Sports-hungry fans are welcoming live events back to TV

Viewer response to the return of live sports on TV can be summed up in a paraphrase of the famous line from “Field of Dreams” — if you build it, they will come.

Golf, NASCAR, Premier League soccer and hockey are pacing well ahead of their viewing levels before all action was shut down by the coronavirus pandemic in March.

Major League Baseball, which has been rocked by game cancellations due to players testing positive for COVID-19, has also come back strong, especially among younger viewers.

The number of simultaneous events, with the NHL and NBA packed into the summer months typically occupied by baseball, have resulted in a staggering boost in total sports viewing compared to 2019. Mike Mulvihill, executive vice president for research and league operations at Fox Sports noted that since action resumed at the end of July, there have been days when sports viewing has been up 100% to 150% over comparable dates last year.

“We’ve very abruptly gone from not having enough sports to having more sports that we could possibly watch and because the environment is as crowded as it is,” Mulvihill said. “Where you’re really seeing the demand in the ratings is in total viewing of sports.”

Disney’s lucrative sports network has hours to fill as arenas and stadiums go dark. The coronavirus could be a major challenge for ESPN, which was already grappling with sharp declines in subscribers before the pandemic struck.

The overall strong return is further proof that live sports remains the most valuable commodity in the TV business as more consumers are turning to streaming services for sitcoms, dramas, movies and other programming that is not time sensitive. Live sports are highly desirable to advertisers who need viewers who are willing to sit through their commercials.

Sports are also the most important factor for consumers who subscribe to a pay TV service, according to a study conducted from March to June by the media consulting firm Magid.

NBA viewing in prime time on TNT and ESPN since July 30 is even with pre-pandemic levels. But the games have a larger share of the TV audience — which is typically smaller overall in the summer — than they did before action was paused.

The number of people who have tuned in to NBA games over the 12 days since play resumed — 47.2 million — is 49% higher than the 31.7 million who tuned in during the first 12 days of the season, according to Nielsen.

The viewing surge should not come as a surprise, as the production of original scripted programming has yet to restart and major theatrical movie releases are delayed, lessening the amount of competition for TV audiences at a time when many are still homebound due to the health crisis sweeping through much of the country.

Magid’s survey showed that 47% of consumers older than 40 and 40% younger than 40 replaced their sports viewing with streaming services such as Netflix and Hulu during the pandemic.

Bill Hague, executive vice president at Magid, said some viewers are likely running out of programs to watch on their streaming platforms after months of heavy usage, which has pent up their appetite for live sports.

The performance of the games quickly answered the question of whether TV viewers would enjoy watching sports played with no fans in the stands. Magid’s research indicated that 89% of the respondents to its survey said they would.

Lee Berke, chief executive of the consulting firm LHB Sports Media and Entertainment, said fans appear to like the greater intimacy of games played without crowds, as networks can get closer to the action with better camera angles and listen in on athlete chatter.

The decision by the NHL to play its games in two locations and the NBA isolating its players in the “bubble” of the Walt Disney World Resort in Orlando has protected players from COVID-19, which has likely helped their performance.

“The bubble keeps everybody tested and apart from everyone else, and they are comfortable to go at it,” Berke said. “The players are trying hard, and you are right up there with them.”

While the NHL typically has the smallest audience of the four major sports leagues, it has seen its post-pandemic audience grow by 60% over its first 24 games on NBC Sports Network and 57% on the NBC broadcast network.

The stacking of as many as six NHL games throughout the day has likely helped build the audience.

“It’s kind of like a March Madness, almost,” said Dan Lovinger, executive vice president of sales for the NBC Sports Group. “People are loving it. They’re getting hockey whenever they want it.”

The condensed 60-game baseball season and expanded playoffs that raises the number of qualifying teams from 10 to 16 has boosted interest, as every contest matters.

There have been 39 million unique viewers of 59 telecasts this year versus 26 million unique viewers last year over 45 telecasts through the third weekend of the regular season, according to Nielsen data provided by Major League Baseball.

Regional sports networks that carry local teams are seeing triple digit increases in audiences. ESPN’s national MLB telecasts are averaging 1.2 million viewers, up 29% from last year. The Walt Disney Co.-owned network has seen a 64% rise among men 18 to 34 and 83% among women 18 to 34, giving the Burbank entertainment giant a much-needed lift after the coronavirus outbreak in March halted live sporting events and forced the shutdown of its lucrative theme parks (Walt Disney World in Orlando has since reopened to a limited number of visitors, but Disneyland in Anaheim remains closed due to the pandemic).

Some events are seeing the largest audiences in recent years.

ESPN’s coverage of the final round of the PGA Championship on Aug. 9 averaged nearly 2 million viewers, the most for cable coverage of the major tournament since 2010.

The 3.2 million viewers who watched CBS’ final-round coverage of the WGC-FedEx St. Jude Invitational on Aug. 2 was the largest audience for the event in 19 years.

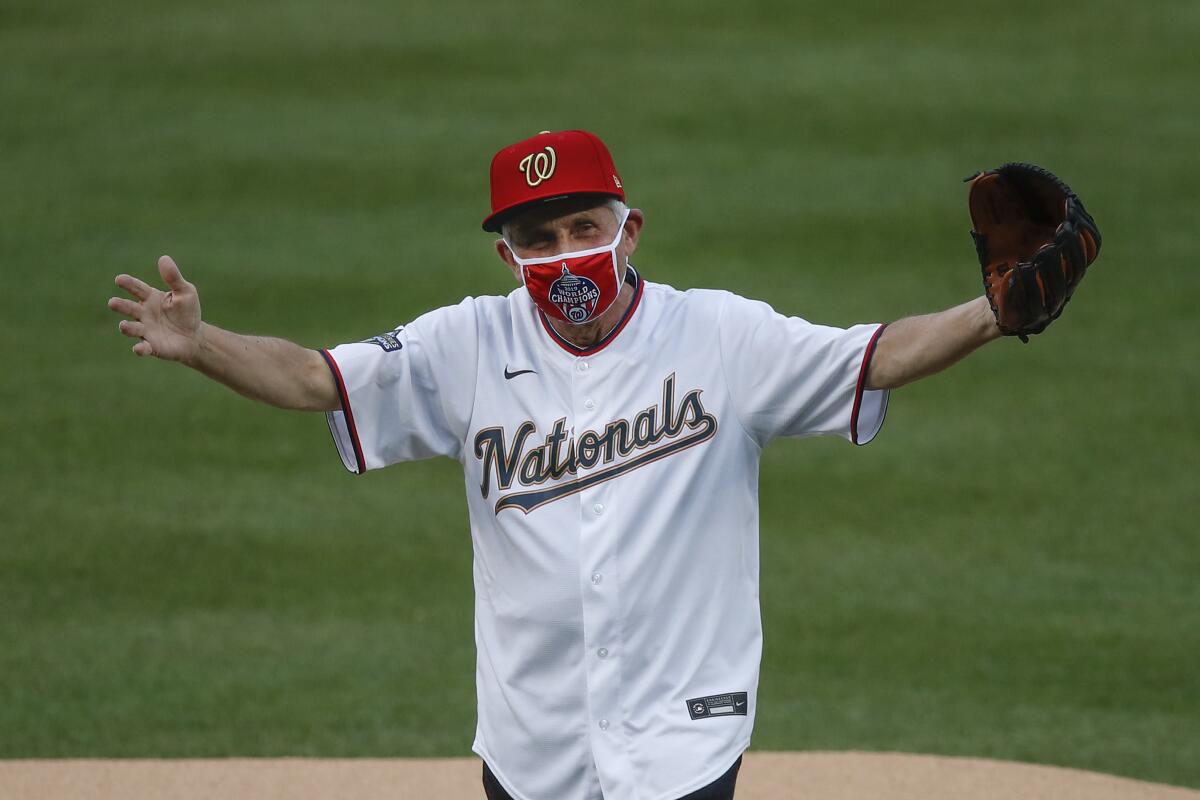

The first national MLB telecast of the delayed season, which featured the New York Yankees and the Washington Nationals on July 23, scored 4 million viewers, the most for any regular season game on any network since 2011.

The WNBA’s season curtain raiser between the Los Angeles Sparks and Phoenix Mercury on July 25 averaged 539,000 viewers, the most-watched opener on an ESPN channel since 2012.

While some events are outside of their usual seasonal dates, Lovinger said 90% of the advertisers who bought commercials on NBC’s hockey and golf telecasts before the pandemic retained their commitments.

Advertiser demand is also picking up as the economy reopens, helping to boost pricing for the commercials that are still available.

The trend is a positive one for the months ahead, as the pause in sports action during the pandemic had a punishing effect on TV ad revenue. Television advertising spending from March through May declined by nearly 37% from the comparable period a year ago, according to Standard Media Index. Demand picked up in June, with a year-to-year decline of 9% to $3.2 billion.

Mulvihill said fan response since sports resumed is promising for the NFL, the most popular property in all of television, which is still on course to start its season in September. That is when the sports calendar will get even more crowded as the Masters and Triple Crown horse racing have been rescheduled into the fall, although with some college football conferences canceling their seasons there is less concern about a glut of events.

“We know that entertainment production has slowed down to such a degree that there’s not going to be as much original programming in the fall as there would typically be,” Mulvihill said. “I think that abundance of sports kind of steps in to fill the void.”

Based on the strong performances of other sports in their opening days, Fox expects its first national Sunday game of the season — the Tampa Bay Buccaneers with Tom Brady against the New Orleans Saints with Drew Brees — to be a blockbuster.

“What the fans have demonstrated already is an incredibly elevated appetite for the first event back,” he said. “I’m expecting a similar spike in excitement around week one, and then I think pretty quickly after that we’ll see a return to normal strong levels of interest in the NFL.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.