Peltz ends Disney proxy fight after layoff announcement. Iger says company was ‘intoxicated’ by subscriber growth

Billionaire activist investor Nelson Peltz on Thursday ended his proxy fight with Walt Disney Co. after Chief Executive Bob Iger announced details of a major restructuring and cost-cutting program that included 7,000 job cuts.

“Now Disney plans to do everything we wanted them to do,” Peltz told Jim Cramer on CNBC. “We wish the very best to Bob, this management team and the board. We will be watching. We will be rooting.”

Peltz added, “The proxy fight is over.”

The influential investor had been lobbying Disney executives and board members since July in an effort to join the company’s board of directors. He began to wage the proxy fight last month after being rebuffed by the company.

His hedge fund, Trian Fund Management, had amassed 9.4 million shares worth roughly $900 million. Trian sent letters to Disney stockholders asking them to vote for Peltz (or his son Matthew) to join the board and to not vote for current board member Michael Froman, a former U.S. trade representative.

Peltz sharply criticized the company, alleging poor succession planning and “self-inflicted” wounds such as the $71.3-billion acquisition of 21st Century Fox, which brought in valuable properties such as “Avatar” and “The Simpsons” but increased Disney’s debt load significantly.

“We respect and value the input of all our shareholders and we appreciate the decision by Trian Fund announced by Nelson Peltz this morning,” Disney said in a statement.

Peltz’s lobbying began when Bob Chapek (Iger’s handpicked successor) was still running the company. Chapek was fired abruptly in November, and the board brought Iger in to replace him.

Iger’s restructuring and cost-cutting program is meant in large part to get the company back on track to make its popular streaming services profitable.

The streaming strategy, which Iger spearheaded before he stepped down as CEO in 2020, has won over customers but is bleeding cash. The company on Wednesday said its direct-to-consumer business — which includes Disney+, Hulu and ESPN+ — lost more than $1 billion during the most recent quarter.

Disney is targeting $5.5 billion in cost savings, largely from its content and marketing. Disney said it plans to achieve $3 billion in content savings, excluding sports, over the next few years.

Iger did not specify the timeline for job cuts, nor did he say which divisions would be hit hardest. However, analysts expect much of the pain to be felt in the company’s media and content businesses.

Disney’s board gave Bob Chapek a three-year contract extension in June. Five months later, the board replaced him with predecessor Bob Iger. What happened?

At the same time, Disney has said it is focusing on its big franchises, particularly in animation, which has struggled at the box office lately. Iger said sequels to “Toy Story,” “Zootopia” and “Frozen” are in the works.

Cuts will probably include reducing costs from a separate distribution division that Chapek created and “removing duplicative costs” at Disney’s TV networks and film studios, wrote Morgan Stanley analyst Benjamin Swinburne in a note to clients.

Disney on Thursday detailed the company’s long-expected reorganization, which divides the company into three distinct units: Disney Entertainment (composed of film, TV and streaming), ESPN, and Disney Parks, Experiences and Products.

The goal, Iger said, is to return power and accountability to the company’s creative executives, instead of distribution chiefs and financial types.

Swinburne was supportive of the move but acknowledged challenges that come with the strategy.

“The risks are fairly clear as well,” Swinburne wrote. “Specifically, how does Disney decide which content ends up on its still unprofitable streaming services?”

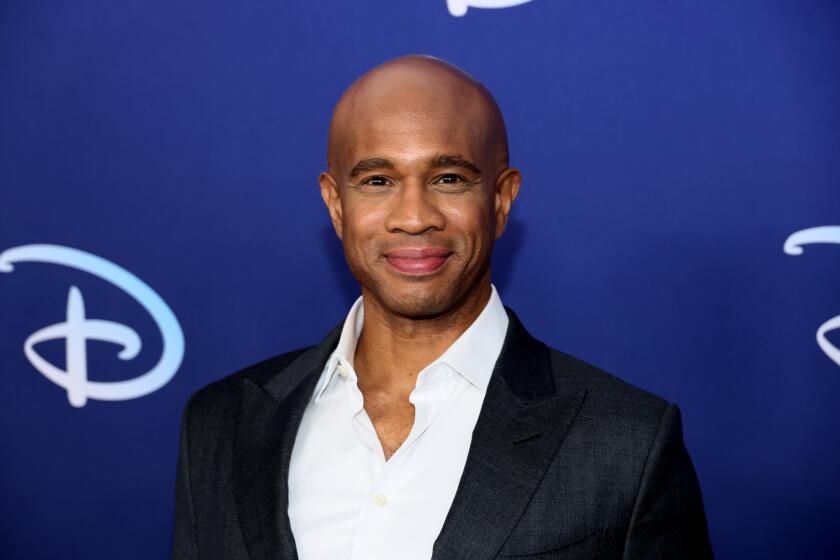

Iger has tasked film studio chief Alan Bergman and TV veteran Dana Walden with leading the entertainment side of the business, including the big streaming operations of Disney+ and Hulu. ESPN and ESPN+ will be headed by Jimmy Pitaro. Josh D’Amaro will run Parks, Experiences and Products. Iger has tasked the executives with a clear mandate for “driving business efficiencies globally,” Disney said.

As part of the reorganization, several back-end departments will be consolidated to support both Disney Entertainment and ESPN, including groups in charge of product and technology, advertising sales and distribution, excluding theatrical and music.

The ascent of Daniel, a close Bob Chapek confidant, to the chairman level was a point of pride for many at Disney in 2020, but he headed an organization that angered creative executives.

International entertainment divisions will now report to Bergman, Walden and Pitaro. As a result, Rebecca Campbell, chairman of international content and operations, will leave the company in June.

The organizational challenges take immediate effect.

The company also said it would ask the board to approve the reinstatement of shareholder dividends, though they will start as a fraction of what they once were.

ESPN being its own unit led to renewed questions about whether Disney would spin off or sell the cable sports giant. Iger has dismissed such speculation.

While much of the cost-cutting is aimed at correcting some of the moves that made streaming such a money-loser, Disney said it was not backing away from its goals for Disney+.

“The streaming business remains a top priority for the company,” Disney said.

Iger has acknowledged that some of the tactics to grow the streaming business, which started under his watch, were too aggressive. For example, Disney+ came to market in 2019 with a price of $6.99 a month, far less than most comparable services. The company has since hiked subscriber fees.

“We got maybe intoxicated by our own sub growth,” Iger said in a CNBC interview Thursday.

Asked whether he truly planned to retire for good after his two-year contract runs out, Iger, who turns 72 on Friday, insisted it was his intention to leave.

“Well, my plan is to stay here for two years, that’s what my contract says, that was my agreement with the board, and that is my preference,” he told CNBC’s David Faber.

Disney’s financial results beat Wall Street estimates. It posted sales of $23.5 billion, up 8% from the same quarter last year. Analysts on average had been expecting $23.4 billion in revenue. Profit rose 11% to $1.28 billion. Disney’s earnings of 99 cents a share exceeded projections of 78 cents.

The stock increased 2% to $114.54 in midday trading.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.