On Spanish-language streaming platforms, call soapy drama what you like. Just don’t use the term “telenovela.”

That’s because the venerable genre — traditionally associated with inexpensive hour-long serials that air on weekdays in prime time for six to eight months at a stretch, with seasons of up to 200 episodes — is in the midst of a makeover, led by brand names like NBCUniversal Telemundo and Televisa/Univision. With easy-to-follow (if predictable) plots, regular cliffhangers and relatable storylines, the telenovela has launched generations of Latin American actors to megastardom, not only in Mexico, its most prolific producer, but also in Colombia, Brazil and beyond. But since Telemundo trademarked the name “SuperSeries” for its melodramatic stories a decade ago, the telenovela has had something of a facelift. The company began spending more on production, tweaked the plots to include ripped-from-the-headlines stories and infused the shows with more action. Episode counts were cut to 60 to 80 a season, and multiple-season arcs became common. A trend soon emerged among audiences as well: SuperSeries — which more accurately reflected today’s society politically, economically and socially — attracted a larger and younger viewership than their traditional forebears.

“The whole family can sit down and watch the SuperSeries because they feel very contemporary,” says Karen Barroeta, executive vice president of production and development and the head of Telemundo Global Studios. This is especially powerful for targeting multigenerational households. She said the key is keeping them fast-paced and filled with action. “Younger audiences are going through TikTok all the time and they get a story every 10 seconds. They cannot stay watching a traditional story.”

The complete guide to home viewing

Get Screen Gab for everything about the TV shows and streaming movies everyone’s talking about.

You may occasionally receive promotional content from the Los Angeles Times.

“El Señor de los Cielos” (“The Lord of the Skies”) is Telemundo’s top-performing SuperSeries, depicting the life of drug trafficker Aurelio Casillas (Rafael Amaya), based on the real-life former leader of the Juarez Cartel, Amado Carrillo Fuentes. It was just renewed for a ninth season. According to Nielsen data, viewers of the most recent season in the coveted 18-49 demographic were 51% female and 49% male — an almost unheard-of level of gender parity when it comes to either telenovelas or U.S. soaps.

The SuperSeries audience mapped perfectly onto another new endeavor for the company: Tplus, the Spanish-language streaming brand the company launched on flagship platform Peacock in early 2022 to appeal to the language-fluid Latino audience living online, whom the company refers to as the “200 percenters”: people who identify as both 100% American and 100% Latino. The goal is to secure the attention of, say, a 22-year-old male who speaks Spanish with his grandmother but texts with his friends in English. And so far, the SuperSeries appear to be succeeding. The 18-34 demographic is stronger for its SuperSeries than its contemporary dramas, for instance, with fully 40% of the audience watching episodes on streaming. And, Barroeta explains, it can push the envelope by being more inclusive of queer representation, empowering female characters to be in charge and breaking extreme stereotypes.

“Women having relationships with multiple men because — why not? Traditionally it was always the opposite,” she says.

By innovating the telenovela form with higher production values and modernized storylines, Spanish-language streamers are trying to bridge the generation gap between young Latino viewers and their abuelas. They see this as a place of major growth potential at a time when the flow of new subscribers for a number of their largest competitors has begun to slow.

One of the largest growing consumer groups in the country, U.S. Latinos were reported as having $1.9 trillion of purchasing power in 2020, an increase of 87% versus 2010. The 2020 Census reported there are more than 62.1 million Hispanics in the U.S. in 2010, which is approximately one-fifth of the country. A recent MRI-Simmons survey of the American consumer revealed that over the last few years, more and more Americans (Spanish-speaking and otherwise) have reported watching Spanish content in the past 12 months.

Latinos spend more time watching videos on smartphones, using apps and interacting on social networks compared with the general population, according to a Focus Latinx 2023 study, which describes Latinos as “content omnivores.” They are more likely to use streaming than the general population, and more likely to consume live content on streaming platforms than on traditional platforms.

And whether the streamer is branded as Spanish-language or not, Spanish-language content has become increasingly central to the water-cooler conversation around television thanks to shows such as Netflix’s “Money Heist” and “Elite” and Max’s “Veneno” and “Los Espookys.” In a world that’s increasingly multilingual — both the users themselves and the content that they binge — Spanish-language streamers hope to capitalize on that market, which is at once large and underserved.

In March 2022, Telemundo’s competitor TelevisaUnivision launched its own Spanish-language streaming service, Vix. The service currently has more than 30 million monthly users globally, and 63 percent of these users do not use Televisa/Univision’s linear service.

Vix’s chief content officer, Rodrigo Mazón, who previously worked at Netflix and Hulu, says he thinks that one of the greatest contributions streaming has brought is introducing people to content from outside of their own countries.

Amid a writers’ strike largely about the power of platforms, we take a snapshot of the streaming pecking order, from Netflix to (formerly HBO) Max.

“I believe that over the past 10 to 15 years, streaming has allowed this content to be discovered more prevalently, and therefore appreciated and loved, and the pandemic only accelerated that trend,” says Mazón.

Similar to Telemundo, Televisa/Univision has its own version of an evolved telenovela, which it calls “serielas” — a portmanteau of series and novela.

“It’s more developed for streaming services,” says Mazón. “Shorter episodes, multiple seasons, higher budgets, but the seriela preserves the melodrama as its core genre.”

And the format is even shorter than Telemundo’s SuperSeries: Serielas have about 8 episodes a season, similar to the episode orders of many of the most popular English-language streaming shows.

“The audience is younger than linear, which is not surprising for streaming,” says Mazón. “And it’s skewing a bit female, which would make sense given the melodrama genre. But the elements creatively speaking, I would say, are not necessarily as female-oriented as maybe they have been traditionally on linear TV through the telenovelas.”

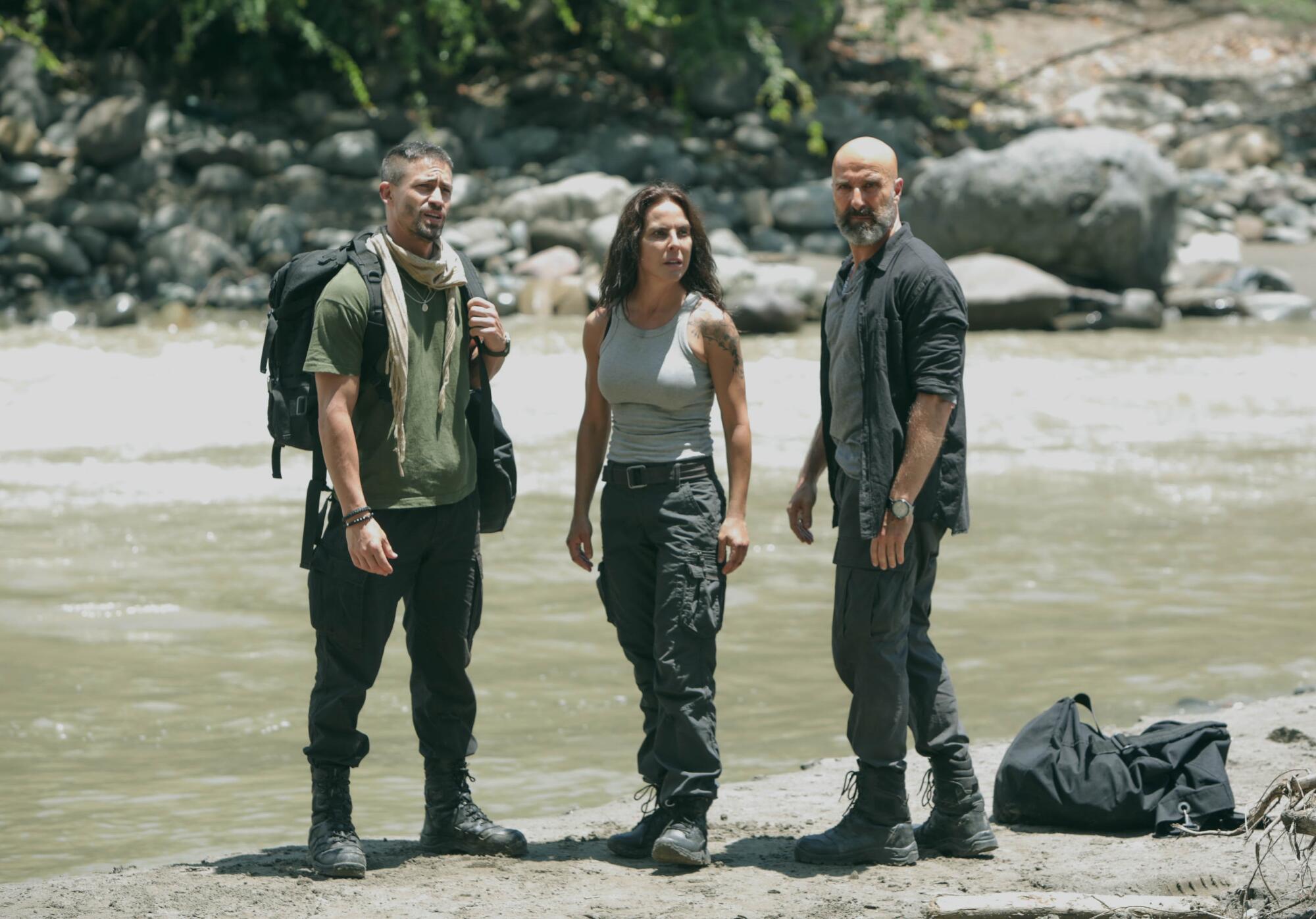

One of Vix’s more popular serielas, “Volver a caer,” starred telenovela royalty Kate del Castillo, who also proved to be incredibly successful for Telemundo in its “La reina del sur” (“Queen of the South”) SuperSeries. Using big-name stars to attract audiences is part of the telenovela evolutionary process. Vix’s new seriela, a thriller called “Isla Brava,” features Fernanda Castillo and Flavio Medina. Vix is dropping two episodes at a time for the eight-episode series.

Without revealing numbers, Mazón said the show’s audience is growing week over week, which doesn’t always happen with streaming — the first weekend is frequently the biggest in a show’s run.

Vix, Tplus and other leaders in the Spanish-language streaming space like FuboTV also see sports as a key to growing their audience — especially soccer, which is the fastest-growing sport in America. In 2017, for instance, Fubo shifted to a live TV streaming platform to bring live sports and other Spanish-language programming to cord-cutters. The company reports its Latino plan has delivered double-digit year-over-year growth in terms of subscribers, and its leading demographic is males between the ages of 25 and 45.

How platforms like Netflix and Prime Video measure success can mean the difference between life and death for a show. But those metrics remain opaque.

The entire FIFA World Cup Qatar tournament in 2022 was the No. 1 live-event franchise in the history of Peacock in terms of reach, usage and subscriber acquisition, with Argentina vs. France being the most streamed FIFA World Cup match in U.S. media history, regardless of language. The company hopes to capture that magic again with the FIFA Women’s World Cup in Australia and New Zealand this summer.

At a moment when the writers’ strike has increased the impetus for platforms to think broadly about their content pipeline — whether overseas scripted productions, reality programming or live sports — it’s more clear than ever that no conversation about the rise of streaming is complete without including Spanish-language streamers. Whether viewers are tuning in because soccer just sounds better in Spanish or because there’s nothing like the thrill of a love triangle between a woman and two brothers.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.