Is Hollywood slipping into recession? The signals are mixed

Welcome to the Wide Shot, a newsletter about the business of entertainment and apologies that come four months late. Sign up here to get it in your inbox.

Hollywood was supposed to be headed for a redux of the Roaring ‘20s after COVID-19 restrictions eased, theaters and theme parks reopened and live sports returned to television.

But as the entertainment industry comes to grips with the challenges of the streaming business, companies are now also having to worry about what it would mean if the economy went into a serious recession.

Analysts worry that the Federal Reserve could tip the economy into decline by raising interest rates to control inflation, which hit a four-decade high of 9.1% in June. Recessions mean job losses. Economic uncertainty normally means less money to spend on discretionary things like trips to Disneyland. On the other hand, consumers facing hard times often seek refuge in movies and television.

“If you zoom out a bit and look at past economic cycles at least in the U.S., most forms of entertainment have been fairly resilient to downturns,” said Netflix executive Spencer Wang, in a video interview discussing earnings last month. “There’s a level of escapism, I think, that entertainment provides.”

Recent economic data are providing mixed signals as economists debate whether it’s more important to pump the brakes on inflation, which affects virtually all consumers, or to avoid a recession that throws millions of people out of work.

Real gross domestic product for the second quarter decreased 0.9%, according to the Bureau of Economic Analysis, though that number could change. This comes after the economy declined 1.6% during the first three months of the year, meaning the U.S. has now had two straight quarters with no economic growth. By one definition, that means the country is already in a recession.

But Federal Reserve Chair Jerome H. Powell, who is trying to pull off a “Mission: Impossible”-style “soft landing” for the economy, cited a robust job market to argue that the country is, in fact, not in a downturn. Further complicating the picture, while consumer sentiment has taken a hit in recent months, Americans are still spending. Nonetheless, chief executives in multiple industries have been talking on earnings calls about an increasingly challenging macroeconomic environment.

Parts of the entertainment industry are already experiencing job losses for reasons that have little to do with the country’s general economic picture. Netflix has laid off 450 employees to contend with a slowdown in revenue after the company surged during the pandemic.

Consolidation is also a factor. David Zaslav, CEO of the newly merged Warner Bros. Discovery, is looking for $3 billion in cost savings from the combination of WarnerMedia and Discovery Inc. assets.

So it’s worth considering the potential effects of a broader slump, which would have a number of specific implications for the entertainment business. Among the most immediate effects of a sluggish economy is a tightening of the advertising market, analysts say. Is that happening?

The upfront advertising market for the 2022-23 TV season is projected to be up slightly over the previous year, hitting $19.63 billion, based on projections from research firm Insider Intelligence. Media companies have been reporting strong demand in the market, where commercials are sold well in advance of the fall TV season. Walt Disney Co., for example, reported a record $9 billion in advertising commitments.

But the true test will come once the season begins, as advertisers can cancel their upfront buys closer to airtime. Softness in the economy is showing up in advertising’s scatter market, where companies buy ads on short notice typically at much higher prices than what upfront buyers pay.

While NBCUniversal reported the highest-grossing upfront in its history at $7 billion, thanks in large part to revenue flowing into its Peacock streaming service, the Comcast-owned media company’s chief executive Jeff Shell told analysts the scatter market weakened in the second quarter of this year.

Streaming device maker Roku also cited recent short-term cutbacks in ad spending in response to the economy slowing down in the San Jose-based company’s latest earnings report. Roku’s stock fell 23% on Friday after the company reported worse than expected earnings and withdrew its full-year revenue estimate.

“We are seeing advertisers worried about a possible recession and so we’re seeing them reduce their spend in places that are easy for them to turn off and turn back on,” said Roku CEO Anthony Wood. “So for example, the scatter market, which is an important source of ad revenue for Roku, is an easy market for advertisers to turn off and turn back on.”

A slowdown in advertising would be bad for traditional TV outlets that are already facing long-term problems in the form of cord cutting and competition from big-spending streaming services.

Warner Bros. Discovery and Paramount Global report earnings this week, which should provide additional insight into the market’s health.

However, Brian Wieser, an analyst at GroupM, said the amount of fretting over the advertising market is overblown. Wieser, in an interview last week, said he expects TV advertising in the second quarter to wind up “flat-ish” year-over year, while the overall ad market grows by high single digits, propelled by double-digit increases in digital spending.

“The overall market is consistent with what we expect it to be,” Wieser said. “It’s not that there aren’t risks, challenges and problems, but I think that the tone of negativity is a little overdone.” (Wieser discussed more thoughts on the ad market in GroupM’s “This Week Next Week” podcast.)

The other big area where you would expect to see problems is in theme parks.

Recessions force families to cut big-ticket items from their budgets, and annual vacations to Orlando and Anaheim certainly qualify. But there’s no sign that this is happening quite yet. NBCUniversal last week said its parks business generated profits of $632 million, the best second-quarter result on record for the division.

“Obviously the parks business historically has been subject to macro trends, and there’s no reason to think that that won’t be the case in the future,” Shell said. “We’re just not seeing it yet.”

Walt Disney Co. reports earnings Aug. 10, so there will be more to learn then about whether kids’ overwhelming desire to hug Mickey and Goofy post-pandemic outweighs economic uncertainties. Morgan Stanley analyst Benjamin Swinburne, in a June note to clients, wrote that pent-up demand for Disneyland and Walt Disney World, plus the company’s pricing strategies, “may allow the business to grow even in a modest recession.”

What’s unclear is what kind of blow a recession would deal to the streaming business. Netflix is already reining in spending to contend with slowing subscription growth, though it’s still spending $17 billion a year on content. Belt tightening could make households choosier about which of their half-dozen monthly streaming video subscriptions are worth keeping.

Co-CEO Ted Sarandos, in an argument for Netflix’s value to consumers, plugged the Russo brothers’ film “The Gray Man” as a killer bang for viewers’ bucks, compared with the expense of seeing a similar movie at a theater.

“This is an enormous big budget action film that normally people would have to go out and spend an enormous amount of money to go see,” Sarandos said during the earnings call. “And they’re premiering it on Netflix.”

Box office is also relatively recession-resistant. Despite the financial crisis, movie theater admissions in the U.S. and Canada totaled a strong 1.4 billion tickets sold in 2009, according to the National Assn. of Theatre Owners. The years immediately following the dot-com crash at the turn of the century were among the biggest in terms of admissions.

But who knows? Economic forecasting is notoriously difficult. Still, recession or not, the overarching trends, such as the decline of cable TV, the disruption of the movie business and the transition to streaming, aren’t going anywhere.

Staff writer Stephen Battaglio contributed to this item.

Stuff we wrote

— Newsletter smackdown in Tinseltown! The Ankler and Puck News are fighting for paying subscribers as the two upstarts bet they have the town covered. (Wide Shot is still free, by the way).

— Going, going, Globes. Hollywood Foreign Press Assn. approves the sale of Golden Globes assets to Todd Boehly in an effort to save the troubled awards show.

— There’s an app for that: Hollywood has a hiring problem. Can this startup help? Husslup tries to be latest LinkedIn for the entertainment business.

— Inside an ad firm’s struggles. This agency received millions from Netflix and abruptly closed. What happened?

— Entertainment companies struggle with post-Roe politics. Ex. A: Disney changes Hulu policy to accept issue-based political ads after Democratic backlash. Ex. B: TV writers ask studios for greater abortion protections.

— Headlines, headlines, headlines. Mayim Bialik and Ken Jennings will continue to share host duties. Stunt coordinator wins round in conservatorship battle. NewsNation signs Chris Cuomo. A Will Smith apology four months in the making. Stallone is mad about MGM’s latest “Rocky” spin-off idea.

Number of the week

Peacock didn’t grow during the second quarter. Comcast Corp. said that the streaming service’s paid subscriber count stayed “relatively flat” at 13 million. Executives cited a tough comparison to the first quarter, which was buoyed by massive programming including the Beijing Olympics and the Super Bowl.

The service has original shows that have gotten pretty good press, like “Killing It” and “Angelyne” and a library that includes “Yellowstone” and “The Office.” Universal Pictures movies hit the app quickly after their theatrical premieres (Hello, “Ambulance!”). But to drive subscribers, it needs more of those “big swings” that Peacock president Kelly Campbell promised.

Hollywood production

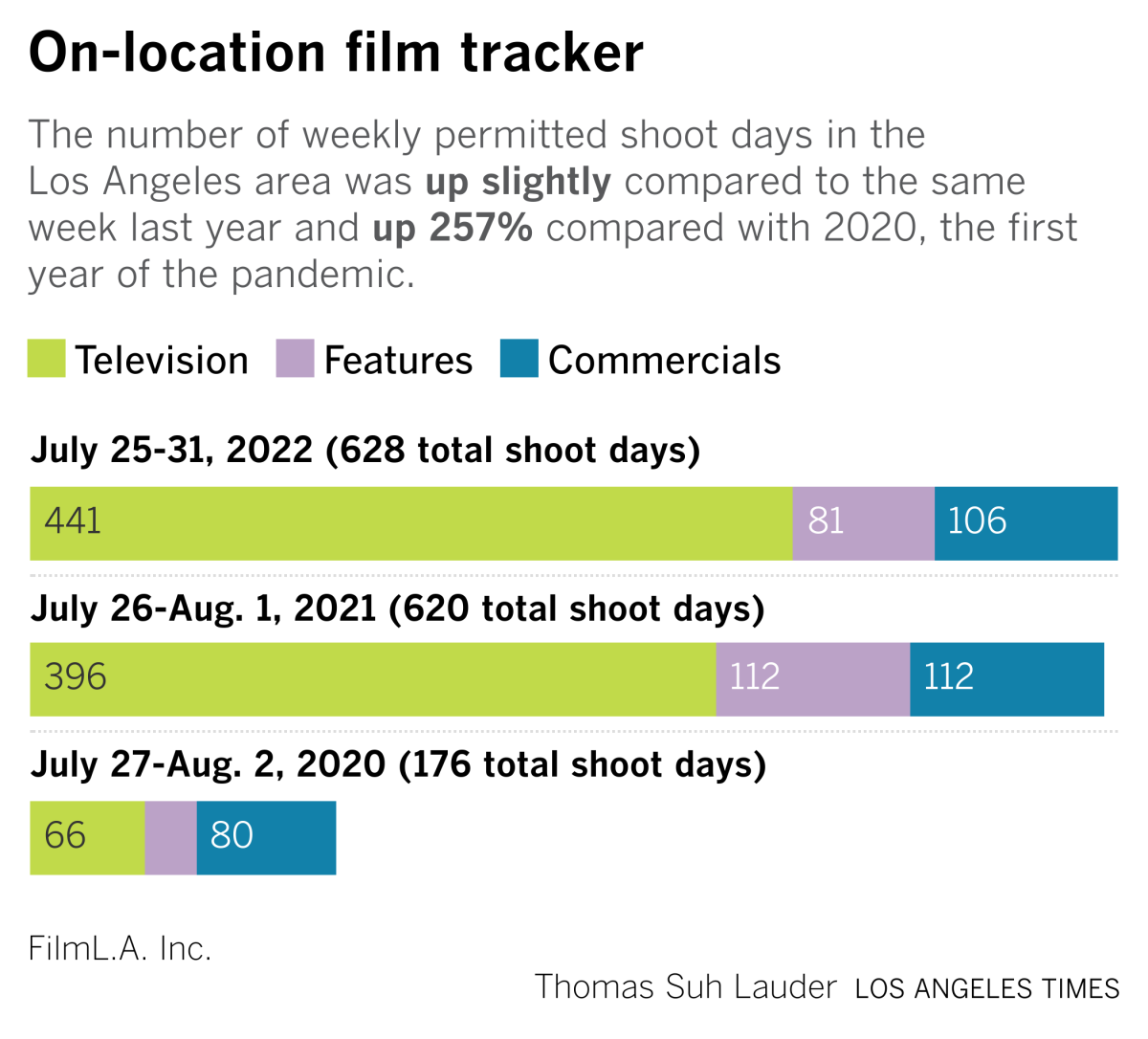

Los Angeles shooting days were up slightly last week compared with the same week in 2021, thanks to an increase in television production, according to FilmLA data.

Catch-up reading

— Norman Lear, at age 100, reflects on Archie Bunker and Trump. (NYT)

— Jennifer Grey on how abortion changed her life. (LAT)

— John Lasseter marks his second act: building Skydance Animation. (THR)

— Gustavo Arellano pays his respects to the Choco Taco. (LAT)

— Mike Judge talks about reviving Beavis and Butt-Head. (NYT)

Finally ...

It’s settled by science. Metal music is good for you. Raise your horns. \m/

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.