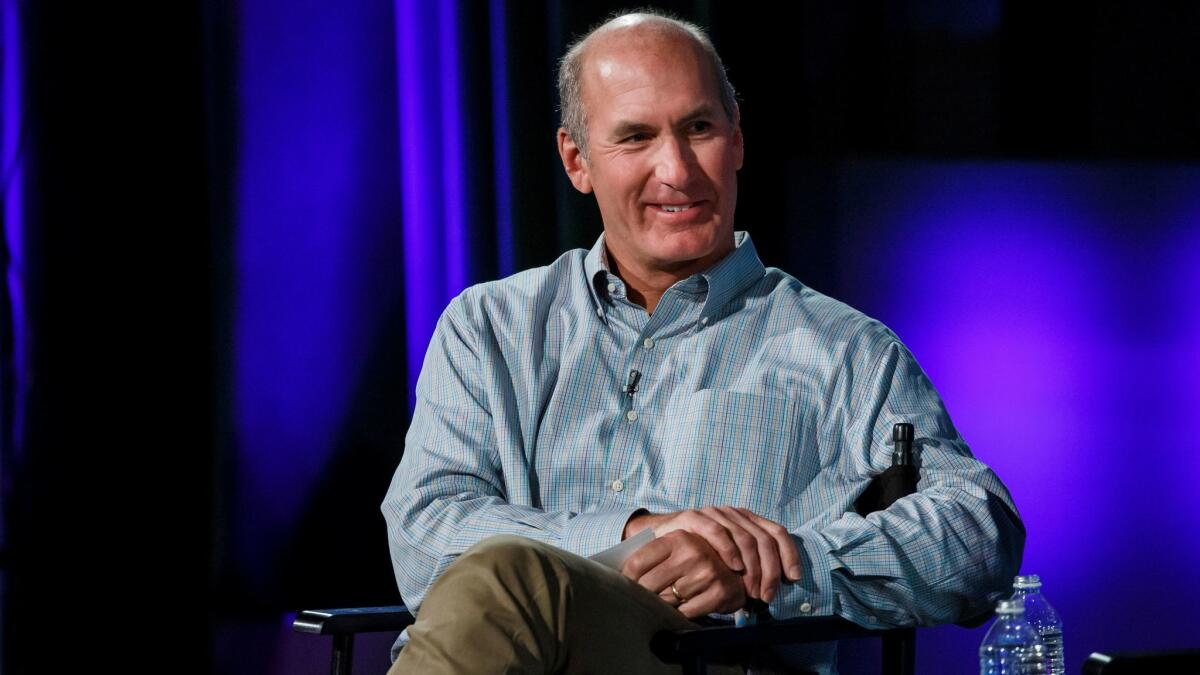

AT&T chief defends HBO Max after Christopher Nolan calls it the ‘worst’

AT&T Inc. Chief Executive John Stankey on Tuesday defended the company’s industry-shaking decision to put Warner Bros.’ entire 17-film slate on the streaming service HBO Max next year, saying it “needed to try something different” to respond to the pandemic.

Stankey’s comments at an investor conference followed sharp criticism of the dramatic move by AT&T’s WarnerMedia, which circumvents industry norms by putting movies in theaters and living rooms simultaneously.

The decision to release movies — including potential hits such as “Dune” and “Matrix 4” — on HBO Max as soon at they hit theaters has shaken Hollywood in an unprecedented way, with some filmmakers and experts believing the decision will do irreparable damage to the traditional film exhibition business.

Among the most vocal critics is Christopher Nolan, director of Warner Bros. movies such as “Inception” and “Tenet,” who blasted WarnerMedia’s strategy on Monday.

“Some of our industry’s biggest filmmakers and most important movie stars went to bed the night before thinking they were working for the greatest movie studio and woke up to find out they were working for the worst streaming service,” he said in a statement to the Hollywood Reporter.

At the investor conference, Stankey did not mention Nolan’s comments directly, but acknowledged that the move had caused a stir.

In response, he argued that the strategy will be good for the industry overall. Warner Bros. has a big lineup of movies that are sitting on the shelf and faces a highly uncertain marketplace, with the coronavirus still raging and many of the nation’s cinemas closed. Even with vaccines on the way, it’s still not clear when people will be ready to return to theaters.

“Any time you’re going to change a model, I know it creates a degree of noise. And this is certainly no exception,” Stankey said Tuesday at the UBS Global TMT Conference, held virtually. “But I think ultimately rational parties will step back and look at this and say giving theater owners a predictable release of content over the next several months that they can plan around and start to work their business around is a good thing for them.”

The new film strategy is also a way for AT&T and WarnerMedia to boost HBO Max with a lineup of premium, exclusive content. Stankey took the opportunity to stump for HBO Max, the $15-a-month streaming service that AT&T and WarnerMedia launched in May to compete with Netflix and Disney+, which has suffered from a slow start in gaining subscribers. Critics have said the price and the service’s absence from Roku have impeded subscriber growth.

Stankey, however, said the service’s performance has been strong. He said the service has grown to 12.6 million subscribers, up from the 8.6 million the company reported at the end of the last quarter. The number of hours people engaged with the service is up by more than one-third in the last 30 days, thanks to programming such as HBO’s “The Undoing” and the Max original “The Flight Attendant.”

“That’s an incredible pace by traditional standards of people authenticating and using the product and being part of it,” Stankey said. “Putting the [Warner Bros.] slate out there is only going to accelerate that further, and getting those active engaged users is so important to us. We’ve had great progress on that.”

Warner Bros. partners, including theater chains and production companies such as Legendary Entertainment, also were taken aback by the decision to put movies directly onto the streaming service at no extra charge. Movie theater giant AMC Entertainment blasted WarnerMedia’s HBO Max decision last week, saying the company clearly intended to sacrifice studio profits to “subsidize its HBO Max start up.”

But Stankey said the strategy is ultimately to give consumers choice over how to watch entertainment.

“It’s to allow the industry to be able to have this transition moment,” Stankey said. “And most importantly, because we care about theatrical and we care about streaming, it ensures that we’re doing this in a way that we still show our respect for the theatrical venues and distribution and not go and push all of our content on a direct-to-streaming exclusively construct or handed off to our competitors that aren’t as invested in the theatrical business.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.