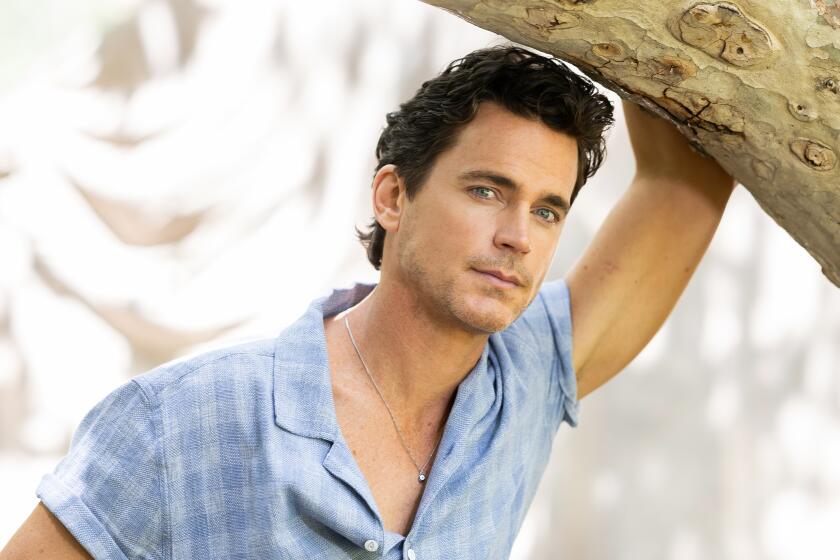

Can this man save the music business?

Lucian Grainge has a vision for the future of the music business that bears scant resemblance to the traditional record company playbook.

He is putting songs on smartphones in Africa, reviving moribund American record labels and making Lorde into a Grammy-winning global sensation. Above all, he wants to forge new partnerships with his industry’s erstwhile adversaries — the technology firms that have upended the way people get their music.

Skeptics question whether anyone can reverse the decline of an industry that has seen global sales plummet from $28 billion in 1999 to $16.5 billion in 2012. But if anyone can save the music business, it might be Grainge. As chairman of Universal Music Group, the biggest of the three remaining major record companies, few rival his influence in determining how people will listen to music, and how they will pay for it.

INTERACTIVE: Discover songs of L.A.

“He’s the great hope for the music business,” said Irving Azoff, manager of the Eagles, Christina Aguilera and other acts. “He started as a song plugger and a publishing guy. He understands the entire worldwide record business. And he gets technology. He understands that’s the future of the business.”

Many have counted out the business as a casualty of the digital age. Grainge, 54, contends that the music industry has turned a corner. Globally, annual sales rose 0.2% in 2012 — a modest number, but the first growth since 1999. Universal itself booked a profit of $706 million last year.

The nascent recovery can be traced to the growing popularity of digital music services. Pandora, Spotify and other streaming enterprises are now the fastest-growing source of revenue for the industry, aided by the spread of smartphones. This has helped create new markets and allowed Universal and other companies to collect monthly fees that provide a steady source of revenue.

Satellite radio is starting to generate serious cash as well. Seven out of 10 new cars sold in the U.S. come equipped with satellite radios, and 25.6 million people pay to tune in. Royalties paid by Sirius XM are the largest chunk of the $590 million that labels and artists pocketed last year, according to SoundExchange, which collects and distributes music royalties.

At the same time, Grainge says the industry has only just begun to reinvent itself — Universal included. Four years ago, he moved the headquarters from New York to California to be closer to the tech companies — such as Google’s YouTube division and Apple Inc. — that have replaced radio stations and record stores as the key gateways through which a new generation hears music.

FACES TO WATCH 2014: Digital Media | Pop music, jazz

The challenges facing even a successful company such as Universal were on display in a conference room at Universal’s offices in Santa Monica.

Rob Wells, the global digital business chief, kicked off a presentation by noting that people in some markets spend less than $1.50 a month on music, or less than a cup of coffee at Starbucks.

“Better turn the lights off,” Grainge said with a smile. “We need to save some electricity.”

Wells then went on to present what might be considered a radical new plan: a service that would permit unlimited song downloads for about $20 a month.

The hook is that consumers would get to keep all the tracks they download, even after the subscription lapses. The risk is that consumers would gorge on music for a month or two, downloading thousands of songs, and then let the subscription lapse.

Grainge found the potential upside to be worth the risk, and urged his team to test the concept in a European market ravaged by piracy.

Such new approaches to distribution serve Grainge’s larger goal of boosting sales by focusing on emerging markets, where revenues are expected to double over the next five years. In Africa, Universal partnered with Samsung last spring to launch the Kleek, a music service that offers a mix of the company’s international catalog as well as local artists such as Power Boyz and DJ Vetkuk.

In countries including Kenya, Uganda and Nigeria, Samsung provides the service free as an incentive to buy its smartphones.

“We’re bundling music into markets where we’ve never been able to monetize anything,” Grainge said.

Some industry analysts believe recent financial improvements in the music business are largely the result of layoffs and cost-cutting. The major record labels employ about 10,000 people in the U.S., down from 25,000 in 1999.

“I don’t think there’s a bright story here that says there’s gold in the hills and we’ve recovered,” said David Pakman, who formerly ran online retailer EMusic and now works in venture capital. “Through cost-cutting, they’ve stabilized — but that’s because they cut huge amounts of costs out.”

::

The music business today is far different than the one Grainge entered in 1979 when, at 18, he used a pay phone in his father’s deli to cold-call music industry executives and angle for a job. A year later, he signed his first act, the English rock band the Psychedelic Furs.

A few years later he was hired as an A&R; (artists and repertoire) man at RCA Music Group, where he helped the Eurythmics top the charts, eventually rising to head the company’s A&R; department.

Through a wave of record company consolidations that began in the 1990s, Grainge steadily gained a reputation as an executive who could smell a hit and who was particularly good with artists — persuading the Rolling Stones, among others, to switch labels.

By 2005 he was running Universal Music Group’s operations outside North America, and in 2011 he was named to lead the company.

PHOTOS: Celebrity production companies

In 2012, Grainge outmaneuvered Warner Music and bought EMI for $1.9 billion — making Universal the biggest by market share of the three remaining labels, with a vast catalog that included the Beatles, Katy Perry and Frank Sinatra.

In the digital era, breadth of catalog has become an increasingly valuable asset. Record companies now get about 15% of their U.S. revenue from the royalties and fees that streaming services such as Pandora, Spotify and Sirius XM pay. And Universal can use the size of its catalog to negotiate favorable deals with new on-demand music services.

At the same time, the lifeblood of the industry is new talent, and Grainge places a big emphasis on finding and developing artists.

Plunging revenue forced record companies to cut A&R; and marketing budgets and consolidate boutique labels. Grainge believes that hurt the ability to identify and nurture new talent. To correct that, he’s invested money into storied labels such as Capitol Records, Virgin Records and Blue Note Records and installed proven hit-makers such as Steve Barnett and Don Was to run them.

Veteran music producer Jimmy Iovine said that as the industry consolidated, it lost creative business executives such as Island Records founder Chris Blackwell, Geffen Records founder David Geffen and Motown Record Corp. founder Berry Gordy. He said Grainge is working to restore that spirit of risk-taking and innovation.

“He’s got the biggest company, and whoever has the biggest company has the responsibility to be bold,” Iovine said. “He’s willing and open to entrepreneurship and that kind of thing the record industry has gotten depleted of.”

PHOTOS: Top 10 tech gadgets we want to see in 2014

Grainge has also forged alliances with tech companies, including inviting Apple Chief Executive Tim Cook to join him at the prestigious Clive Davis pre-Grammy dinner party. Universal has also been working alongside venture capitalists and angel investors to provide advice and capital to entertainment start-ups.

The first fruits of those early-stage investments are Spotify, the streaming service that launched in the U.S. in 2011, and Beats Music, which debuted in January. And he encouraged his digital team to seek out the next tech venture that would benefit from an association with Universal’s marquee acts.

“A dozen entrepreneurs in the tech space — they’d be like Irish coffee.... The cream would hit the whiskey and the coffee really nicely,” Grainge said. “Technology and talent: That’s what I’m trying to do. Merge talent and technology.”

Grainge’s passion for nurturing young artists was on display at Universal’s offices one fall morning as singer-songwriter Yuna took the stage in a meeting room converted to performance space. He initiated the informal Friday morning concert series to showcase the label’s up-and-coming acts.

The petite 27-year-old pop singer from Malaysia had appeared the previous evening on Conan O’Brien’s late night show. After watching the acoustic set, Grainge explained how artists like Yuna are key to his plan to build business in dozens of new markets by finding and developing local artists.

“We’re actually grabbing them by the scruff of the neck,” he said. “Technology has made everything global, and I think there are opportunities.”

::

In a Glendale recording studio, 27-year-old Lindsey Stirling tucks her high-tech violin under her chin and improvises a Celtic-inflected tune that will evolve into a track for her next album.

Almost three years ago, the Santa Ana native posted a homemade music video of her song “Spontaneous Me” on YouTube, eventually garnering more than 15 million views. The dubstep violinist is one of a generation of independent artists who have mastered recording and distributing music on their own.

That trend was underscored at the Grammy Awards in January, when rapper Macklemore, collecting the best new artist award with producer Ryan Lewis, said there was no need to thank his record company during his acceptance speech. “We made this album without a record label.”

Indeed, artists no longer need a big label to produce or distribute their songs. Yet Stirling, despite her initial success as a do-it-yourself artist, decided to sign a deal with Universal.

She noted that Universal’s German subsidiary was instrumental in helping her attain platinum sales in that country for her 2013 self-titled album. The label bought billboards, arranged television appearances and media interviews, and flew her to Germany for concerts.

“It’s impossible to take on the whole world yourself,” Stirling said. “You need a little bit of help.”

To Grainge, Universal Music Group and other record companies will survive as long as they can fulfill their mission of connecting the world’s music with fans.

In an office adorned with emblems of success, he unwrapped a framed copy of Billboard magazine’s Hot 100 chart of the top songs in the country, based on sales, radio play and music streams. Universal artists scored the top 10 spots, leading off with “Roar,” by Katy Perry.

“We have literally thousands of people around the world whose responsibility, task, joy, is to get as much music to as many fans in as many ways as possible,” Grainge said, then adding: “Music has been around a thousand years, and it’s going to be around for another thousand years. Human beings like rhythm. That’s why there is a future. It’s never going away.”

---------------------------------------------

Universal Music Group

(quarter ended Dec. 31, 2013)

Revenues: $2.1 billion

Headquarters: Santa Monica

Key Artists: The Beatles, Katy Perry, Rihanna, U2, Lorde, Robin Thicke, Taylor Swift, Avicii

Digital Initiatives: Co-founded Vevo, invested in Spotify and Beats Music, licensed music to digital services like Apple’s iTunes Radio

Sony Music Entertainment

(quarter ended Dec. 31, 2013)

Revenues: $1.4 billion

Headquarters: New York City

Key Artists: One Direction, Beyoncé, Miley Cyrus, Justin Timberlake, Kelly Clarkson

Digital Initiatives: CEO Doug Morris launched Vevo, Sony Music Unlimited, invested in Spotify and Deezer

Warner Music Group

(quarter ended Dec. 31, 2013)

Revenues: $815 million

Headquarters: New York City

Key Artists: Bruno Mars, Michael Buble, Fun, Ed Sheeran

Digital Initiatives: Shazam, Clear Channel & iHeartRadio, Apple’s iTunes Radio, Google Play deals

MORE

ON LOCATION: People and places behind what’s onscreen

PHOTOS: Biggest box office flops of 2013

PHOTOS: Celebrity production companies

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.