Omnicom, Publicis merger could benefit rivals, spur other deals

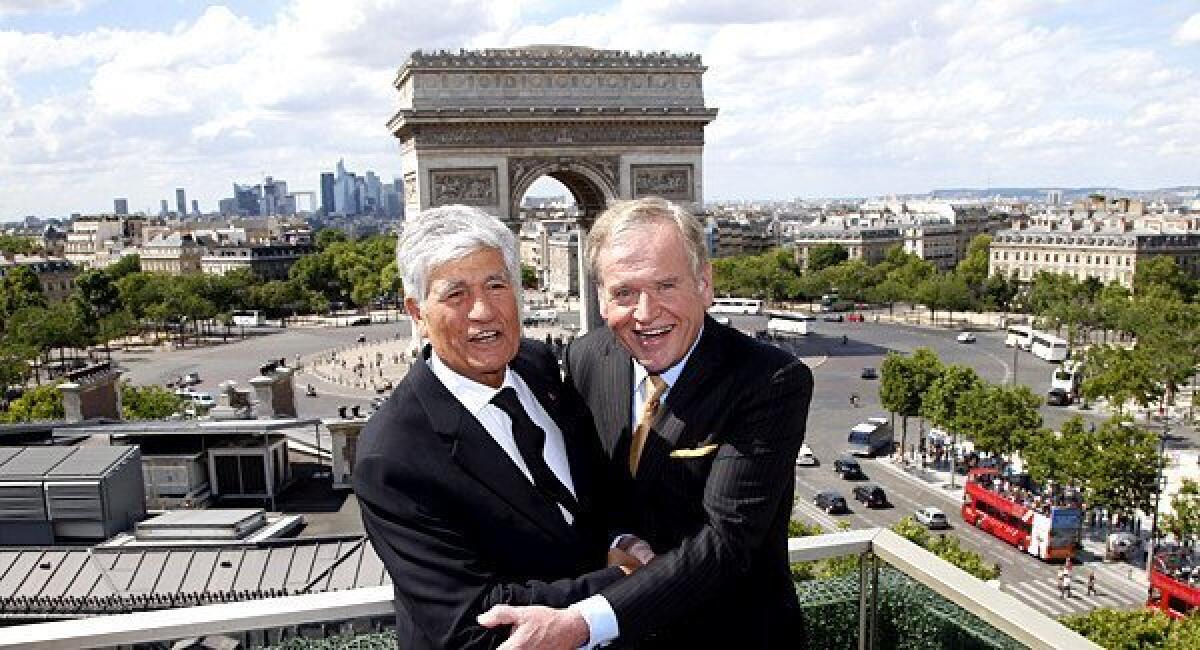

The planned merger of Omnicom Group Inc. in New York and Publicis Groupe in Paris into the world’s biggest advertising firm gives the combined company lots of clout.

The deal was designed to give the new company more leverage when negotiating advertising rates and placements with television networks and with Internet Goliaths such as Google Inc. and Yahoo Inc.

The merger could also help smaller advertising rivals who might scoop up clients.

Shares of advertising companies rose Monday, the first day of trading after the two giants announced their intent to merge.

PHOTOS: Tech we want to see in 2013

French competitor Havas SA rose 4.7%, while Interpublic Group of Companies Inc. in New York rose 4.7%. Barclays analyst Anthony DiClemente said the deal between Omnicom and Publicis to become a new entity called Publicis Omnicom Group could benefit rivals by allowing them to poach clients as advertisers to review their agencies in order to get better deals.

“The combined company is likely to lose some clients as a result of the merger,” said DiClemente in a note to clients. “We wouldn’t expect the new Publicis Omnicom Group to win all the reviews. This should benefit Havas, Interpublic and WPP unless they decide to engage in a merger of their own.”

The new company, with combined 2012 revenue of $22.7 billion, would make it the world’s largest agency with a market value exceeding $35 billion, unseating WPP Plc, which is currently the biggest agency. The two companies announced the all-stock transaction Sunday. Shareholders of each company would hold about 50% of the new entity.

PHOTOS: Cable versus broadcast ratings

Shares of WWP, Publicis Groupe and Omnicom were little changed Monday.

More consolidation may be on the way.

The merger opens up the possibility of other deals between advertising companies, said Brian Wieser, an analyst at Pivotal Research, who argued Interpublic Group should now be considered an acquisition target, with WPP the most likely buyer.

“Interpublic will immediately be considered to be in play by investors,” Wieser said in a research note.

Havas and Japan’s Dentsu may also look to do deals, he said, adding that Havas would likely buy a company rather than be acquired.

PHOTOS: 2012 highest-paid media executives

Omnicom is the parent company of TBWA\Chiat\Day of Los Angeles, which creates advertising for such high-profile accounts as Pepsico Inc. and Nissan; BBDO Worldwide agency; and OMD, which handles ad buying duties for film studio Warner Bros., among others.

Publicis Groupe owns such ad firms as Saatchi & Saatchi, which handles advertising for Toyota, and Leo Burnett in Chicago. Publicis also boasts the Chicago advertising buying powerhouse Starcom MediaVest.

The merged group will have more than 130,000 employees and be jointly managed by Publicis Groupe Chief Executive Maurice Levy and Omnicom Chief Executive John Wren.

The boards of both firms have approved the merger, which will be subject to numerous regulatory reviews as well as the approvals of shareholders of both companies. The deal is expected to close in 2014.

Los Angeles Times reporter Meg James contributed to this report.

ALSO:

Omnicom, Publicis merging to create global advertising behemoth

“The Wolverine” is No. 1 but comes in far below expectations

NBC likely to cover Russia’s anti-gay laws during Winter Olympics

Follow on Twitter: @rfaughnder

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.