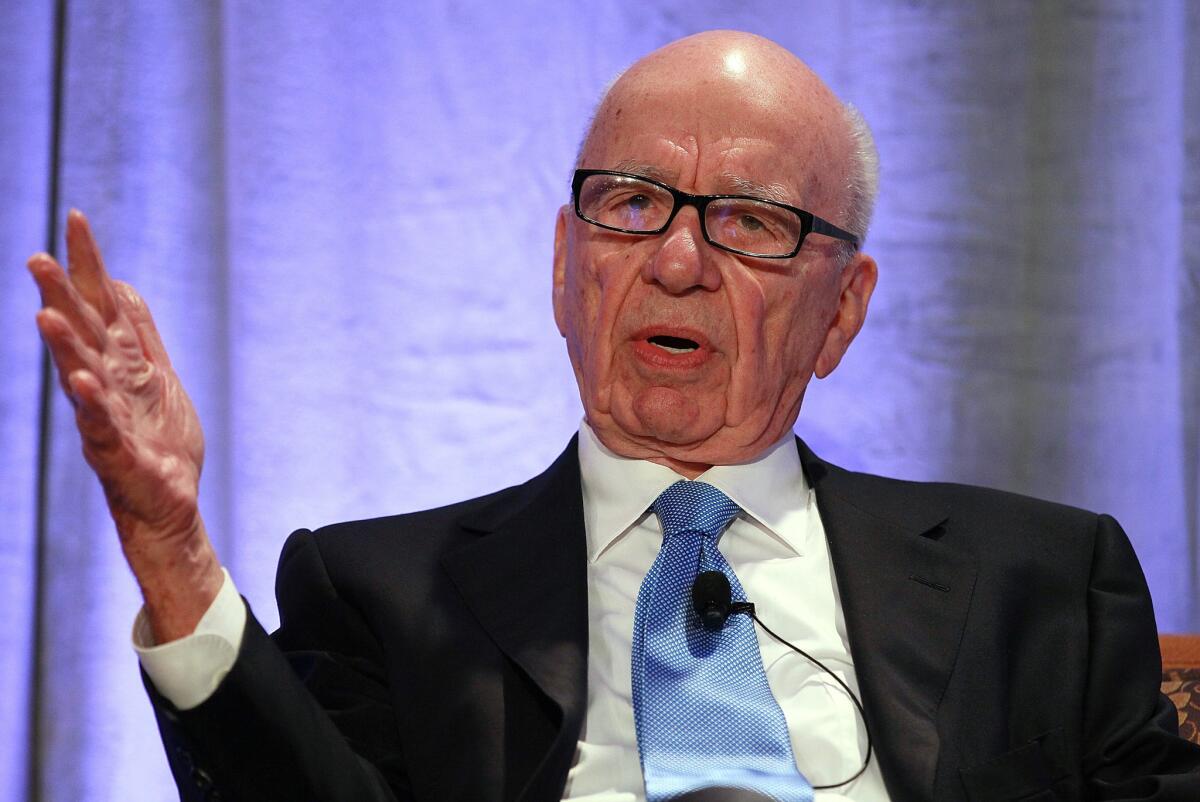

Activist investors demand Murdoch give up Fox chairmanship

Rupert Murdoch’s media company’s annual meeting has become a fall classic.

Each year, pension funds, activist investors and proxy advisory firms demand that Murdoch -- who serves as both chairman of the board and chief executive -- loosen his grip on the company by relinquishing his role as chairman.

And each year, Murdoch ignores them.

This year is expected to be no different. The company, now named 21st Century Fox, holds its annual shareholder meeting Friday in West Los Angeles. There, votes will be collected and counted.

ON LOCATION: Where the cameras roll

Advisory firms Institutional Shareholder Services and Glass Lewis again have recommended that shareholders dump most of the 21st Century Fox board members -- including Murdoch, his two sons, James and Lachlan, and Chase Carey, the company’s chief operating officer. The firms also have called for an independent chairman to be appointed.

California State Teachers Retirement System, which represents 862,000 California educators, said Thursday that it has voted against the entire slate of board members. CalSTRS also voted to install an independent chairman to replace Murdoch.

CalSTRS said it was unhappy because fewer than two-thirds of the Fox board could be considered independent from the company or the Murdoch family. CalSTRS and others also have objected because Fox popped a “poison pill” in June to prevent other shareholders from significantly increasing their voting stakes in the company, which would threaten Murdoch’s control, without putting the measure to a vote by shareholders.

CalSTRS controls nearly 50,000 voting shares.

Christian Bros. Investment Services, which oversees $4.6 billion in investments on behalf of Catholic dioceses, educational institutions and healthcare facilities, has been leading the charge for Fox’s independent board members to step out from Murdoch’s shadow.

PHOTOS: Billion-dollar movie club

“While this company has a new name that evokes the future, its corporate governance practices are clearly rooted in the past,” Julie Tanner, assistant director of socially responsible investing at Christian Bros. Investment Services, said in an interview.

Murdoch controls 39.4% of Fox voting shares, which all but guarantees that the 82-year-old mogul will remain firmly in control. Fox has two classes of stock, the voting shares and the non-voting stock; most shareholders own the latter.

Last year, nearly a third of voting shareholders approved the measure to remove Murdoch as chairman. When Murdoch’s shares were excluded, the total swelled to 66%.

For its part, Fox says its corporate government practices are sufficiently strong and the company has been humming along. Fox stock soared nearly 50% during its fiscal year, which ended June 30.

PHOTOS: Hollywood Backlot moments

“ISS and Glass Lewis’ analyses are completely out of touch with reality given the incredible value 21st Century Fox has created for shareholders,” Fox said in a statement. “The company’s directors have shepherded remarkable progress both in terms of bolstering shareholder value and strengthening 21st Century Fox’s corporate governance and compliance policies.”

Tanner noted that while the company said it has instituted stronger controls and practices, it hasn’t provided details about how effective these programs have been. Fox agreed to improve its ethics standards in the wake of the phone-hacking scandal at Murdoch’s newspapers in London.

Fox, in its statement, dismissed such calls. It said that ISS and Glass Lewis place a “disproportionate focus .... on historical matters [which] underscores the widening credibility gap between them and our shareholders.”

ALSO:

Comic book firm IDW Publishing to expand into TV

20th Century Fox Chief Marketing Officer Oren Aviv departing

‘Glee’ to sing final number next year, co-creator Ryan Murphy says

Follow Meg James on Twitter: @MegJamesLAT

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.