PG&E and Southern California Edison can’t raise profit margins, regulators decide

The California Public Utilities Commission ruled Thursday that profit margins will remain the same at the state’s major utilities, denying the companies the higher shareholder returns they had sought.

Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric had argued that higher profits were necessary to keep attracting sufficient capital to fund their operations. They pointed to the billions of dollars in wildfire liabilities that prompted PG&E to file for bankruptcy protection, saying that investors may need larger returns to justify funding the companies, which provide electricity to a majority of Californians.

In a unanimous vote, the utilities commission rejected those arguments.

The commission cited Assembly Bill 1054, which could give utility companies access to billions of dollars to help pay for damage from fires ignited by their equipment. That and other “investor supportive policies,” the commission wrote, “have mitigated wildfire exposure faced by California’s utilities.”

“This proposed decision reaches a fair and just outcome,” commission President Marybel Batjer said.

With a 2020 shutdown deadline looming, four coastal gas plants have become an early battleground in an increasingly urgent debate.

Regulators also denied a request for higher profits from Southern California Gas, which, like SDG&E, is a subsidiary of San Diego-based Sempra Energy.

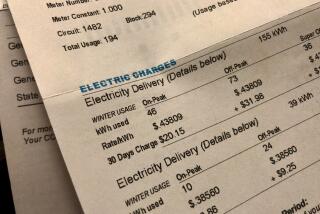

Profit margins will stay level at 10.3% for Edison, 10.25% for PG&E, 10.2% for SDG&E and 10.05% for SoCalGas. That means for every dollar the utilities spend building electric or gas infrastructure, they’ll be allowed to charge customers an additional 10 cents or so in profits for their shareholders.

The Public Utilities Commission is supposed to guarantee shareholders a “return on equity” no higher than is necessary to attract investment so that utilities have enough money to pay for infrastructure projects, safety upgrades and the growing amounts of climate-friendly energy required by state law.

Ratepayer advocates had asked regulators to reduce utility profits, citing a long-term decline in interest rates and other factors.

At a commission hearing earlier this month, Edward Lopez, executive director of the Utility Consumers’ Action Network, said the average shareholder return approved by utilities regulators nationwide was 9.6% in 2018. He urged the commission to perform a “reality check” by revising profits downward.

Shrinking the profit margins “could result in a very real-world difference for California ratepayers,” Lopez said.

The utilities commission’s in-house ratepayer watchdog, the Public Advocates Office, proposed returns on equity of 8.65% for Edison and 8.49% for PG&E, SDG&E and SoCalGas. The Utility Reform Network, a San Francisco-based consumer advocacy group known as TURN, asked for profit margins below 10%.

“National authorized equity returns have trended steadily downward since 2013,” Marcel Hawiger, a staff attorney at TURN, told the commission.

The commission largely sidestepped those arguments, writing only that it had considered evidence including “market conditions, trends, creditworthiness, interest rate forecasts, quantitative financial models, additional risk factors including business risk, and interest coverage presented by the parties.”

Clean energy advocates are talking about what comes next — and warning that climate change demands faster action.

The monopoly electric utilities originally asked for dramatically higher profits, which could have resulted in monthly electric bill hikes of $7.85 for PG&E customers, $12.20 for Edison customers and $5.59 for SDG&E customers. They substantially lowered those requests after Gov. Gavin Newsom signed AB 1054.

But the three utilities still asked for increased shareholder returns, which would have led to higher customer bills as early as January 2020.

Kevin Payne, Edison’s president and chief executive, told regulators this month that even with the passage of AB 1054, his utility is “clearly exposed to greater risk than it was in 2017,” the last time profit margins were set. He noted that Edison’s credit ratings have been downgraded since 2017.

He also cited California’s “inverse condemnation” standard, which could put shareholders on the hook for the costs of wildfires sparked by utility equipment.

“While we agree that AB 1054 limits risk, albeit at significant cost to shareholders, we do not agree that it eliminates all residual risk,” Payne said.

Jason Wells, PG&E’s executive vice president and chief financial officer, made a similar argument.

Wells told the utilities commission that PG&E plans to invest $28 billion in energy infrastructure through 2022, with much of that spending intended to reduce the risk of utility-ignited fires and help California meet its clean energy goals. To attract that capital, Wells said at a hearing earlier this month, PG&E “must offer investors a fair return for the risks they bear comparable to opportunities they have nationally and internationally.”

“No other state faces the combined risks of climate change, wildfires, inverse condemnation, and decarbonizing the natural gas system,” Wells said. “And no other state has seen such an overall decline in the financial health of its utility as experienced here in California.”

In its decision keeping profit margins the same, the Public Utilities Commission noted that even with inverse condemnation, utility shareholders will pay only for financial losses from wildfires caused by “imprudent actions” — and even then, shareholder liability will most likely be capped by AB 1054.

“Investor owned utilities should not be rewarded with [a return on equity] that is inflated due to imprudent actions,” the commission wrote.

Regulators also declined a request from the Environmental Defense Fund, a nonprofit advocacy group, to set different profit margins for investments in electric and gas infrastructure at the two investor-owned utilities that deliver both commodities, Pacific Gas & Electric and San Diego Gas & Electric.

The Environmental Defense Fund argued that shareholders at PG&E and SDG&E should earn higher profits for investing in electric infrastructure than in gas infrastructure, with a goal of encouraging the utilities to help shift their customers from gas to electricity for heating and cooking. A growing number of clean energy advocates and state policymakers see “electrification” as a key strategy for reducing California’s dependence on natural gas, a planet-warming fossil fuel.

Southern California Gas is engaged in a wide-ranging campaign to preserve the role of its pipelines in powering society.

PG&E opposed the environmental group’s proposal, saying in a commission filing that it “fails to recognize that maintaining safe and reliable service on the gas system requires capital, for which investors should receive a fair return.” Sempra subsidiary SDG&E was also opposed, writing that the concept of separate profit margins for gas and electric investments can be “quickly dispensed with” because it is contrary to Supreme Court precedent.

Sempra has pushed back against state- and city-level efforts to replace gas with electricity, describing electrification as a threat to its bottom line and arguing that it can reduce planet-warming carbon dioxide emissions more cheaply by replacing the fossil gas in its pipeline with cleaner fuels.

Bruce Folkmann, chief financial officer for SoCalGas and SDG&E, described electrification as one of the reasons SoCalGas needs higher profit margins.

“SoCalGas is the largest gas distribution utility in the U.S., at a time when efforts to decarbonize the energy supply with greater electrification, for example, directly elevate the risk profile for investors in the gas company,” Folkmann told the PUC earlier this month.

The commission said in its decision Thursday that it may study the idea of different profit margins for gas and electric investments in a future proceeding.