Netflix changed media forever. Can this streamer bring the revolution to Latino audiences?

The Edward James Olmos movie “Windows on the World,” about a Mexican family’s ordeal during the Sept. 11 terrorist attacks, was scheduled to open on 100 theater screens nationwide this summer. Then, the novel coronavirus struck and shut down cinemas worldwide.

So the film’s producers scrambled to find another way to release the movie. They settled on a small but fast-growing streaming service called Vix. The platform has 20,000 hours of mostly Spanish-language content and has a large following in Mexico and in the U.S.

“All things being equal, they were the best,” said co-writer and producer Robert Mailer Anderson. “They understood the film.”

The high profile release in April was another boost for Vix. The Miami-based streaming service aims to be a hub for Spanish-language films and TV shows by catering to Latinos, who are huge consumers of Hollywood productions but remain underrepresented on the big screen. The service, which is free with ads, says it has 50 million monthly visitors on its website and 5 million app installs. Its audience — split evenly between the U.S. and Latin America — has doubled over the last two months.

“The bulk of our content catalog and our big differentiator is the fact that we have authentically Latino content,” said Chief Executive Rafael Urbina. “It touches on issues that are culturally relevant for Latino audiences. It’s not just ‘OK, let me switch the audio to Spanish or throw subtitles on an English-language movie.’”

Latinos still woefully underrepresented in Hollywood, with major movie portrayals remaining rare and stereotypical, USC study finds.

Vix, backed by New York-based Discovery Inc. and the Boston-based private equity firm HarbourVest Partners, was founded in 2016, initially as a hub for viral videos and stories for Latino audiences.

Last year, the company acquired L.A.-based streaming company Pongalo, expanding its foothold into video. With 170 employees, including 15 in Hollywood, Vix expects to generate $20 million in revenue this year, up 40% from 2019.

“Latino audiences are just coming around to the adoption of AVOD [advertising-based video on demand],” said Rich Hull, Vix’s chief strategy officer and founder of Pongalo. “For us, it’s a particularly great time to come together.”

Unlike major streaming services such as Netflix, most of Vix’s programming, from dramas to action flicks and comedies, is in Spanish, followed by Portuguese. A handful of movies are in English with Spanish or Portuguese subtitles. Popular titles include the fantasy-action movie “El Gigante de Piedra”; the TV series “La Promesa,” a drama that delves into human trafficking; and “Tarde lo Conocí,” a show based on the life of singer Patricia Teherán.

Although the U.S. streaming market is increasingly crowded, Vix believes it is well positioned to grow in Latin America, as consumers embrace on-demand streaming. Vix is among the top Spanish-language apps on Roku in the U.S and Latin America.

Consumers access Vix online or through its mobile and connected TV apps. The mobile app has been installed by 3.8 million users, with 44% of installs coming from Mexico, according to the San Francisco app market research firm Sensor Tower. The U.S. is the second largest market for Vix’s mobile apps, Sensor Tower said.

Like other streamers, Vix has seen a surge in growth as people began sheltering at home and looking for ways to entertain themselves during the COVID-19 pandemic.

“Windows on the World,” a movie about a Mexican son who searches for his undocumented father after the 9/11 attacks, has been especially popular. It was the most watched title on Vix for several weeks, generating more than half a million viewers in its first month.

“It’s a redemption story that takes place in a time of national tragedy,” Hull said. ”Today, we’re going through a time of national crisis, and hopefully, our national story will be one of redemption as well, but we thought that it was relevant for today, and I think audiences saw that.”

People who identify as Hispanic or Latino represent 18.5% of the U.S. population, the country’s largest diverse ethnic group, according to the U.S Census Bureau. Latino Americans as a group tend to be younger than the rest of the population and more digitally savvy.

Sixty percent of U.S. Latinos said in June that they spent three to five hours more than usual streaming video during the pandemic, according to a survey by Santa Monica-based H Code, which works with brands and connects them with U.S. Latino audiences.

“Having a younger audience that is more digital first, mobile first in how they consume internet content, positions them in a place where they are going to be more receptive to accessing content in the digital format,” said Chief Executive Parker Morse. “They are cord cutters, and that’s how they first consume content.”

In Paramount’s live-action “Dora the Explorer” film, five lead actors are of Latino descent. Director James Bobin and stars Isabela Moner, Eva Longoria, Michael Peña and Eugenio Derbez discuss the character’s big-screen debut with “Dora and the Lost City of Gold.”

Major subscription streaming companies such as Netflix and Amazon also have invested heavily in foreign-language productions, including Spanish titles. Netflix said the third season of the Spanish crime drama “La Casa de Papel” drew 44 million households in its first four weeks.

Demand for Spanish-language series in the U.S. has increased 15% this year, reflecting the popularity of “La Casa de Papel” and teen dramas like Netflix’s “Elite,” according to the West Hollywood-based Parrot Analytics.

“This signals that younger audiences, who tend to be more diverse, are avid consumers of content that reflects the diversity they see in their day-to-day experience,” said Alejandro Rojas, Parrot’s director of applied analytics. “It may also reflect that Latinx, who are underrepresented by talent who appears on-screen, are being served by Spanish-language content produced outside the U.S.”

Other subscription streaming services focused on the Spanish-language include Univision Now, which costs $9.99 a month, and Pantaya (a joint venture between Lionsgate and the Hemisphere Media Group) for $5.99 a month, Morse said.

Manolo Caro yelled “Cut,” rose from the director’s chair and pushed through the swinging doors of the kitchen.

The majority of Latinos surveyed by H Code said they use at least two streaming services, with about one-third signing up for other platforms during the pandemic.

Morse believes Vix’s biggest competition is Pluto TV, a ViacomCBS-owned ad-supported streaming service. Last year, Pluto TV Latino launched in the U.S.; today it has 26 channels with more than 5,000 hours of content in Spanish and Portuguese.

More competition is growing. In May, the New York-based digital media company Canela Media launched its own free, ad-supported streaming service, Canela.TV.

“We recognize that Hispanics’ viewing habits are rapidly shifting away from traditional Spanish-language television as consumers seek content that better reflects their lifestyle, culture and passion points,” Canela Media Chief Executive Isabel Rafferty said in a statement.

Established broadcast networks like Telemundo are also gaining traction on YouTube. This month, Telemundo became the first U.S. broadcast network to surpass 10 million subscribers on its main YouTube channel. The company has 11 channels on YouTube generating more than 35 million subscribers.

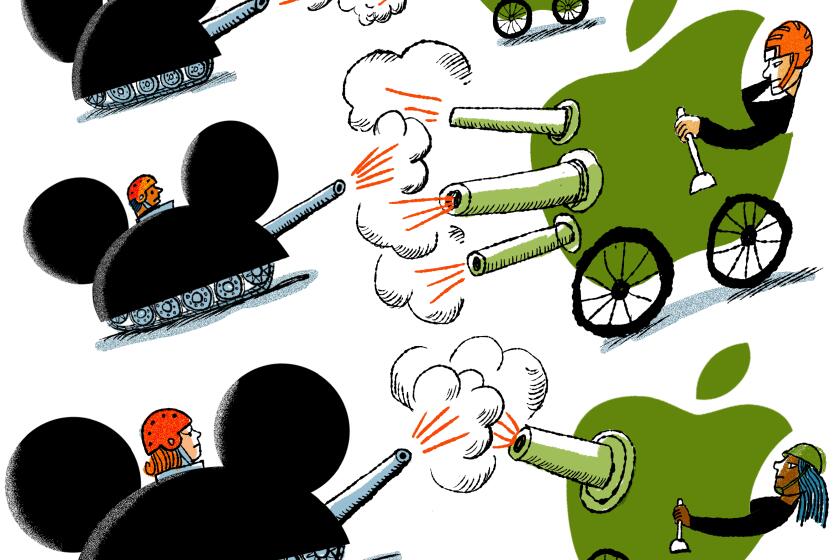

Disney takes on Netflix, as HBO Max, Peacock, Apple TV+ and Quibi prepare to enter the streaming fray. Not all will be able to thrive in the increasingly crowded market, analysts warn.

Vix believes its scale, focus and library of content give it an advantage. Urbina said Vix has the largest library of Spanish-language content available on any internet TV and film streaming platform and relationships with hundreds of advertisers. The company’s biggest demographic is people ages 25 to 44.

“We feel we’re in great shape to compete and continue to hold onto that first mover advantage,” Urbina said. “We see a massive opportunity in reaching Latino audiences.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.