How Taylor Sheridan’s ‘Yellowstone’ franchise could solve a big problem for Paramount+

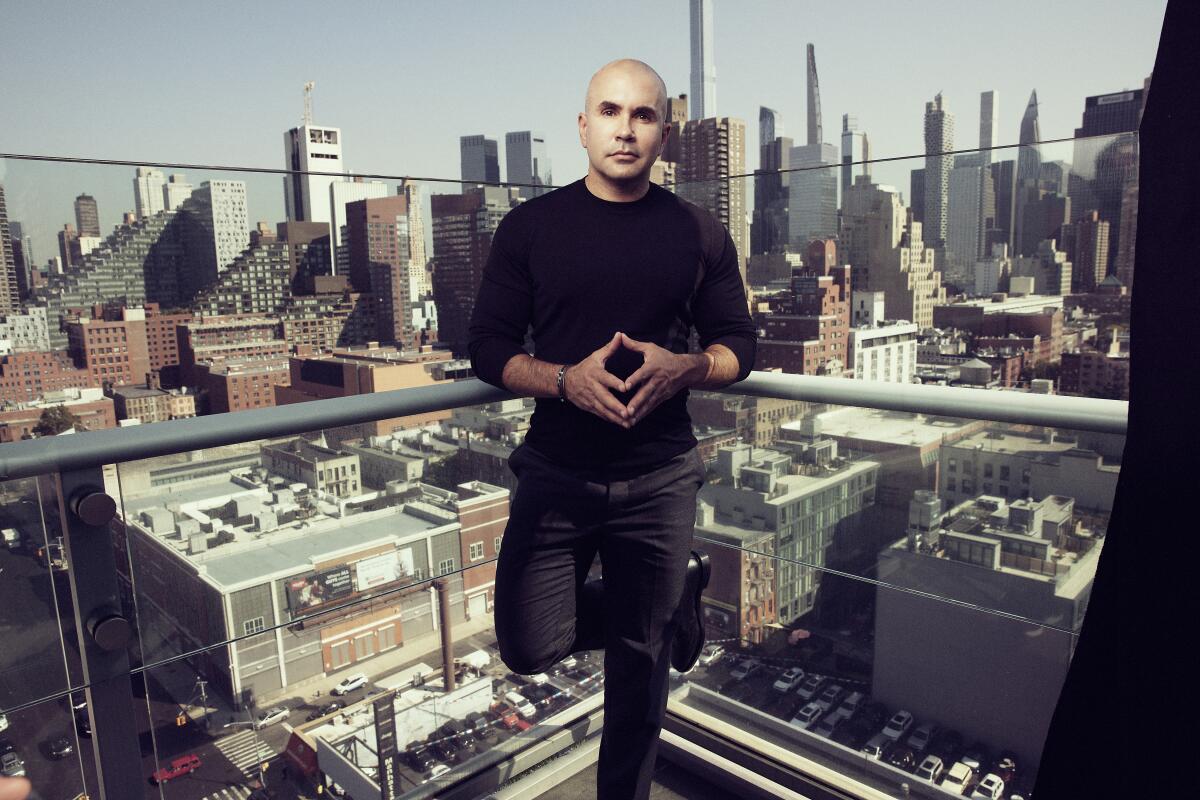

As Viacom Inc. and CBS Corp. were recombining in 2019, Chris McCarthy faced a key decision: What to do about “Yellowstone”?

After leading VH1 and MTV, the Viacom television executive had recently added “Yellowstone’s” cable TV home, Paramount Network, to his portfolio, along with Comedy Central.

The neo-western drama, starring Kevin Costner as powerful Montana ranch owner John Dutton, was popular but expensive to produce. Basic cable was abandoning scripted drama in favor of cheaper reality shows. What’s more, the streaming rights were committed to a rival, Comcast Corp.’s Peacock, presenting a problem for ViacomCBS’ own nascent streaming ambitions.

Instead of cutting the show, McCarthy came up with a plan to expand “Yellowstone” and deepen ties with its creator- director, Taylor Sheridan. The result was a deal for Sheridan to create six shows — including three “Yellowstone”-related programs — exclusively for Paramount+.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

“We decided to take the harder path,” said McCarthy, president and chief executive of MTV Entertainment Group. “It would certainly be challenging, but the reward would be exceptional.”

The strategy faces a major test Nov. 14 with the premiere of Sheridan’s new show, “Mayor of Kingstown,” a Michigan-set drama about the business of incarceration, starring Jeremy Renner, Dianne Wiest and Kyle Chandler. In December, Paramount+ will stream the first “Yellowstone” spinoff, “1883,” a prequel starring Sam Elliott and country music stars Tim McGraw and Faith Hill.

Both series will kick off by running their first two episodes on Paramount Network after episodes of “Yellowstone.” After two episodes, the shows will move exclusively to Paramount+.

Upcoming projects in the Sheridan oeuvre include another “Yellowstone” spinoff, “6666,” plus “Land Man,” a series about the West Texas oil boom and bust, inspired by a Texas Monthly article.

The strategy is risky. With their big-name stars and epic vistas, Sheridan’s productions are pricier than the typical basic-cable series. His shows cost an average of $6 million to $8 million per episode to make, according to people familiar with the series’ finances.

The first season of “1883,” which was launched quickly and with additional costs to prevent COVID-19 outbreaks, was nearly twice as expensive. “1883,” an Old West origin story for the Dutton family, is filmed mostly in Texas, where the crew re-created 19th century Dallas-Fort Worth. Sheridan also is shooting in Montana, an hour outside the nearest town, he said. .

Paramount+ launches next month. Disney+’s price hike is coming. Churn concern is at the forefront.

“My sincere hope is that I deliver,” said Sheridan, who earned an Oscar nomination for writing the contemporary western “Hell or High Water.” “I do feel that the model Chris is building is the future. Since I’m the test dummy for it, I hope I survive the crash, so to speak, and deliver something worthy of the gamble.”

If the wager works, it could boost subscribers for Paramount+, which needs brand-name shows to compete with the likes of Netflix, HBO Max, Hulu and Disney+.

Paramount+, renamed from CBS All Access, launched in March with the aim of luring subscribers with brands including MTV, Nickelodeon, BET, Paramount and CBS. ViacomCBS in August reported reaching 42 million combined subscribers for streaming services including Paramount+ and Showtime’s over-the-top offering, adding 6.5 million accounts in the most recent quarter. The company does not break out numbers for Paramount+.

ViacomCBS plans to boost its annual streaming content spending to $5 billion by 2024 to hit its target of 65 million to 75 million subscribers. That’s part of the total amount Viacom spends on content, which was $15 billion in 2020.

While Paramount+ has a broad array of material, it doesn’t have the brand awareness of some of its rivals such as HBO/HBO Max (69.4 million subscribers), Disney+ (116 million) and Netflix (214 million), said Steven Cahall, senior equity analyst at Wells Fargo Securities.

“Carving out that brand value in the mind of the consumer, at a time when there’s a lot of competition out there, is their biggest challenge,” Cahall said.

ViacomCBS’ efforts have been hobbled by deals such as the one to license “Yellowstone” to Peacock. That deal was signed in September 2019, after Viacom and CBS agreed to merge but before the transaction closed and plans for Paramount+ took shape. It had a similar problem with “South Park,” which is licensed to HBO Max for streaming.

To alleviate that issue, McCarthy signed “South Park” creators Matt Stone and Trey Parker to a deal for two movies a year through 2027 for Paramount+ that are based on the beloved, foul-mouthed animated show. The “South Park” pact, which includes additional seasons of the Comedy Central staple, is valued at $900 million.

“He believes in franchises,” ViacomCBS Chief Executive Bob Bakish said of McCarthy. “We have some franchises that were, call it ‘encumbered,’ in streaming. But he didn’t say, ‘Screw it. We won’t do anything with those.’ He figured out a path.”

McCarthy, who has an MBA from the University of Pennsylvania’s Wharton business school, joined Viacom in 2004 as a freelance marketing director for MTVU, a network aimed at college students. He rose through the ranks to become president of VH1 and Logo TV in 2016, shortly before also taking over MTV, where he was tasked with turning around the struggling brands.

In a key early move, McCarthy revived the “Jersey Shore” franchise with “Floribama Shore” and “Jersey Shore: Family Vacation,” which have both run for four seasons. Also in unscripted, he launched “The Challenge: All Stars” for Paramount+, a spinoff from the MTV reality competition show.

ViacomCBS executives outlined their plans for their new streaming service, which launches March 4.

“I think having grown up at MTV, you really learn how to thrive in chaos and complicated times,” McCarthy said. “Everything is constantly changing. It ended up being an incredible skill as I matured throughout the company.”

Overseeing a portfolio of scripted dramas is a relatively new area for McCarthy, who made his mark by expanding reality franchises such as “Love & Hip Hop” and “Black Ink Crew.”

But the growing audience for “Yellowstone” gave executives confidence. Once McCarthy’s group took over Paramount Network, they decided to promote the show, which had an older-skewing audience, on its youth-focused networks, including MTV and VH1.

Season 3 viewership averaged 6.2 million, up 22% from the second season, culminating in 7.6 million for the finale, according to Nielsen data. The company also saw significant growth of digital download sales, which totaled $60 million last year, equal to 1 million to 3 million viewers, according to people familiar with the financials.

Plus, the series reaches demos that were underserved by prestigious dramas that are popular in Los Angeles and New York. The show is popular in cities in the South and Midwest, including Dallas, Denver and Kansas City, and over-indexes in smaller counties. The demographics also overlapped with CBS’ NFL audience.

Veteran film executive Jim Gianopulos took the reins at the Los Angeles studio in 2017. Since then, Paramount has been through a major merger and industry tumult.

While “Mayor of Kingstown” and the upcoming oil-industry drama are not directly related to “Yellowstone,” Sheridan’s shows tend to explore similar themes, which are universal but also relevant to specific regions of the country. Those often include the gentrification of the American West and the failure of institutions, whether it’s the oil industry, local government or the penal system.

“What we’re doing is serving audiences that are really starving for content,” McCarthy said. “We are in the business of driving massive commercial hits. We can’t survive on just the coasts.”

David C. Glasser, chief executive of “Yellowstone” production company 101 Studios, credited McCarthy with doubling down on the series despite the risks.

“Their reputation for turning around businesses and world-building is terrific, but it’s been chiefly in the unscripted space,” said Glasser, previously Weinstein Co.’s president and chief operating officer, of McCarthy’s group. “Rather than change course, [they] did just the opposite by immediately doubling down on ‘Yellowstone’ and Taylor.”

The franchise’s growth was partly the result of a period of creative productivity during the COVID-19 pandemic for Sheridan. In four months, he said, he turned in a slew of scripts for the overall deal he signed with ViacomCBS in 2020. The company wanted more.

Three veteran programming executives, Showtime’s David Nevins, Nickelodeon’s Brian Robbins and MTV’s Chris McCarthy, are getting increased turf as part of a management overhaul at ViacomCBS.

“I think they saw an opportunity to build a bigger world, at the same time people had a lot of time to sort of reassess, and they decided to really double down on Paramount+ and the kind of content I make,” Sheridan said. “And so I talked to Chris about a lot of ambitious ideas, and he bet on them.”

McCarthy was sold on the idea of an expanded “Yellowstone”-related franchise after hearing Sheridan explain his ideas, including the one for “1883,” which he saw as a grand-scale expansion on the world and themes established by the original series. While Sheridan’s work is steeped in classic western drama, his films and shows complicate the traditional good guy-versus-bad guy narratives of the genre.

“This was a conversation he was already having with himself,” McCarthy said. “When you listen to him tell a story, it’s like telling the story of America gone West, the fight for the last frontier. … The question is, how big can we get it?”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.