price/rent ratio, while working class areas have low ratios. What this means is that choosing to rent on the ritzier Westside, expensive as that may be, technically gets you a better bang for your buck than renting in a more affordable Eastside neighborhood.

Beverly Hills ($955/sq.ft.) and Santa Monica ($855/sq.ft.) are two of the most expensive addresses in the region, and they command some of the highest rents as well ($48-49/sq.ft.). The high purchase prices and expensive rents reflect the immediate desirability of living there and the stability of the neighborhoods. Yet the price/rent ratios in these neighborhoods are 18-19x, among the highest of the neighborhoods we analyzed. As a result, a landlord purchasing a property in these neighborhoods would earn a lesser yield in rent on their investment than in a more affordable Eastside neighborhood. We can guess then that those who pay a premium to buy in Beverly Hills or Santa Monica tend to live in their property, because they could get better immediate returns by buying rental properties in lower-profile neighborhoods.

As a renter, on the other hand, while you may be paying out the nose for your unit, you’re still able to access the tremendous resources of these communities at a relative bargain, compared with the cost of buying a home.

At the other end of the spectrum, two of the most affordable neighborhoods of Los Angeles, Gardena ($311/s.ft.) and Downey ($321/sq.ft.), also have some of the lowest rents ($21-22/sq.ft.) — but some of the highest rental yields. Their price/rent ratios are the lowest of the neighborhoods we analyzed: 14.9x and 14.4x, respectively. Even as these neighborhoods attract renters because of their affordability, they also attract investors because the low purchase prices generate comparatively high yields. Affordable as these neighborhoods may be if you live there, your landlord probably isn’t having a tough time putting her kids through college.

Not all the affordable neighborhoods in Los Angeles offer these kinds of rental yields, however.

Boyle Heights and Crenshaw also have some of the lowest rents in the city: at $22 per square foot, they are comparable to those in Downey. However, the purchase prices for these neighborhoods are slightly higher ($352 and $363/sq.ft., respectively) than in Downey — and the price/rent ratios (16.03x and 16.53x) are in line with the Los Angeles average of 16.8x.

These numbers raise some questions: if the rent in these neighborhoods is the same as in Downey, why is there a premium to own property in Boyle Heights or Crenshaw?

The rental price point suggests that the neighborhoods currently offer comparable lifestyles to that of Downey. The higher purchase prices, however, indicate the market thinks Boyle Heights and Crenshaw are better positioned for revival. These neighborhoods are transit-adjacent with easy downtown connections, and are home to a number of attractive historic houses — a good indication that property values will rise further. On the other hand, the lower prices in Downey for the same amount of rental income could reflect an expectation that property values will remain largely flat.

And there are apparent anomalies, like the pricing of Hollywood and Silver Lake.

While renters put the same value on both neighborhoods, the lower purchase prices in Hollywood suggest that the neighborhoods draw different kinds of buyers. In other words, an owner-occupant might pay a premium to enjoy Silver Lake’s lifestyle and charm, while Hollywood’s inherent challenges (and thus lower selling prices and higher yields) may instead attract investors. This is supported by the ratios - the price/rent ratio in Hollywood is 14.1x (in line with predominantly rental neighborhoods like Gardena or Downey), while in Silver Lake it is 17.1x (closer to an established neighborhood like Beverly Hills).

These examples illustrate how price/rent ratios can help us understand where a particular neighborhood is in the real estate cycle.

You can use the rent per square foot calculator below to help see how your own rental situation stacks up to the trends.

Living in Los Angeles can be an expensive proposition, for both renters and owners alike. Using real estate data — as well as the ratios that put those numbers in context — is crucial to avoid getting ripped off in this overblown housing market.

Constantine Valhouli is the co-founder of NeighborhoodX, a soon-to-launch site that explores cities at the neighborhood level. Follow NeighborhoodX on Facebook or Constantine on Twitter at @c_valhouli.

Follow the Opinion section on Twitter @latimesopinion and Facebook

MORE FROM OPINION:

Which NFL stadium proposal would screw up L.A. traffic the least?

How we can use data to prevent cycling deaths in Los Angeles

If L.A. wants to be a world class city, it needs to stop micromanaging its public space

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.