Viacom exploring sale of minority stake in Paramount Pictures

Viacom is exploring a possible sale of a minority interest in Paramount Pictures, the famed Los Angeles movie studio.

Viacom Inc. is exploring a sale of a minority stake in its Los Angeles movie studio Paramount Pictures, opening the door to a possible break up of the media giant.

The announcement made Tuesday by Viacom Chief Executive Philippe Dauman comes as Viacom has been under mounting pressure to reverse its flagging fortunes.

Viacom’s signature TV channels, including Comedy Central, MTV and Nickelodeon, have stumbled in the ratings and Paramount Pictures lags well behind its rivals.

Cash-rich investors, such as Chinese e-commerce giant Alibaba, could give Viacom a much-needed infusion of capital to help expand the studio’s film and TV slate, pay down debt or buy other assets, analysts said.

“It’s very rare for one of the majors to become available for purchase, and Viacom is struggling and under great pressure to make some bold moves,” said Stanley Rosen, a USC political science professor.

Hollywood-based Paramount is worth about $4 billion, according to analysts and investors. Some analysts have suggested the studio could be valued at as much as $10 billion if Viacom was able to make a deal with an investor eager for a trophy like Paramount, one of the original Hollywood studios.

The move could pave the way for Viacom, controlled by the ailing 92-year-old Sumner Redstone, to be sold piecemeal.

Viacom’s stock value has fallen more than 50% in the last two years as investors have grown increasingly impatient with Viacom’s lackluster performance and its leadership, including Dauman.

Some investors have agitated for dramatic action.

“Philippe knows how to read the tea leaves,” Mario Gabelli, Viacom’s second-largest voting shareholder, said in an interview with The Times.

Viacom’s shares closed up Tuesday 15 cents, or 0.4%, to $37.01.

Under a frugal strategy employed by Paramount CEO Brad Grey, the studio has stumbled with thin movie slates in recent years and high-profile misses, such as this month’s “Zoolander 2.” Even Dauman has acknowledged the studio hasn’t produced enough movies to support its operations.

Last year it ranked last among the six major studios in terms of domestic box-office market share. Paramount also has been a consistent drag on the company’s bottom line. Paramount posted an operating loss of $146 million in the quarter ended Dec. 31.

Dauman on Tuesday stressed that Viacom intended to retain control of the century-old film studio that is known for the “Transformers” and “Mission: Impossible” franchises.

He said the company would engage in “discussions with a select group of potential investors” after fielding inquiries from several potential partners.

“The contours of our industry continue to shift, which means we must evolve, innovate and make the organizational and strategic changes necessary to ensure our future success,” Dauman said Tuesday in an email to employees.

The process is expected to take several months.

Some investors would likely demand an option to eventually take full ownership of the film studio, triggering a long-anticipated consolidation of the major movie studios.

“This is an asset that has significant value, and strategic value, to a number of potential investors,” Gabelli said.

Paramount is expected to attract interest from foreign buyers — particularly from China.

“Chinese companies are very interested in Hollywood as the center of the global entertainment industry, and this represents a golden opportunity,” said Lindsay Conner, an entertainment industry lawyer and partner in Manatt, Phelps & Phillips.

Although Dauman did not name any specific possible investors, Alibaba Group, the Chinese e-commerce giant run by billionaire Jack Ma, is considered a leading candidate.

Last year, Alibaba Pictures invested in and helped promote Paramount’s summer release “Mission: Impossible – Rogue Nation.” That deal came after Ma met with executives from several studios, including Paramount, in the fall of 2014 to discuss possible partnerships.

Dalian Wanda Group, which owns the U.S. cinema chain AMC Theatres, also has been expanding its profile in the U.S. Last month, the real estate and media conglomerate, which is headed by China’s richest man, Wang Jianlin, bought Burbank production company Legendary Entertainment for $3.5 billion.

“Alibaba would of course love to trump Wang Jianlin and Wanda by purchasing a [significant] share of Paramount,” Rosen said.

Other potential bidders could include Japanese telecommunications firm Softbank Group and Indian conglomerate Reliance Anil Dhirubhai Ambani Group, which previously backed Steven Spielberg’s DreamWorks Studios.

Media companies including John Malone’s Liberty Media Corp., Sony Corp., 21st Century Fox and Time Warner Inc. might also have an interest in Paramount.

Even tech giants could enter the fray as they look to compete with Hollywood. Online retailer Amazon.com Inc. has been ramping up its slate of original TV shows, while Apple Inc. is looking at ways to create its own online series for streaming.

Paramount’s rich library of blockbusters would provide much of the value to a strategic partner, analysts said.

“They have a fantastic library, but if you had a different team with a different approach you might be able to create more value,” Gabelli said. “Everyone is focused on content creation, and Paramount doesn’t have good TV series creation capabilities.”

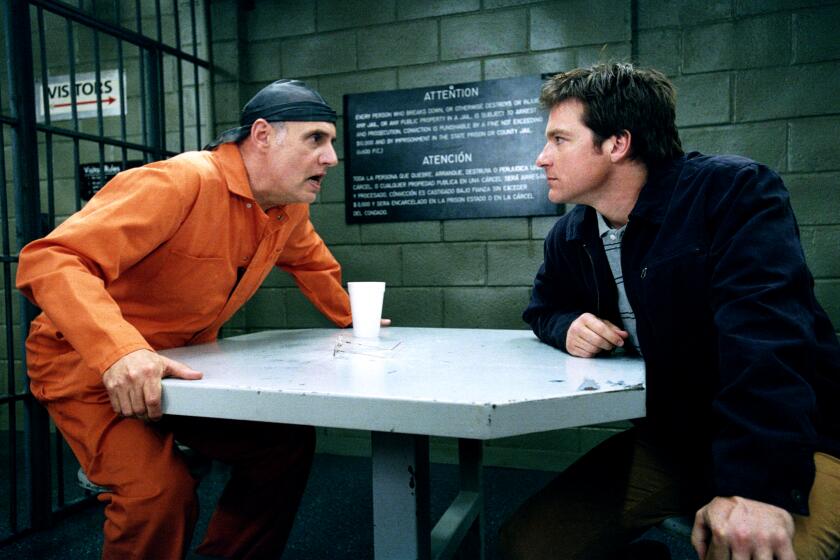

Paramount relinquished its TV library in the 2006 corporate break-up with CBS Corp., which took over rights to old Paramount television shows, including “Cheers.”

The studio’s real estate, which encompasses the historic lot on Melrose Ave. in the heart of Hollywood, could be worth as much as $1 billion, analysts have said.

Selling a piece of Paramount represents a retreat for Viacom, which paid more than $10 billion for the studio in 1994 after a drawn-out battle with Barry Diller for control. Redstone wanted to own the studio behind such classics as “The Godfather,” “Sunset Boulevard,” “African Queen” and “Saturday Night Fever.”

“Sumner was dead set against ever selling Paramount, but those days are waning,” said Lloyd Greif, chief executive of downtown L.A. investment bank Greif & Co. “This is, no question, hanging a big for-sale sign on the company.”

More to Read

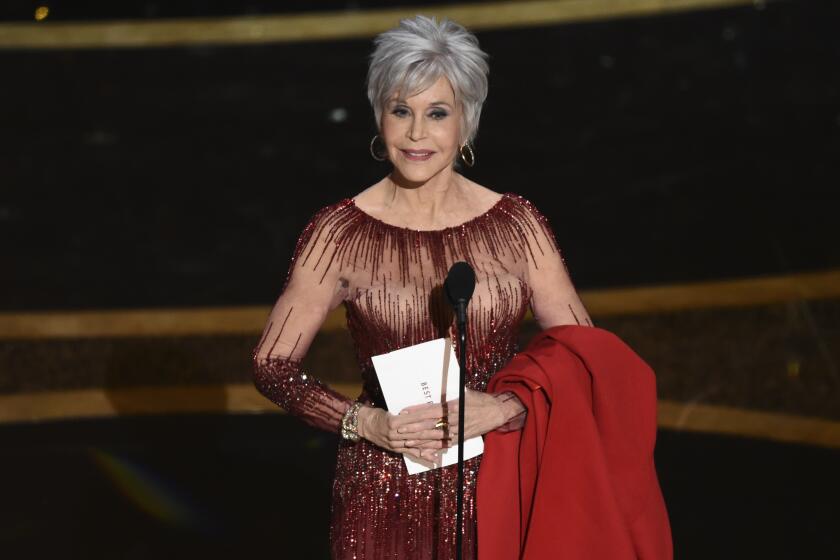

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.