Fox stock up 2%; News Corp. holds its own in first day of trading

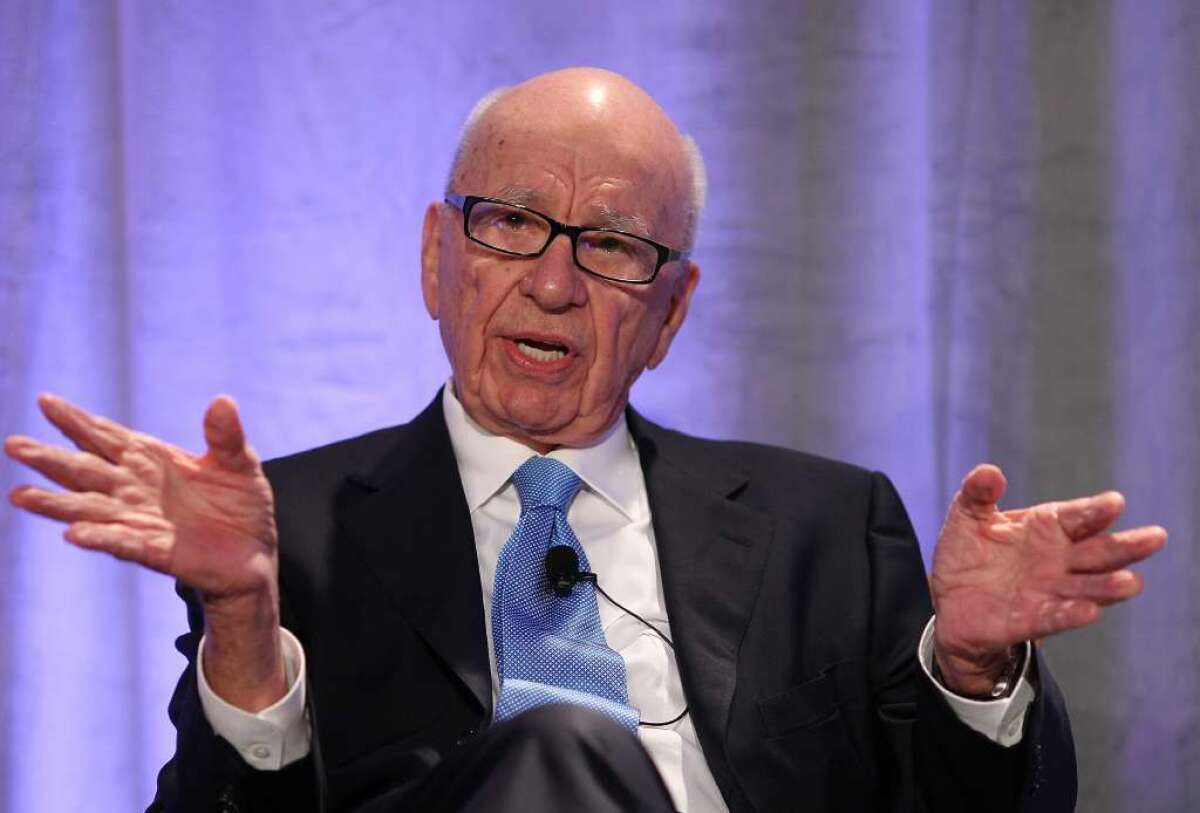

On the first day of trading as separate companies, Rupert Murdoch’s television and movie empire, 21st Century Fox, gained nearly 2% while the publishing company ended the day down 5%.

Still, the publishing entity, which took the name News Corp., largely held its own with investors.

Murdoch last year agreed to break his media empire News Corp. in two pieces in large part to free the entertainment businesses from the drag of the newspapers, which have declined in profitability.

Investors had long urged Murdoch to shed the papers, but the press baron from Australia would have none of it until a year ago when the company’s British tabloids were mired in scandal, further weighing down the value of News Corp. stock.

PHOTOS: Hollywood Backlot moments

News Corp. completed the corporate split Friday, after the financial markets closed. So Monday provided a test to see whether Fox stock would soar and, as importantly, whether investors shared Murdoch’s enthusiasm for the prospects of publishing.

Fox Class A shares closed at $29.40 a share, up from its opening price of $29.04 a share. Fox is now one the industry’s highest-valued media stocks. The company, with a newly minted market value of $68 billion, consists of television networks Fox Broadcasting, FX, Fox News Channel, Fox Sports and the 20th Century Fox television and movie production studios.

The newly formed News Corp. includes the Wall Street Journal, New York Post, Times of London, the Australian, HarperCollins book publishing and some Australian TV interests.

News Corp.’s widely traded Class A shares opened Monday at $15.59 a share. They gradually declined in value throughout the day to close at $14.79 a share.

However, the stock did not fall substantially from the levels maintained last week during trading of preliminary shares, so that much was good news for Murdoch and other investors.

ALSO:

Rupert Murdoch awaiting California liquor license

Tribune Co. buys 19 television stations in $2.7-billion deal

Walt Disney Co. extends Bob Iger’s CEO deal through June 2016

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.