Editorial: Trump is stocking his Cabinet with the ethically challenged. Case in point: Tom Price

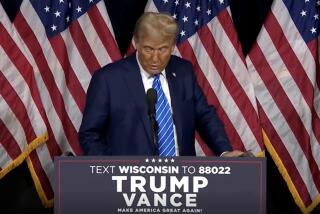

Health and Human Services Secretary-designate, Rep. Tom Price, R-Ga.testifying on Capitol Hill in Washington at his confirmation hearing on Jan. 24.

It’s bad enough that President Trump confined his Cabinet search to members of the 1%. But it’s particularly galling that his choice for secretary of the Department of Health and Human Services — an agency vital to poor and infirm Americans — may have used his congressional office to expand his personal fortune.

That nominee — Rep. Tom Price (R-Ga.), an orthopedic surgeon who has served on two House committees that help shape healthcare policy — invested in more than half a dozen healthcare-industry companies even as he took steps as a legislator that benefited them. That’s a clear conflict of interest, and if Trump honestly wanted to drain the swamp of self-serving elites in Washington, he would have withdrawn Price’s nomination as soon as Price’s investing habits came to light.

Granted, those investments represent a small fraction of Price’s net worth, which the House’s imprecise financial disclosures value at $10 million or more. The problem is that Price would invest at all in drug companies, medical device makers and other health-industry firms with so clear a stake in the measures he sponsored. By the Wall Street Journal’s tabulation, Price traded more than $300,000 worth of healthcare-company stocks in his last two terms as he sponsored and voted on legislation affecting those companies.

Trump should not be able to...fill his Cabinet with people who can’t or refuse to see the conflicts between their own interests and the public’s.

Three particular sets of transactions stand out. According to Time magazine, a broker acquired $6,000 to $90,000 worth of shares in six major pharmaceutical companies for the congressman in March 2016, just after a division of the Health and Human Services Department proposed to change how doctors were reimbursed by Medicare for the drugs they buy and administer to patients. The point was to eliminate a perverse incentive for doctors to use the most expensive drugs available, rather than the ones that would help their patients the most. The six companies lobbied hard against the proposal, and after buying their stock, Price cosponsored a resolution to block the rule and sent a letter (with wide support from both parties) to the Obama administration urging that the rule be dropped. It was.

Also in March 2016, CNN reported, Price acquired $1,000 to $15,000 worth of stock in Zimmer Biomet, a top manufacturer of artificial knees and hips. A few days later, Price introduced a bill to delay a proposed rule designed to rein in hospitals’ spending on … knee and hip replacements. The proposal, part of the Obama administration’s push to get more value out of the money spent on healthcare, mirrored efforts by states and private insurers to come up with better ways to pay doctors and hospitals.

Finally, last June, Price bought $50,000 to $100,000 worth of stock in an Australian biotech company at a special discounted price available only to a small circle of buyers, the Wall Street Journal reported. The shares have more than doubled in value since then.

Price’s supporters argue that most of the trades were made without Price’s prior knowledge and that Price was hardly the only person given access to the discounted biotech shares. The problem is more fundamental than that, however. Price knew what he owned, and that knowledge created a conflict. That’s why lawmakers should not hold shares in individual companies or narrowly targeted mutual funds, particularly not in the fields directly affected by their work.

The congressman also happens to be wrong on healthcare policy, simultaneously seeking to lower governmental spending on care while freeing doctors, hospitals and drug makers to charge more. But his views are (sadly) within his party’s mainstream, and Trump should have the leeway to pick nominees whose policy choices reflect his own. What he should not be able to do, however, is fill his Cabinet with people who can’t or refuse to see the conflicts between their own interests and the public’s.

The Senate is expected to vote on Price this week, then turn to Trump’s nominee for secretary of the Treasury: Steve Mnuchin, a former Goldman Sachs partner, hedge fund manager and OneWest Bank honcho. Mnuchin presents a different ethics-related issue for senators. Although he’s been flailed for some apparently dodgy testimony at his nomination hearing — for example, he said that OneWest engaged in no robo-signing of foreclosure documents when it clearly did — the main rap against Mnuchin is that he grew rich and his bank prospered while foreclosing on thousands of people, often unfairly and at times with stunning heartlessness, and evicting a disproportionate number of people of color.

In other words, Mnuchin’s problems stem from his company’s and his industry’s bad behavior — yet the ethical problem may be as serious as Price’s. In fact, it is precisely the sort of Wall Street greed and arrogance that Trump denounced on the campaign trail, back when he often sounded like a populist. He doesn’t seem to mind it as much now.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.