CEOs want <i>you</i> -- to fix the debt

Many of the nation’s top CEOs have joined forces to “fix the debt.” They want to achieve this goal, in part, by reducing Social Security benefits and raising the retirement age to 70.

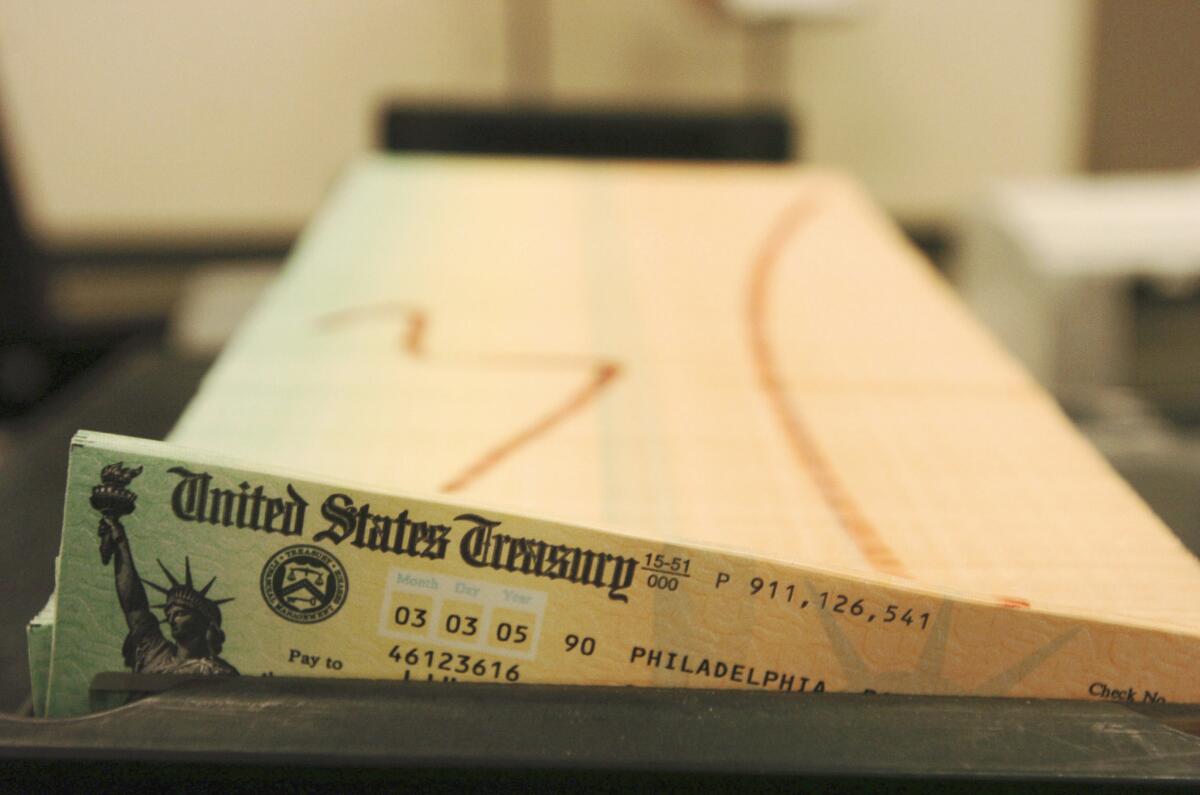

One of the chief executive officers, David Cote, runs Honeywell. “As an American, I couldn’t know about this problem and not try to do something about it,” Cote told Wall Street Journal TV. Cote has $134 million in his Honeywell retirement account, according to documents filed with the Securities and Exchange Commission, and he has worked there only 11 years. That amount could provide him a monthly retirement check of $795,134 once he turns 65. The Social Security retirees whose checks he wants to reduce receive, on average, $1,237 a month.

Cote is not alone among those with lavish private retirement benefits to be calling for major cuts in Social Security. He is one of 200 large-company CEOs who belong to the Business Roundtable, a powerful lobbying club that represents the interests of America’s corporate leaders. Roundtable is a leading voice calling for replacing the current formula used to calculate Social Security cost-of-living increases with a less generous one. The change it suggests would steadily chip away at retiree benefits each year until, after 20 years, Social Security checks would be about $100 less than if the current formula was retained.

The Business Roundtable also advocates raising the retirement age to receive full Social Security benefits to 70, which would give the U.S. the dubious distinction of requiring workers to wait longer than any other developed nation to receive their public pensions.

Like Cote, many of the CEOs on the Business Roundtable have corporate retirement benefits that ordinary Americans would find unimaginable: an average of $14.5 million, enough to garner monthly retirement checks of $86,043, according to a new report, “Platinum-Plated Pensions,” published by the Center for Effective Government and the Institute for Policy Studies.

The report examines America’s growing retirement crisis. CEOs’ decisions to cut their workers’ pensions have played a direct role in this crisis. In 1980, 89% of America’s largest corporations offered their workers a defined-benefit pension that reliably delivered monthly pension checks to retirees. Today, only 11% of these firms offer pensions. Most have switched workers to riskier 401(k) plans, which generate huge fees for Wall Street — and the prospect of an uncertain retirement for most employees.

The elimination of so many corporate pensions has left Americans more dependent on Social Security. More than a third of all Americans over age 65 receive 90% or more of their monthly income from Social Security, and that’s in an era when many retirees still draw pension benefits. Six million Americans over the age of 65 currently live beneath the poverty line, with 2 million more expected to join them by 2020. Cutting Social Security benefits would make things worse.

It wasn’t always this way in America. When I was growing up, my father was an executive in a plant that made earthmoving equipment, the giant trucks used in mining and to build roads. During economic downturns when workers were laid off, our family knew that my dad would keep his job but his pay would be reduced. That was as it should be. The families of workers and managers lived their lives together — they sat next to one another at church and cheered together at their children’s baseball games. Everyone was in it together.

The world has changed. We live in a world of even greater abundance than back then. The U.S. economy produces fabulous wealth, and workers are more productive than ever. But the wealth isn’t benefiting all. As employee pensions evaporate and public funding for things such as schools are cut, those savings are winding up in the pensions and paychecks of corporate leaders, who are increasingly distant from the people they work with and the members of their community.

Rather than the “I’ve got mine” platinum pension set calling for cuts to everyone else’s Social Security, perhaps some real CEO patriots will lead the charge for lifting the cap on wages subject to Social Security taxes. Doing so would secure the Social Security system for the next 75 years, far longer than raising the retirement age.

If CEOs want to continue calling for reductions in retirement benefits, they should do so while looking in a mirror.

Scott Klinger is director of revenue and spending policies at the Center for Effective Government in Washington and a coauthor of the “Platinum-Plated Pensions” report.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.