Activist investor Dan Loeb boosts rhetoric in call for Sony spinoff

Activist investor Daniel Loeb, the chief executive of hedge fund Third Point, has turned up the heat on Sony Corp. in his call for the electronics and media giant to make an initial public stock offering of up to 20% of its entertainment arm.

Loeb, who since May has made multiple public pleas for the Tokyo-based company to adopt his proposal, said in his second-quarter letter to Third Point investors that Sony’s entertainment arm “remains poorly managed.” He also criticized Sony President and Chief Executive Kazuo Hirai for giving “free passes” to Sony Pictures Entertainment’s Chairman and Chief Executive Michael Lynton and co-Chairman Amy Pascal.

Loeb labeled two recent Sony Pictures releases -- the Will Smith action movie “After Earth” and the Channing Tatum vehicle “White House Down” -- “2013’s versions of ‘Waterworld’ and ‘Ishtar’ back-to-back,” a reference to two of the most famous flops of all-time.

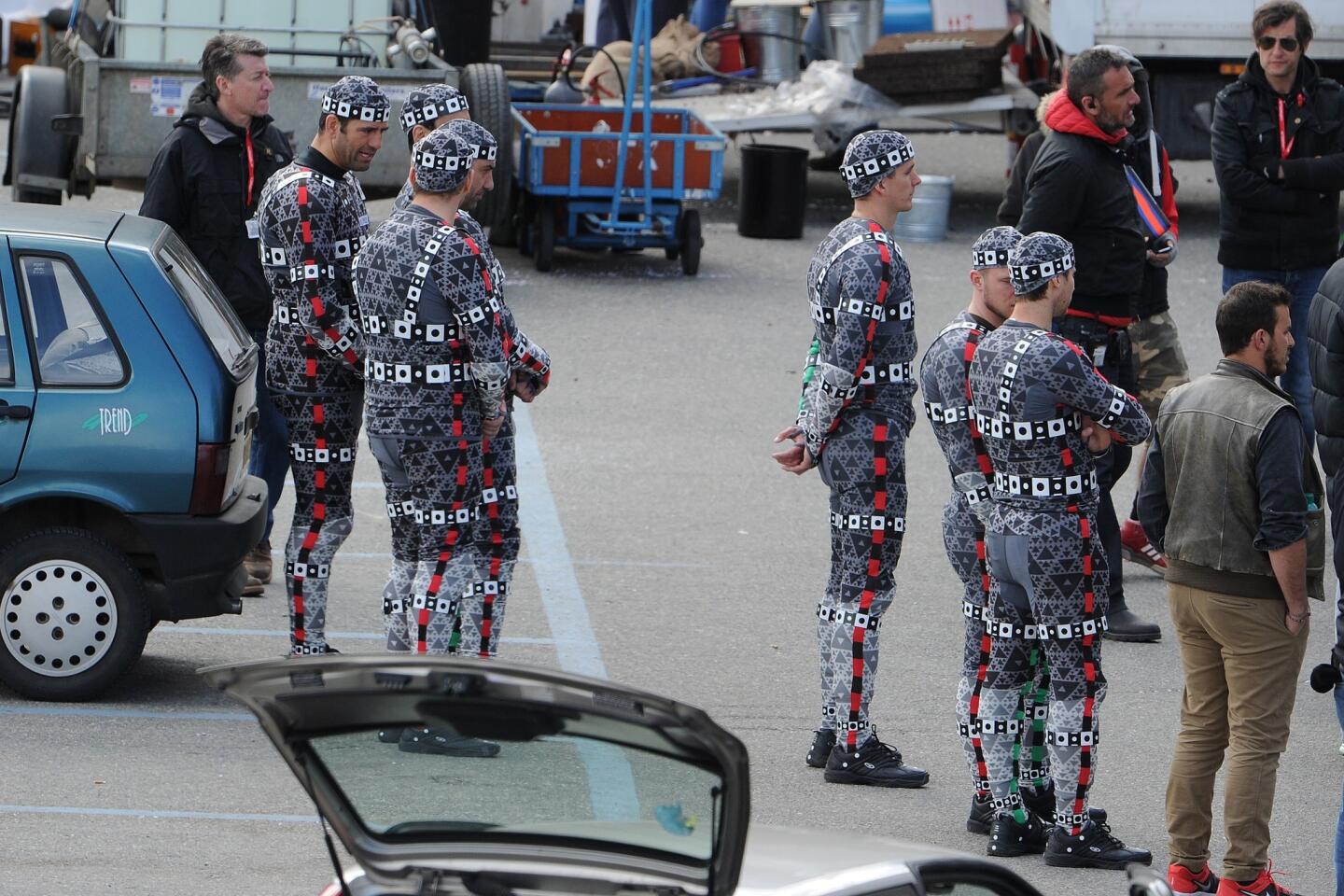

PHOTOS: Hollywood Backlot moments

“After Earth” has grossed a disappointing $236 million worldwide, while “White House Down” has bombed, taking in $116 million globally.

Loeb said that Lynton and Pascal were “responsible for these debacles,” and castigated Hirai for comments the executive made at July’s Allen & Co. conference in Sun Valley, Idaho. Loeb quoted Hirai saying, “I don’t worry about the Entertainment business, it’s doing just fine.”

“Unfortunately, Mr. Hirai’s remark is consistent with accounts we have heard repeatedly from key industry players and others: under Mr. Lynton and Ms. Pascal’s leadership, Entertainment’s culture is characterized by a complete lack of accountability and poor financial controls,” Loeb said.

A Sony spokesman said in a statement that the company is reviewing the Loeb proposal, echoing comments made by Hirai at the All Things D conference in May in Rancho Palos Verdes.

“Sony is focused on creating shareholder value by executing on our plan to revitalize and grow the electronics business, while further strengthening the entertainment and financial service businesses, which generate stable profit,” Sony spokesman Jim Kennedy said in a statement. “The Sony Board of Directors, as previously noted, is reviewing its proposals. Sony looks forward to continuing a constructive dialogue with our shareholders as we pursue our strategy.”

Loeb’s Third Point owns about 6% of Sony, whose entertainment arm, Sony Entertainment Inc., includes film and television studio Sony Pictures Entertainment, Sony/ATV Music Publishing and Sony Music Entertainment.

“Many casual observers would be surprised to learn that while Sony is electronics, much of its current value is derived from a hidden gem -- Sony’s Entertainment division,” wrote Loeb in the proposal, adding that an infusion of capital would help Sony with its “burdensome debt” and provide it with the financial resources to improve its electronics business. Third Point holds $1.1 billion worth of Sony shares.

Loeb said that “drastic” action is required, writing that the company’s entertainment unit -- unlike its electronics group -- “remains poorly managed, with a famously bloated corporate structure, generous perk packages, high salaries for underperforming senior executives, and marketing budgets that do not seem to be in line with any sense of return on capital invested.”

Under the terms of Loeb’s proposal, Sony would retain a majority stake in Sony Entertainment, which also is headed by Lynton.

On May 14, Loeb hand delivered a letter to Hirai that outlined the proposal.

Then, on May 30, Hirai said the company was taking “a serious look” at Loeb’s proposal. “It’s something that’s been discussed at the board level, and discussed thoroughly,” he said.

Third Point declined to comment.

ALSO:

Analyst makes case for separating Sony from Sony Pictures

Sony shares jump as hedge fund urges IPO of entertainment unit

On eve of Sony meeting, report says company could discuss spinoff

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.