Consumer groups say FCC conditions on AT&T-DirecTV merger fall short

Consumer groups that have been lobbying against AT&T’s purchase of DirecTV -- which would create the nation’s largest pay-TV operator -- expressed disappointment in federal regulators’ proposed conditions on the deal, saying they do not appear to go far enough to promote competition among Internet and TV providers.

Federal Communications Commission Chairman Tom Wheeler has recommended that the full FCC approve the AT&T-DirecTV merger with several conditions designed to prevent AT&T from using its clout to squeeze potential rivals.

FCC negotiators in recent weeks also sought a commitment from AT&T to expand its broadband Internet fiber network so that more homes in the nation have access to high-speed Internet.

Increasing the availability of high-speed Internet connections has been a top priority for Wheeler and the FCC.

“This additional build-out is about 10 times the size of AT&T’s current fiber-to-the-premise deployment,” Wheeler said in a statement.

AT&T’s entry into additional metropolitan markets, Wheeler said, would help to increase “the entire nation’s residential fiber build by more than 40%.”

Wheeler late Tuesday provided a preview of the deal conditions, but the full list of conditions was not made public.

Consumer groups on Wednesday argued that despite the proposed conditions, the combination of two rival pay-TV companies would reduce competition, rather than increase the options available to most consumers.

“While acknowledging the effort made by Chairman Wheeler to protect existing competition, encourage fiber deployment, and address affordability, no one should imagine that this has solved the underlying problem of our lack of competition,” said John Bergmayer, senior staff attorney at Public Knowledge.

While AT&T appears willing to increase its broadband fiber build-out in the U.S., the telecommunications giant could have accomplished that on its own without the prodding of the FCC, said Matt Wood, policy director for the consumer group Free Press.

“AT&T could take the money that they are using to wipe out a competitor and invest that to expand their own broadband network,” Wood said. “They didn’t need a merger for that.”

Wood said currently there are four pay-TV operators that customers can choose from in some regions of the country: a traditional cable company like Time Warner Cable, the two satellite operators -- DirecTV and Dish Network -- and AT&T.

“We are going from four pay-TV operators down to three, and the story on the broadband side is even more bleak,” Wood said. “Some people only have one or two choices for true high-speed Internet service.”

As part of the deal terms, Wheeler wanted some protection for the fast-growing market of Internet streaming services. One proposed condition would restrict AT&T from imposing high-speed Internet data caps in a way that would give its own video product an advantage over that of a competitor.

“In order to prevent discrimination against online video competition, AT&T will not be permitted to exclude affiliated video services and content from data caps on its fixed broadband connections,” Wheeler explained in a statement late Tuesday.

For example, in the past, other Internet providers have tried to encourage customers to watch video on their own sites by not counting those streams toward an established data cap. But the FCC said it does not want AT&T to enforce two sets of rules.

Consumer groups hope the FCC’s conditions include more safeguards.

“The merger conditions announced thus far won’t do enough to offset this deal’s many harms,” Wood, of Free Press, said. “We need to see the final order to pass final judgment, but what’s been revealed at this point doesn’t go nearly far enough -- and doesn’t appear to address the problems from pay-TV consolidation at all.”

Twitter: @MegJamesLAT

ALSO

Tom Calderone to exit as president of VH1

AMC Theatres CEO Gerry Lopez to step down

ESPN’s Grantland founder Bill Simmons joins HBO

More to Read

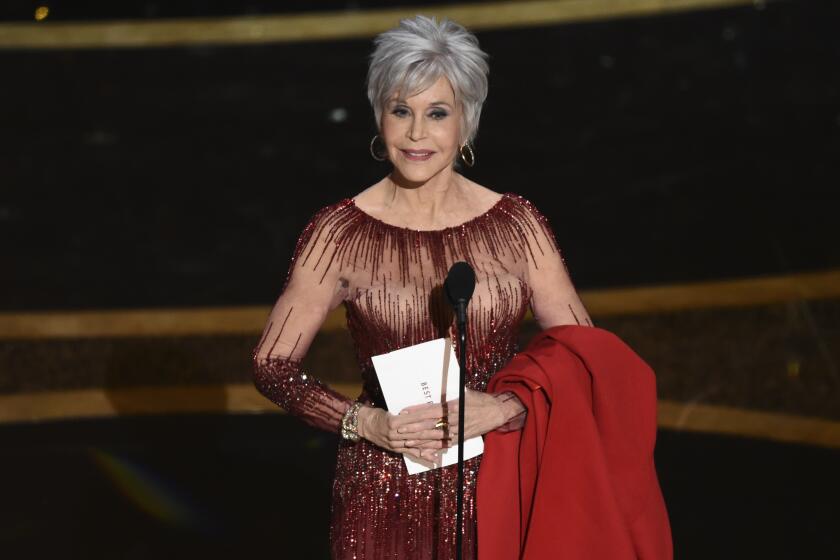

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.