How Leslie Moonves continues to guide CBS to the top of the TV industry

Leslie Moonves, who joined CBS in 1995 and replaced the ailing Sumner Redstone as chairman this month, says he was able to put his own stamp on the network even when reporting to his predecessor.

Reporting from NEW YORK — Every day that CBS Corp., Chairman Leslie Moonves goes to his New York office on the 35th floor of the Eero Saarinen-designed corporate headquarters in Manhattan, he never forgets it once belonged to the company’s founder, William Paley.

“I walk in here and think, ‘This is the man that created CBS, that created broadcasting,’” Moonves said in an exclusive interview with The Times at his office decorated with modern art pieces by Roy Lichtenstein and Robert Rauschenberg. “Being in the space Bill Paley was in is pretty important.”

See more of Entertainment’s top stories on Facebook >>

Tradition matters to Moonves, who joined CBS in 1995 and on Feb. 3 was elected chairman of the company, replacing the ailing Sumner Redstone. But the 66-year-old Long Island native has restored CBS’ vaunted place in the industry by adapting it to a rapidly changing media landscape, in which viewers have more choice and control over how they watch television. This month, CBS posted its best quarterly earnings in its history, helped by having shows that are not just prime-time hits but also assets that can generate revenue from around the world and online.

“What they’ve done is amplified by their having been left for dead in 2006,” said Brian Wieser, a senior analyst for Pivotal Research Group.

What we put on the television set and sell advertising to is still very important. The back end has become just as important.

— CBS Corp., Chairman Leslie Moonves

That was the year Redstone split up Viacom and CBS after acquiring the latter in 1999. CBS was pegged as a slow-growth, mature company with broadcast TV and radio properties and a premium cable network, Showtime, which at the time did not have the cachet or profits of HBO. Viacom — home of popular cable brands Nickelodeon, MTV and Comedy Central and film studio Paramount Pictures — was destined to ride in the fast lane.

The fortunes have reversed under Moonves’ watch. CBS today is valued at about $22.6 billion, while Viacom is worth $15.5 billion and dogged by questions about its future as more consumers get untethered from cable TV and Paramount lags behind its rivals in Hollywood. The struggles have put mounting pressure on Viacom and its chairman, Philippe Dauman, who on Tuesday said the company was considering selling a minority stake in Paramount.

Moonves has emerged unscathed from the conflict between 92-year-old Redstone and his daughter Shari over who should lead the New York media empire. He would not discuss Viacom’s performance or the dispute surrounding the Redstone family, which has been in a legal squabble over the company founder’s medical care. But he does say he was able to put his own stamp on CBS even when reporting to his predecessor.

“Sumner always treated me great,” Moonves said. “He was always supportive and in terms of the operation, he did leave me alone.... I never felt any form of interference.”

It probably helped that CBS has been the most-watched network in 12 of the last 13 years and is on track to win the 2015-16 TV season in viewers, averaging 9.4 million in prime time, well ahead of NBC’s 5.07 million. The network also has a narrow lead over NBC in the advertiser-coveted 18-to-49 age group.

CBS is holding onto its lead while having to contend with the rapidly changing habits of the TV audience, which are challenging the entire broadcasting business. Real-time TV viewing among young adults is declining as more of them use Internet-connected devices, DVRs and video-on-demand services to watch their favorite shows. With more than 400 scripted TV shows in production that viewers can choose from, coming up with a massive hit is more difficult than ever.

To compete, CBS maintained an aggressive stance on owning the series it puts on its prime-time schedule. The network’s production studio made eight of the 20 most-watched scripted series of 2015. Its pipeline is generating new revenue from program buyers in emerging TV markets overseas — including China — and the rise of online streaming services Netflix, Hulu and Amazon.

International broadcasters have snapped up “NCIS,” still TV’s No. 1 drama in the U.S. after 13 seasons on the air, and its spinoffs. Like CBS’ “CSI” franchise, “NCIS” has generated more than $2 billion in revenue.

“What we put on the television set and sell advertising to is still very important,” Moonves said. “The back end has become just as important.”

Even series that have been mid-level ratings performers in the U.S., such as “Elementary,” are generating profits globally. CBS can launch original programs such as “Zoo” and “Under the Dome” in the summer — once a time when cable would eat its lunch — because the series were already profitable from sales to Amazon and TV networks outside the U.S.

“When we’re in development, the international guys are in there, and they are talking about what the show is going to be worth,” Moonves said. “That becomes part of your strategy.”

CBS’s hard line in getting affiliates, cable and satellite operators to pay to carry its signal has also paid off — the company is on track to generate $2 billion in retransmission fees next year, up from $250 million in 2012.

“When I have something big in front of me I can rarely think about anything else,” Leslie Monoves said. “When there is something bugging me, my wife realizes she shouldn’t even talk to me.”

Moonves believes increased consumer desire for smaller packages of cable channels will not have an effect on CBS. A schedule of broadly popular hits and sports properties, such as the National Football League, helps when CBS is sitting across a negotiating table from a multichannel video program distributor.

“There are other basic channels out there that they don’t have to have,” Moonves said. “They have to have CBS.”

To prepare for the cord-cutting and cord-shaving generation, CBS is aiming to be an “over-the-top” player too with its own subscription-based streaming services that offer content from CBS and Showtime. They will have a positive effect on its balance sheet by next year, the company said.

Analysts are taking CBS All Access more seriously since CBS announced it will be the exclusive home of the next TV iteration of “Star Trek.” CBS could have made a bundle on the sci-fi program by airing it on the network, in syndication or selling it to Netflix or Amazon. Instead, it will be a lure for new subscribers to pay $5.99 a month for the service.

Moonves has always been an aggressive competitor. In his early years as an entertainment president at CBS, he battled to upgrade the network’s ratings and stodgy image, even personally calling reporters if he believed they were not giving his programs a fair shake in the press.

Transcendental Meditation puts me in a calm state, which I’m not always in.

— CBS Corp., Chairman Leslie Moonves

He has a much larger portfolio today and focuses more on getting Wall Street to recognize CBS’ overall strength as a company. He admits he gets consumed by an unwillingness to accept defeat.

“When I have something big in front of me I can rarely think about anything else,” he said. “When there is something bugging me, my wife realizes she shouldn’t even talk to me.”

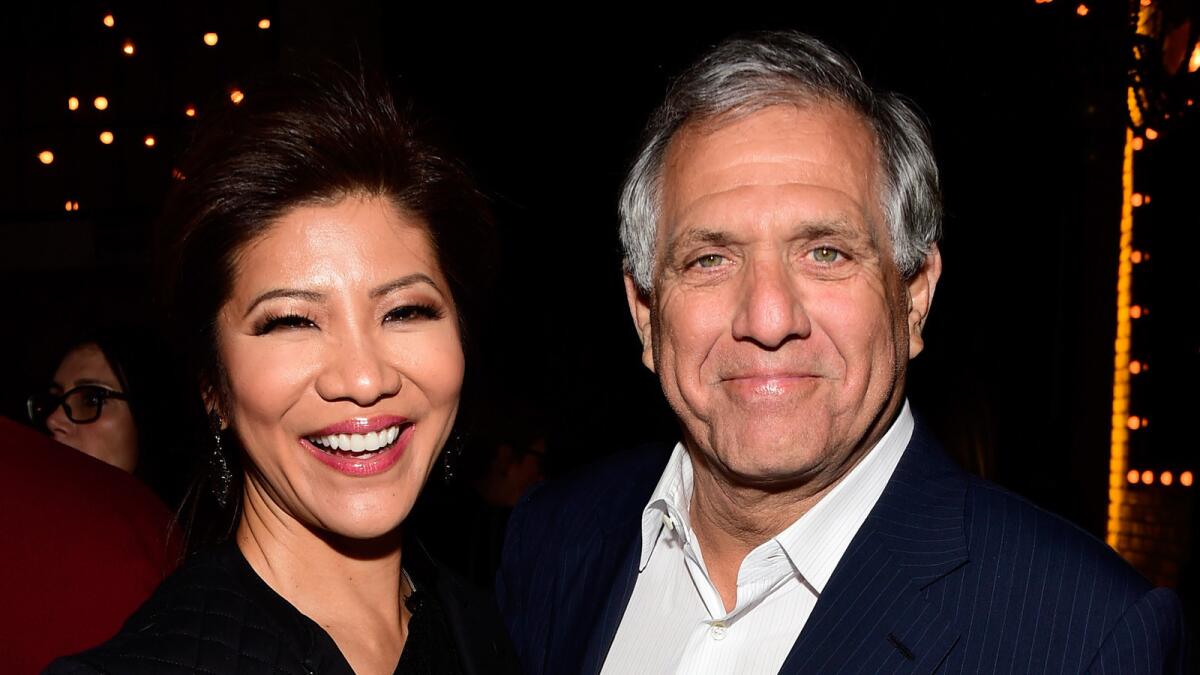

Moonves cools down by practicing Transcendental Meditation several times a week. His wife, Julie Chen, co-host of the CBS daytime show “The Talk,” only recently learned that it’s part of his routine.

“I do it right before I go to sleep,” he said. “It puts me in a calm state, which I’m not always in.”

Moonves has a core of loyal executives who are used to his intensity and hands-on involvement — he still signs off on most programming decisions at the network. Departures from the top executive ranks are rare, the last being CBS Entertainment Chairman Nina Tassler, who left after 19 years at the network and was succeeded by another long-timer, Glenn Geller.

“Am I a micromanager? Probably,” Moonves said. “I’m sure there are days when people say, ‘I wish the hell he’d leave me alone to do this.’ But I treat them well by and large, and I think they like it here.”

Follow @SteveBattaglio on Twitter

ALSO:

Shari Redstone will play a key role in what happens to Paramount, MTV and CBS

A comedy centered on addiction? ‘Mom’ on CBS keeps making it work

CBS Chairman Leslie Moonves is bullish on TV’s upfront ad-selling season

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.