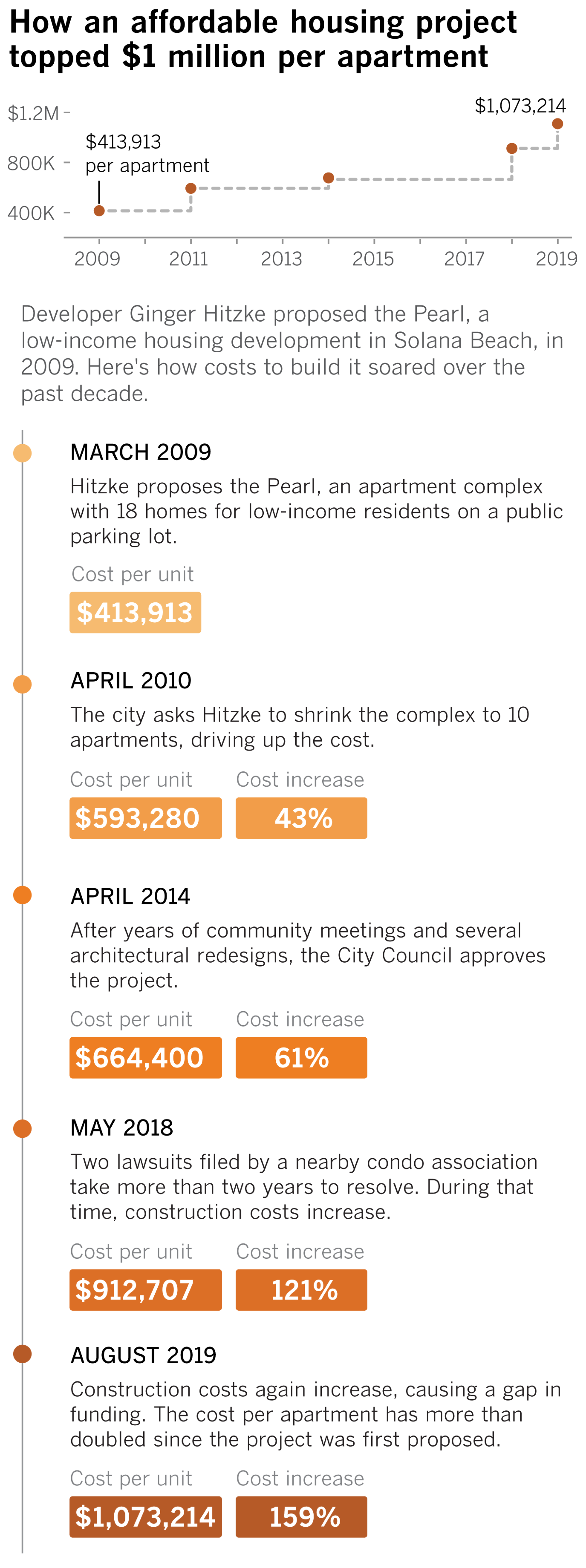

SOLANA BEACH, Calif. — When developer Ginger Hitzke first proposed an affordable housing complex on a parking lot in Solana Beach, she envisioned building 18 new homes for low-income families and adults at a cost of $414,000 per apartment.

More than a decade later, her project has shrunk in size by nearly half and become more than twice as expensive.

At $1.1 million per apartment, the Pearl is the priciest affordable housing project in the state and, likely, the country. It also serves as an alarming example of how political, economic and bureaucratic forces have converged to drive up the cost of such housing at a time when growing numbers of Californians need it.

“I have sticker shock,” Hitzke said. “It’s insane.”

These are some of the unusual new scenes across the Southland during the coronavirus outbreak.

California leads the nation in the cost of building government-subsidized apartment complexes for low-income residents. A Times analysis of state data found that apartments cost an average of about $500,000. In the last decade, the price tag has grown 26%, after adjusting for inflation.

The notoriously high price of land and the rising cost of construction materials are part of the reason. But The Times found that numerous factors within the control of state and local governments also are to blame, including opposition from neighbors and rules that compel developers to meet labor and environmental standards that often exceed what’s required for luxury condominiums.

All this has complicated California’s efforts to alleviate its homelessness and affordable housing crises, driven by a shortage of 1.3 million homes for low-income households, sky-high rental prices and a poverty rate to match.

With the coronavirus pandemic already leading to significant job losses, particularly in the low-wage hospitality and service industries, experts believe the demand for affordable housing is only going to grow. The economic damage also is likely to severely depress government tax revenue, leaving less money available to finance new construction.

That steps up pressure on California to overhaul the way it builds low-income housing, said Carolina Reid, faculty research advisor at UC Berkeley’s Terner Center for Housing Innovation and author of a new study on the cost to build low-income housing.

“Every single one of the actors in it, from cities to developers to construction workers, is going to face stress from the coronavirus for years,” Reid said. “This public health crisis adds more urgency to making the reforms we had already needed.”

In recent years, voters across California have approved billions of dollars to build homes for low-income families and homeless people. But those plans often have failed to meet public expectations because those billions build fewer and fewer apartments.

In addition to the Pearl, The Times found six affordable housing developments in California — all in the Bay Area — that have eclipsed $900,000 per apartment to build as well. Half opened in the last year and the rest are under construction.

Building costs have soared far from the coast as well. In Imperial County, one of the state’s poorest, the cost has climbed 70% in the last decade. And in Fresno County, the average price for affordable housing has doubled to $376,000 per apartment, an amount a third higher than a median single-family home.

Indeed, what developers in California pay to build affordable housing is more than what they do for market-rate homes for the broader population, another UC Berkeley study found. California was the most expensive place to build in the country, according to a recent report from the U.S. Government Accountability Office, which compared the state to New York City and 10 other cities and states. If building was as cheap here as everywhere else, about 12,000 more low-income families could have received homes between 2011 and 2015, The Times found.

Why do these homes cost so much to build? One reason is that regulations require developers to pay construction workers union-level wages. Another is California’s labyrinthine financing process, which forces developers to navigate a dozen different funding programs controlled by five separate departments with authority divided between the governor and state treasurer.

Developers also have to appease local governments, which often make projects less economically viable by insisting on fewer apartments and more parking. That happened in the wealthy San Diego County enclave of Solana Beach, where the Pearl was cut from 18 apartments to 10 and its approval required an underground garage with 53 parking spots.

The cumulative result is that millions of Californians have been unable to find an affordable place to live.

::

The Pearl’s saga began three decades ago in a rundown motel in Solana Beach. Miguel Zamora, who lived in the motel with his wife and four children, remembers that the hot water came and went, the roof leaked and toilets overflowed. Cockroaches, fleas and rats infested the rooms.

“It was all dirt,” said Zamora, who worked in construction and as a dishwasher and gardener. “It wasn’t even paved.”

In 1992, the city of Solana Beach filed a criminal complaint against the motel’s Beverly Hills-based owner. As part of the settlement, the city demolished the motel, but agreed to provide Zamora’s family and more than half a dozen other residents new affordable housing by 1999.

Zamora and the others also received federal housing assistance vouchers, which helped him find an apartment five miles away from the old motel. His family has been living there for the last two decades, but the apartment they never received still weighs on his mind.

Should the Pearl or other low-income housing ever get built in the city, Zamora has the right to move in first. He longs to bring his extended family together in a place that feels more like home.

“I’d like to enjoy my grandchildren,” said Zamora, 67. “Because being apart is hard.”

Even though the deadline to provide the affordable housing was 1999, it took almost another 10 years for Solana Beach’s leaders to take the first step of asking developers to pitch projects.

To understand why it can cost $1 million to build a single unit of affordable housing, The Times combed data from state, federal and academic sources.

Hitzke proposed building the Pearl on a 20,000-square-foot public parking lot, situated along a bluff on the same block as the old motel and a beach access point. The 18 apartments included enough three- and four-bedroom units to accommodate Zamora’s family and the others entitled to new housing.

Residents and the public would pay for parking in an underground garage, which would help finance the project, as would rent from a small grocery store. The Pearl would cost $414,000 per apartment to build.

City officials were intrigued but knew the idea would cause problems among Solana Beach’s 13,000 residents. The community has a median annual household income of more than $100,000. The parking lot sits on prime real estate, separated by a white fence from timeshare rentals. Across a tree-lined street is a three-story condominium complex where a two-bedroom unit recently sold for $1.2 million.

After a year of negotiations with the city, Hitzke agreed to shrink the Pearl to 10 apartments and make it free for the public to park in the 53-space garage. The redesign raised the price of the project to just under $600,000 per apartment.

At that point, in 2010, Hitzke and city officials were ready to unveil the Pearl to Solana Beach’s residents. It didn’t go well.

“Low-income people tend to own cars that are in disrepair and ride motorcycles adding to the noise of a ‘lights out at 8 p.m. community,’” Marylyn Rinaldi, a neighboring condominium owner, wrote in 2011 in a letter to the City Council that was later cited in a lawsuit over the project.

Rinaldi and others said that affordable housing didn’t belong in their community, and flooded the council with complaints.

::

The vast majority of housing is subsidized by the government. In fact, in California and across the U.S., low-income renters receive far less than homeowners, who can take a tax deduction for interest paid on their mortgages.

Still, each year federal and state governments spend billions of dollars on affordable rental housing. The primary way it’s funded is through tax credits, which reduce what banks and other large investors owe the Internal Revenue Service and state treasury if they help pay for housing projects. In Los Angeles, a family of four must make no more than $62,640 a year to qualify for housing built for those earning less than 60% of the region’s median income. In turn, that family would pay a maximum of $1,410 a month for a two-bedroom apartment.

Many large states have only one department that hands out affordable housing funding. California has five. And those departments report to different elected officials, leaving no one in charge of overseeing the system as a whole.

Gov. Gavin Newsom has learned this lesson the hard way. Last year, he issued an executive order that aimed to speed up construction and reduce the cost of affordable housing by offering state-owned land for development.

One of the first projects to take advantage was a proposal for 56 small studios in downtown Sacramento. But two months ago, a department that hands out bond financing for affordable housing — one controlled by the Treasurer’s Office, not Newsom — rejected funding for the project. It’s now in limbo.

Developers have to file a series of applications to access a dozen different funding programs that, like the bond financing department, have their own regulations determining what projects win. To make matters more confusing, there are three separate programs to finance homeless housing, and four geared toward affordable housing near mass transit — each with different rules.

To win state dollars, developers often first have to secure funding from locally run affordable housing programs and bond measures — such as the Proposition HHH homeless housing bond in Los Angeles — that have their own regulations.

For developers, the process of cobbling together multiple streams of revenue is expensive. The Times found that each additional funding source increases the average per-unit cost by more than $6,000.

The volume of financing requirements leads developers to hire consultants, attorneys and compliance officers. The U.S. GAO study found that 14% of the price tag for California’s affordable housing projects was made up of these types of administrative costs — the highest in the country and more than developers spend on land.

As a result, there’s a huge backlog of projects, said Matt Schwartz, president of the California Housing Partnership Corp., which helps developers secure financing.

“The folks in our office who work on all these applications, they’re just going bananas,” Schwartz said. “We can’t keep up with the workload.”

The state is so overwhelmed that at a public meeting last summer, a top deputy with the Treasurer’s Office admitted that he had recently discovered piles of paper stacked in an office because staff couldn’t process them quickly enough.

Newsom has promised to lead an effort this year to simplify how developers get state money for affordable housing.

“I’ve just had enough with TCAC and CDLAC and OPRs and CalVets and HCDs and CalHFAs,” the governor said, name-dropping the alphabet soup of departments involved in financing projects, while unveiling his budget proposal in January. “Six of you understand what the hell I just said. No one else does. And that’s the point.”

::

The Solana Beach City Council finally approved the Pearl at the end of a four-hour meeting in spring 2014.

Almost immediately, the association for the condominium complex across the street sued, arguing that the city couldn’t build housing on the land because the deed required it to be a parking lot. The condo association lost the case and an appeal, but it took 2½ years to resolve.

Afterward, Hitzke was able to win some tax credits from the state, but the legal delay presented her with a new challenge: construction costs.

She attributes nearly all the 62% increase in the price per apartment in the six years since the project was approved to labor and materials. Overall, the UC Berkeley study found that those costs have gone up 30% for California affordable housing projects in that time.

With a cost of building at $1.1 million per apartment, Hitzke hasn’t been able to find enough state and local money to break ground. The state and local governments have refused to give her the $1 million she still needed. And neighbors have never stopped fighting the development.

Ernest Kurschat, a resident of a timeshare next to the site proposed for the Pearl, wrote to oppose the project in 2018, speculating that the retail space in the building would be “a food stamp office for the low-income housing.”

Solana Beach leaders have continued to support the Pearl, however, contending much of the costs of building are unavoidable in a community where the median home value is $1.4 million.

Hitzke said she’d have enough money to build the development, which is less than a mile from a major commuter rail stop, if she didn’t have to include the large underground parking garage.

But City Councilman David Zito defended the garage. Even if Solana Beach were legally allowed to do away with the parking, he said, the city was “ethically, morally obligated” to replace it because of “residential harmony.” It’s the same reason he believed the Pearl’s height should fit in with the surrounding neighborhood — so it doesn’t remind people of notorious high-rise public housing.

“You start talking about big projects that are wholly affordable and people start thinking about ‘projects,’ right? Like Cabrini-Green in Chicago or something like that,” said Zito, the only elected official who voted to approve the Pearl who remains on the council. “That then turns into a whole different discussion.”

Elected officials in other cities have had second thoughts about bowing to public pressure.

Last year, the Bay Area city of Alameda opened Everett Commons, a low-income development providing homes for 20 families at a cost of $947,000 per apartment to build. That project did not face the same level of opposition as the Pearl. But in the decade before Everett Commons’ approval, the number of proposed apartments shrank from 36 to 20.

John Knox White, who voted for Everett Commons while on the planning commission and now serves on the City Council, said he regrets how little the city prioritized low-income families who were being forced out of Alameda.

It’s a system that “provides excessive and undue voice and influence for people who are connected to the political process,” he said. “Who is speaking and who is being heard is very skewed, and it’s skewed toward people who have land and property.”

::

Even if state officials are able to streamline bureaucracy and local officials are able to fend off naysaying neighbors, other drivers of California’s high housing costs remain tied to goals embraced by key Democratic constituencies: labor unions and environmentalists.

Many state and local funding programs require low-income housing developers to pay union-level wages to construction workers. In Los Angeles, for example, these rules require developers to pay plumbers $51 an hour compared with their $24-an-hour median wage in the region.

The UC Berkeley report found that projects paying union-level wages can cost $50,000 more per apartment. A Times analysis found a similar trend.

California labor leaders cite other research, including their own, concluding that the cost impacts are much lower. Beyond that, they contend that construction workers should earn enough money when building low-income housing so that they won’t need low-income housing themselves. State lawmakers often repeat that argument.

To have the best chance of winning tax credit funding, low-income housing developers also must build their projects to environmental standards that exceed even what the state requires of developers of new luxury condominiums. That includes using solar power for most of their electricity or certifying their energy efficiency with LEED or other third parties.

The thinking is state-funded affordable housing should be “the most superior, energy-efficient buildings in the world,” said Doug Shoemaker, a senior vice president at nonprofit developer Mercy Housing. “I’m not sure that that last bit of benefit really is worth the cost.”

The UC Berkeley study found that projects built to stricter environmental standards cost $17,000 more per apartment than those that aren’t.

The Pearl’s funding requirements called for the building to be LEED-certified and for Hitzke to pay union-level wages for construction workers. The initial budget had left room for a profit. But as early as 2013, Hitzke realized that she wasn’t going to make any money on the deal.

Now it looks like the Pearl won’t happen at all.

In December, the state informed her that it was planning to pull her funding because the project hadn’t broken ground. A month ago, Hitzke met with city officials to tell them she wanted out of her development agreement.

“I am thrilled to be done with this thing,” Hitzke said. “It’s done nothing but kill me. But at the same time, I tried to do everything I could to get it done.”

Zamora and his family, meanwhile, are still waiting in their apartment five miles away. When he drives by his old community these days, he feels only disappointment.

“It’s sad to see the place so desolate,” Zamora said.

Times staff writer Ryan Menezes contributed to this report.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.