A political disaster: How Measure EE, L.A. schools tax hike, failed so badly

Backers of the Los Angeles Unified School District’s proposed parcel tax always knew they had an uphill battle and that defeat was a possibility.

They needed a two-thirds majority for the measure to pass. They thought they could eke out a win.

After the ballots were counted, though, the tax earned only 45% of the vote — a stunning defeat for school leaders and Mayor Eric Garcetti, who campaigned hard for the measure.

Here is a look at what went wrong:

What was the measure?

Measure EE would have imposed a levy of 16 cents per square foot of indoor space on a property, excluding parking areas. It would have raised an estimated $500 million annually over its 12-year term for the district.

LAUSD officials said money from the parcel tax was badly needed to provide more resources and staffing for classrooms. They pointed to much higher spending levels for schools in New York City and other large urban areas.

The school system also needs more money to deal with a long-term projected funding shortfall, which is exacerbated by commitments to pay for retiree health benefits and pension obligations.

How did the backers hope to win?

Local voters had surpassed the two-thirds mark on recent funding measures affecting parks, transportation and homeless services.

But not this time

“It is a very high threshold. It’s easier to count to 34 than it is to 67,” said Garcetti, alluding to the two-thirds requirement. “In most democracies, in most states, even redder states … it’s a simple majority.”

Across most of the sprawling school system, the tax measure was the only item on the ballot, and that hurt turnout. Turnout is expected to reach around 10% once all the votes are tallied.

Low-turnout elections generally bring out a disproportionately older, more conservative and less tax-friendly electorate.

The time frame for the campaign was tight, but supporters assembled a wide-ranging coalition that raised about $8 million.

Two powerful employee unions combined forces, providing volunteers and financial backing: United Teachers Los Angeles, which represents teachers, nurses, counselors and librarians, and Local 99 of the Service Employees International Union, which represents a comparable number of employees including cafeteria workers, bus drivers, classroom assistants and security aides.

Community groups generally supported the measure, as did some key local business and civic leaders, including Clippers owner Steve Ballmer and philanthropist Eli Broad.

What did the opposition do?

Although opponents failed to raise nearly as much money, they had enough to get their message out. Funding for the opposition came primarily from taxpayer organizations and local groups representing business interests, including the L.A. Area Chamber of Commerce, the Valley Industry & Commerce Assn. and BizFed.

Opponents also generated attention by capitalizing on a district stumble: a last-minute change to the wording of the measure that made it seem, to critics, as though officials were trying to expand the tax without appropriate public scrutiny.

District officials denied wrongdoing, but the issue was headed for a court hearing before Tuesday. At this point, the litigation over the measure is probably pointless with the measure’s defeat.

What is next?

It’s possible the district will come back with another parcel tax plan, perhaps during an election when there would be greater turnout.

The June parcel tax bid was an aggressive change of direction for district leaders. They had narrowly rejected this very strategy less than a year earlier as unlikely to succeed until L.A. Unified demonstrated financial and academic progress. They also spoke of choosing an election date likely to have a higher and more liberal turnout, to give a tax measure a better chance of succeeding. And they wanted plenty of time to run a campaign. They were pointing toward the presidential election year of 2020.

That logic changed after the six-day teachers’ strike in January, which seemed to generate broad support for the issues raised by teachers, including their advocacy for more education funding.

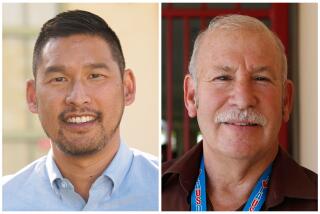

Based on promising polling, Supt. Austin Beutner put aside his previous caution and urged the Board of Education to make the try.

There is a precedent for this: Previously, voters rejected school spending ballot measures initially, only to come back and support them later.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.