CBS fight with Time Warner Cable shows dinosaurs are still scary

Broadcast networks are sometimes viewed as dinosaurs trying to dodge a shower of meteors that take the form of sleek cable channels like HBO and AMC and digital platforms such as Netflix and Amazon.

But CBS proved that a Tyrannosaurus rex is still pretty scary, especially to a big cable operator.

The network’s new distribution agreement with Time Warner Cable, reached after a 32-day blackout, will see it receive a substantial increase in fees from the pay-TV distributor. The deal, announced Monday, returned local CBS stations in Los Angeles, New York City and Dallas to Time Warner Cable subscribers. The premium channel Showtime, also owned by CBS, had its signal restored to Time Warner Cable homes as well.

PHOTOS: Hollywood Backlot moments

While terms were not disclosed, a person familiar with the contract said CBS hit its target of north of $2 per-subscriber, per-month over the life of the deal, which runs just under five years. The previous contract CBS had with Time Warner Cable to carry its local TV stations, including KCBS-TV Channel 2 Los Angeles, had a subscriber fee of less than $1 per-month.

“This outcome was obvious from the start, there was no way Time Warner Cable was going to not carry CBS,” said Sanford C. Bernstein analyst Todd Juenger in a Tuesday report.

Although the Time Warner Cable-CBS pact was finalized on Labor Day, a turning point in the talks was almost two weeks earlier. That was when CBS signed a new distribution agreement with Verizon FiOS that was very similar in terms to what the network wanted from Time Warner Cable. Because Verizon FiOS is one of Time Warner Cable’s main competitors, the pressure to settle with CBS grew.

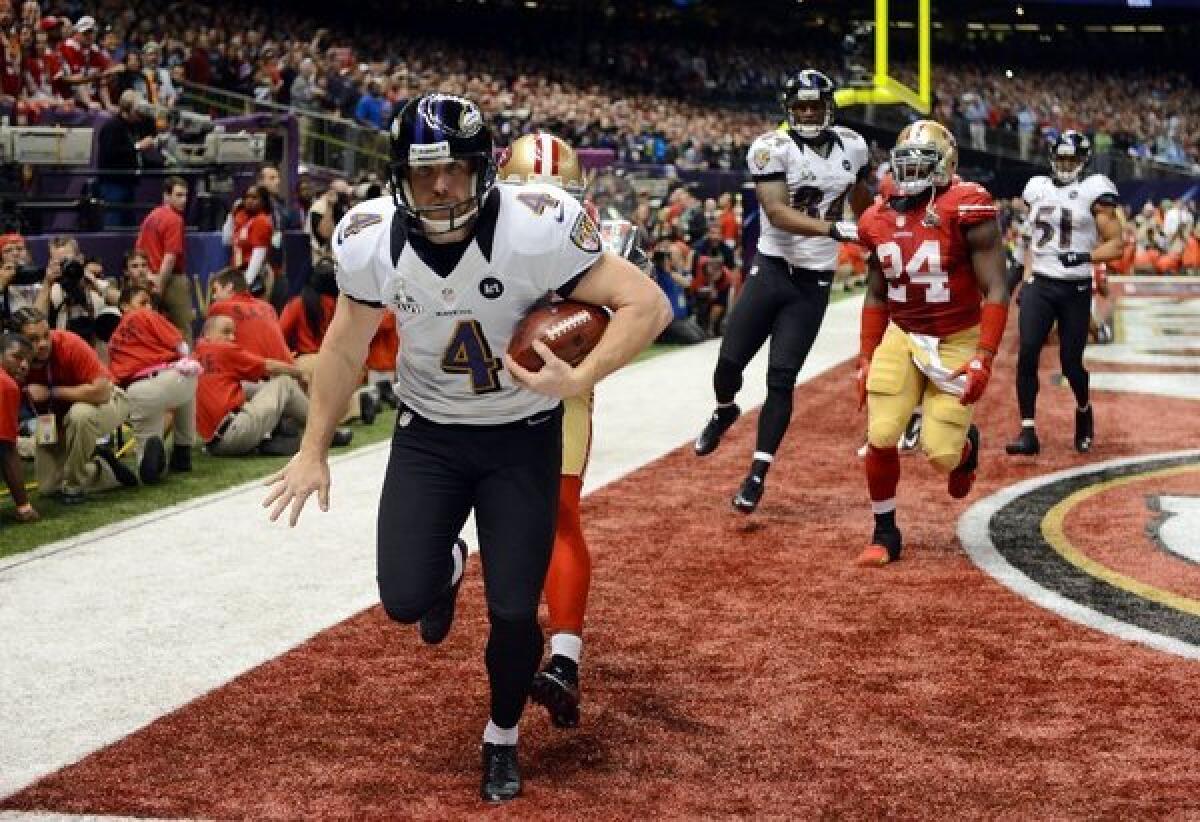

CBS should also send a big box of chocolates and a case of beer to National Football League headquarters along with the next rights fee check. The network’s coverage of the regular season starts this Sunday and Time Warner Cable didn’t want to deal with irate phone calls from subscribers threatening to drop the service in favor of a rival distributor such as Verizon if they couldn’t see football.

“With the start of the NFL season days away, subscriber losses would have simply been too painful and Time Warner Cable had to cave within the next week or two,” said BTIG analyst Rich Greenfield, who was outspoken in his support of the cable operator in this dispute.

PHOTOS: 2012 highest-paid media executives

CBS and other broadcasters are counting on distribution fees to level the playing field with cable networks who receive money from both advertisers and subscribers. For years, multichannel video program distributors such as Time Warner Cable resisted paying broadcasters fees to carry their signals. After all, since consumers could get the programming free with an antenna, why should they pay?

The 1992 Cable Act gave broadcasters the right to negotiate for cash and pull their signal as leverage. Since then, many broadcasters, including NBC, Fox and ABC, have used so-called retransmission consent as leverage to launch new cable channels.

Now though, there is little room for new networks, and broadcast networks instead want cash to help cover their own growing programming costs, especially for sports.

In his statement on the CBS agreement, Time Warner Cable Chief Executive Glenn Britt said it was time for Congress and the FCC to revisit retransmission consent as the regulations are no longer serving their intended purpose.

“The rules are woefully out of date, are the primary reason cable bills are rising and too frequently leave our customers without the programming they love,” Britt said.

ON LOCATION: Where the cameras roll

BTIG’s Greenfield said the original purpose of retransmission consent was to boost local TV stations and help them with their news and public affairs programming. Instead, the broadcast networks take the majority of the fees from the stations that carry their programing.

For consumers, the new agreement will likely end up hitting them in the wallet and pocketbook.

“As in the past, the resolution of this dispute could lead to higher bills for consumers. Broadcasters have proven effective at leveraging their government-protected business models to generate ever-higher revenues, and the structure of the cable TV market makes it possible to pass along rate hikes to consumers who have few competitive alternatives,” said John Bergmayer, a senior staff attorney for Public Knowledge, a media watchdog group.

Some are responding by cutting the cord to their pay-TV service. According to SNL Kagan, 217,000 people dropped their pay-TV service in the second quarter. If viewers are patient, they can watch many of their favorite shows when they pop up online.

That’s bad not just for distributors but programmers as well. Ratings at the CBS-owned stations in Time Warner Cable markets dropped significantly during the blackout.

CBS is generating significant revenue selling its shows to Netflix, Amazon and elsewhere, but that will only remain the case if the pay-TV industry stays strong and CBS reaches a broad audience. Going forward, it will be crucial for programmers and distributors to find a way to co-exist or they will put both of their businesses at risk.

ALSO:CBS and Time Warner Cable reach deal

Cord-cutting trend continues in second quarter

Reviving canceled soap operas becomes a real-life drama

Follow Joe Flint on Twitter @JBFlint.

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.