‘Veep,’ ‘Westworld’ among 55 projects that got state film tax breaks

“Veep” follows politician Selina Meyer through the corridors of power and public shame in Washington, D.C. But for its fifth season, the award-winning HBO comedy series relocated to Los Angeles from Maryland to take advantage of California’s expanded tax-incentive program.

The California Film Commission said in a new report issued Thursday that “Veep” was among 55 film and TV projects that benefited from the enhanced incentives during its latest fiscal year, which ended in June. The number represents a twofold increase from the previous year, according to the commission.

That is largely because $230 million in tax credits were awarded during the period, up from $100 million last year. The amount is scheduled to increase to $330 million for the current fiscal year and stay at that annual level through the remainder of the five-year program that was initiated to reverse the flow of runaway productions.

“We’re very pleased with the program,” said Amy Lemisch, director of the commission. She said six TV series relocated to California during the period, which is “indicative that the program is working.”

Among the TV shows that relocated to receive the tax credits for the 2015-16 period were “Veep,” Fox’s “Scream Queens,” ABC’s “American Crime,” FX’s “American Horror Story” and ABC’s “Secrets and Lies.” The ABC drama series “Mistresses” was also part of the group, though the network has since canceled the show after four seasons.

Other TV projects that benefited from the incentive include David Lynch’s new “Twin Peaks” series for Showtime, HBO’s “Westworld” and Amazon’s journalism-themed series “Good Girls Revolt.”

In the past, feature film projects have had difficulty taking advantage of the tax credits because “TV got priority and left little to no funds for features,” Lemisch said. Under the expanded program, which took effect in July 2015, funds are specially earmarked for feature films.

Movies that recently received tax credits include the upcoming comedy “Why Him,” starring Bryan Cranston and James Franco; the horror sequel “Annabelle 2” and the big-screen version of “CHiPs.”

The old incentive program limited the award to feature films with budgets of $75 million or less. The new program removed all budget caps, though the tax credit applies to only the first $100 million in “qualified” spending — which doesn’t include compensation for actors, directors, producers, writers and other above-the-line talent.

The change is designed to lure more big-budget movie shoots back to California. The commission said the enticement is showing some results, with credits recently awarded to Disney’s upcoming “A Wrinkle in Time,” the largest project so far to take advantage of the incentive.

The movie, adapted from the Madeleine L’Engle book, will shoot throughout the state, Lemisch said.

Relatively few large-budget movies, however, film in California, reflecting the ongoing competition the state faces from other states and countries that offer lucrative tax breaks and rebates to Hollywood.

The commission estimates that the 55 productions pumped $1.5 billion into the state economy, including $600 million in qualified wages, in the last year.

Twitter: @DavidNgLAT

More to Read

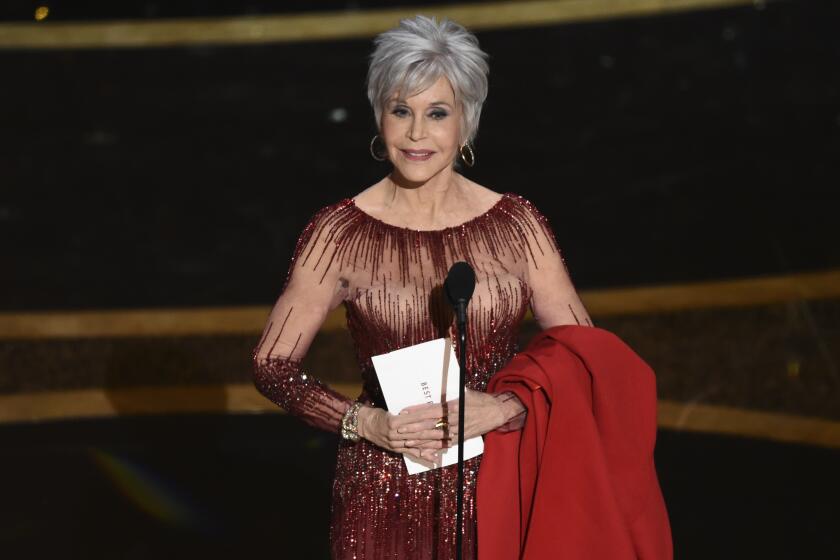

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.