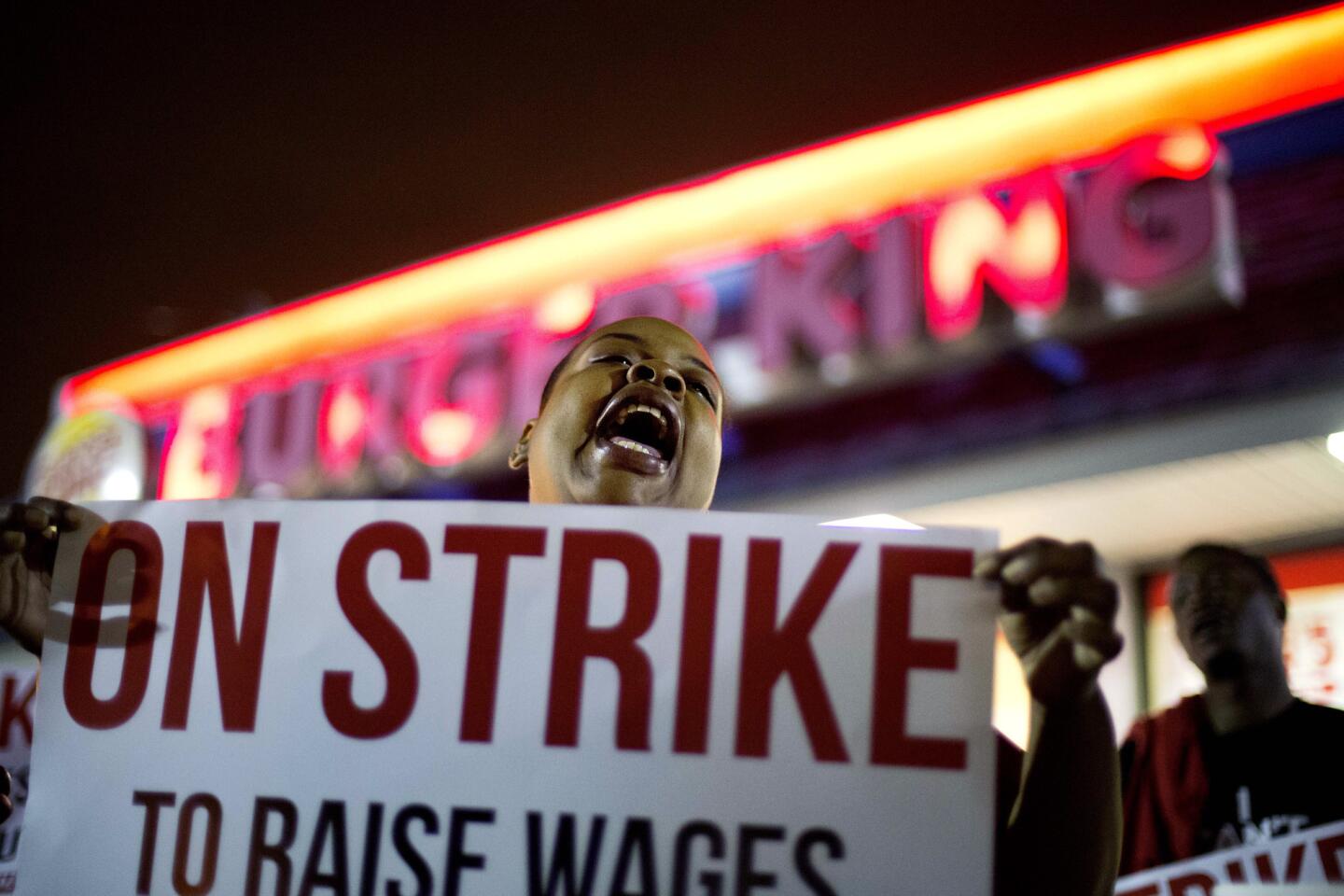

Minimum-wage workers take to streets to ‘Fight for 15’

Andrew Olson works at a McDonald’s here, making about $8.60 an hour while his fiancee earns minimum wage at a nearby Dollar Tree.

Their salaries are so meager, he says, that they rely on food stamps and Medicaid to get by.

“The taxpayers shouldn’t have to pay for what we need to survive,” said the 25-year-old Olson, who plans on taking part in the “Fight for 15” march for an increased minimum wage Wednesday in Denver. “It should be between employees and companies to determine a living wage.”

Fast-food workers and other low-wage earners staged protests nationwide Wednesday. In Chicago, demonstrators carried signs reading “We are worth more!” while in New York, dozens of protesters staged a “die-in,” lying on the ground in front of a McDonald’s. Some New York protesters carried signs too: “WE SEE WAGE SLAVERY” and “WE WORK HARD.”

As the ranks of service jobs swell and incomes stagnate, increasing numbers of minimum wage earners are unable to make ends meet without government assistance, a situation labor advocates say poses an undue burden to both employees and taxpayers.

A study released Monday from the UC Berkeley Center for Labor Research and Education, funded by the Service Employees International Union, reported 56% of all state and federal public assistance programs now go to working families. That adds up to $153 billion a year, including $25 billion in state funding.

“When companies pay too little for workers to provide for their families, workers rely on public assistance programs to meet their basic needs,” said Ken Jacobs, chairman of the center and coauthor of the report, in a prepared statement. “This creates significant cost to the states.”

At least one state is looking to address those costs through legislation.

A bill winding through the Connecticut General Assembly would require companies with more than 250 workers to pay a fee to the state for every employee not earning at least $15 an hour. The legislation, sponsored by Democratic State Rep. Peter Tercyak, is estimated to generate $171 million in revenue its first year and $341 million after that.

“We are providing all kinds of services that these employees qualify for because they are paid so little,” Tercyak said. “We have actually found some of these companies steering their employees to these state services.”

In Colorado, there are rumblings of such a “McWalmart” bill aimed at addressing what some call corporate “free-riding” on the backs of taxpayers.

“There is a high level of chatter about it,” said Tim Hoover, director of communications for the Colorado Fiscal Institute, a left-leaning think tank. “Something is likely to materialize but we have no idea when.”

This week’s UC Berkeley study underscores the costs states absorb to support low-wage earners. According to the study, California spends $3.7 billion, New York $3.3 billion and Texas $2 billion on public assistance programs to, among others, fast-food employees, child- and home-care workers and part-time college faculty.

Last week the Colorado Fiscal Institute said 600,000 Colorado employees, or a quarter of the state workforce, earn less than $12 an hour. As a result, taxpayers ante up about $304 million a year to cover their healthcare costs.

“We have always known that high numbers of working people were on public assistance but what we found out was staggering,” Hoover said. “It’s clear these big employers are shifting their costs to the taxpayers.”

Fixing the problem won’t be easy. There are few bolder fault lines between Republicans and Democrats than their perceptions of income inequality, and those lines are growing starker as presidential candidates stake out their positions. Democrats blame an inherent unfairness in the economy for the wage gap, while the GOP cites high taxation and onerous regulations.

But while politicians posture, states are beginning to take up the issue themselves.

Colorado, Maine, California, Oregon and Washington are all considering increasing their minimum wage to $12 an hour.

Then there’s the McWalmart bill.

If such legislation became law in Connecticut, Colorado and elsewhere, would it be a good idea? Some say a dramatic increase in minimum wage would result in companies hiring far fewer workers, causing greater unemployment. In that case, the government would wind up subsidizing even more people.

“It’s not the job of a business to pay everyone who works there a socially determined income,” said Michael Strain, deputy director of economic policy studies at the conservative American Enterprise Institute. “If McDonald’s paid the cashier $30,000 a year, they would be losing a lot of money on their employees.”

Strain said the tensions are understandable in a society where wages for most have barely budged while salaries for those at the top keep rising.

“The question isn’t if the concern is unreasonable, it’s how to address it,” he said. “It’s in the best interests of society for labor markets to get paid roughly for what they bring in. If you’re a brain surgeon and making money for your hospital you should make more money than the person working in the hospital cafeteria.”

Perhaps, but for Andrew Olson, that’s a bit academic. He found himself on the low-wage treadmill when he realized he couldn’t afford college and now wonders whether he can ever get off. He’ll soon be getting a small raise but says it’s unlikely to make much of a difference.

“Just because I work in fast food does that mean I should have to just scrape by in life?” he asked.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.