Cinema is back? What the $70-million ‘F9’ box office means and what it doesn’t

This is the June 29, 2021, edition of The Wide Shot, a weekly newsletter about everything happening in the business of entertainment. Sign up here to get it in your inbox.

It didn’t take long for Vin Diesel to declare that “cinema is back” after “F9: The Fast Saga” grossed $70 million at the domestic box office in its opening weekend. Let’s think about that.

Judging the health of an entire industry by the performance of one action movie is a weird but time-honored tradition in Hollywood. Also, how do you assess the results from the ninth installment of a two decade-old franchise (10th, if you count spinoff “Hobbs & Shaw”) as a business is inching its way out of a crippling pandemic? Especially when 20% of domestic theaters are still closed.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

On the one hand, analysts noted that the opening was down 30% from “The Fate of the Furious” in 2017, which in normal times would be a sign of a long-running series showing its age. On the other hand, that’s not a very useful comparison given the state of the theatrical business’ fragile recovery.

That “F9” is the highest-opening film to come out of the pandemic — and the biggest since “The Rise of Skywalker,” for what it’s worth — bolsters the argument that the box office is gaining muscle after atrophying during COVID.

In a business that’s all about momentum, “F9” builds on the success of “Godzilla vs. Kong” ($48 million over Easter weekend) and “A Quiet Place Part II” ($57 million during Memorial Day weekend). And box office needs revving up. Industrywide, ticket sales in the U.S. and Canada are still running about 50% behind pre-pandemic levels, according to Eric Handler of MKM Partners.

The next major test will be Marvel’s “Black Widow” on July 9, which Walt Disney Co. is putting both in theaters and on its marquee streaming service, Disney+, for a $30 upcharge.

Which leads to one of the most interesting questions of 2021 for studios: to window or not to window? And by “window,” we refer to the traditional gap between a movie’s release in theaters and when it becomes available at home, which averaged 90 days before the shutdowns. The alternative is releasing “day-and-date,” meaning in theaters and online on the same day (a.k.a., the HBO Max way for 2021).

“F9” debuted in theaters with no simultaneous availability on streaming services or video-on-demand and, under terms of deals forged with the theater companies, will be exclusively in theaters for weeks before being available in living rooms. If fans wanted to see the movie, they had to go to the local multiplex, and it helped that the series has built a loyal fan base over the years. They largely showed up.

“This franchise talks a lot about family, and our audience feels like it’s very much a part of this ‘Fast’ family,” said Jim Orr, Universal’s president of domestic distribution.

It’s impossible to know how many people would have chosen to watch the movie on their couches if it had been available to rent for, say, $20 to $30. Analyst Shawn Robbins, of Boxoffice Pro, estimates a premium video-on-demand (PVOD) release would’ve cannibalized at least $10 million to $15 million in ticket sales. My hunch is that it could have been much more.

Proponents of windows will point to “A Quiet Place Part II” for further evidence that the strategy works, especially for movies where the gimmick, the genre or the stunts really benefit from being seen on a big screen in a dark room with silent strangers. The film was still No. 2 domestically last weekend, after five weeks in release. They’ll also point to the underperformance of “In the Heights,” which launched on HBO Max and in theaters on the same day, though that film suffered from other problems.

There’s a reason Warner Bros. promised to limit same-day releases to this year. Executives at the major film studios seem to agree that sending films directly to streaming is not financially sustainable, so companies aren’t doing it unless they have a compelling reason. Disney and WarnerMedia are both trying to boost subscriber numbers for their streaming services.

Other studios, including Paramount, Sony and Lionsgate, are sticking with windows for movies that they didn’t sell off to streamers. Universal parent Comcast is experimenting by funneling its “Boss Baby” sequel to Peacock, but the company is not as “all in” on streaming as Disney or WarnerMedia. “We’re definitely leaning into theatrical, period,” Orr said.

Disney is releasing some films direct-to-streaming, others in theaters first and others day-and-date for a premium. Disney won’t say how many people pay extra to watch movies like “Black Widow” at home, so the tactic will be difficult to evaluate. The $30 at-home option doesn’t appear to be a death sentence for moviegoing. “Cruella” was released last month in theaters and on Premier Access and remains in the top five at the box office with $71 million so far.

It’s worth remembering that Universal has been releasing movies in theaters with exclusive windows for months through PVOD deals with major exhibitors. Universal’s arrangements with AMC and Cinemark, which are still very much in effect, allow it to distribute movies to iTunes and Amazon for a $20 rental after 17 days. Both deals allow for high-grossing films to stay exclusively in cinemas for longer. The Cinemark deal, for example, holds that movies that open higher than $50 million have to wait at least 31 days before going online.

The next test is how fast the grosses for “F9” deteriorate next weekend. Normally, revenue for the second weekend of a “Fast and Furious” movie is about 60% lower than its opening. Any drop significantly more than that could indicate lingering hesitancy among moviegoers or a negative effect of shorter windows, which used to be 74 days for digital releases.

Theater owners have long argued that collapsing windows would eat into box office, believing that if people know they can wait to watch at home soon, they will do so.

“If there is a larger decay rate, it might suggest those who typically wait out the first week may take a bit longer to come back to the theaters or maybe they will patiently wait for PVOD,” Handler said.

Maybe, but this writer doubts that the typical moviegoer has any clue when the window of theatrical exclusivity expires for any given film. That’s by design.

Stuff we wrote

— Can Turner Classic Movies survive in a streaming world? Stephen Battaglio on how TCM and its ad-free format have adapted through ownership changes and shifts in the cable business.

— A Disney animator draws on his Salvadoran boyhood of beauty and brutality. As a child, José Zelaya dreamed of working for Mickey Mouse and took “refuge from El Salvador’s agonizing civil war in the oasis of his imagination.” His dream came true.

— Look inside Apple’s new downtown L.A. store and event space, a symbol of its Hollywood ambitions. The converted cinema is an amped-up and reimagined version of Apple’s normal store format, writes Roger Vincent.

Zoom concerts forever?

Concerts are back, but livestreamed shows aren’t going away. At least that’s the takeaway from a new survey by UTA IQ. Of those who participated in a virtual event during the pandemic, 88% said they plan to do so again even when in-person gatherings return.

Note of caution: What people say they will do and what they actually do are often different. I’ve sat in on a couple of Zoom-based comedy shows and don’t ever need to do it again, but not everyone agrees.

Meanwhile, YouTube, the home of so many of the livestreamed concerts that happened during the pandemic, is getting further into the “irl” event space with a new theater in Inglewood. YouTube Theater, opening this summer, will be a live-entertainment venue, created through a multiyear partnership between YouTube and Inglewood development Hollywood Park.

Number of the week

That’s the valuation of BuzzFeed, which is going public by merging with a special purpose acquisition company (or SPAC) called 890 Fifth Avenue Partners Inc. Cue the “OMG” and “Win” headlines, even though the number is down from its previous valuation of $1.7 billion.

As with most SPACs, there’s a lot to unpack. BuzzFeed will come out of the deal raising $438 million, including $150 million in debt, some of which will fund the acquisition of rival Complex Networks. SPACs have been the IPO alternative of choice for many companies. Vice and Vox have also held talks about making deals with SPACs, which are public shell companies specifically set up to make acquisitions. The theory is that they’re a way for companies to go public and raise money while bypassing the headaches of a normal IPO.

BuzzFeed has been through a lot in the last few years — including layoffs — as it tries to figure out how to best tackle the online advertising space. One thing seems sure: The BuzzFeed of the future will be bigger and more diversified through acquisitions.

More stories from the week

— In theory, the Amazon purchase of MGM Studios doesn’t create much of a monopoly in entertainment, given the Beverly Hills studio’s relatively tiny footprint. Federal regulators, however, may not see it that way. The Amazon-MGM deal will be reviewed by the FTC, which is led by a prominent critic of gigantic tech companies and their business practices. (Bloomberg)

— Kenya Barris, never one to hold back, is taking shots at Netflix as he moves over to his big new BET gig. “Netflix became CBS,” he said. ViacomCBS owns BET. I wonder how Bob Bakish feels about the comparison. (The Hollywood Reporter)

— Britney Spears quietly pushed for years to end her conservatorship. Confidential court records obtained by the New York Times revealed that the singer has urged changes to the arrangement that controls her life. There’s nothing quiet about her push now. Here’s what legal experts told the Los Angeles Times about the situation.

— Ken Burns is an optimist. But he’s very worried about America. A thoughtful interview with the prolific documentarian. (Washington Post)

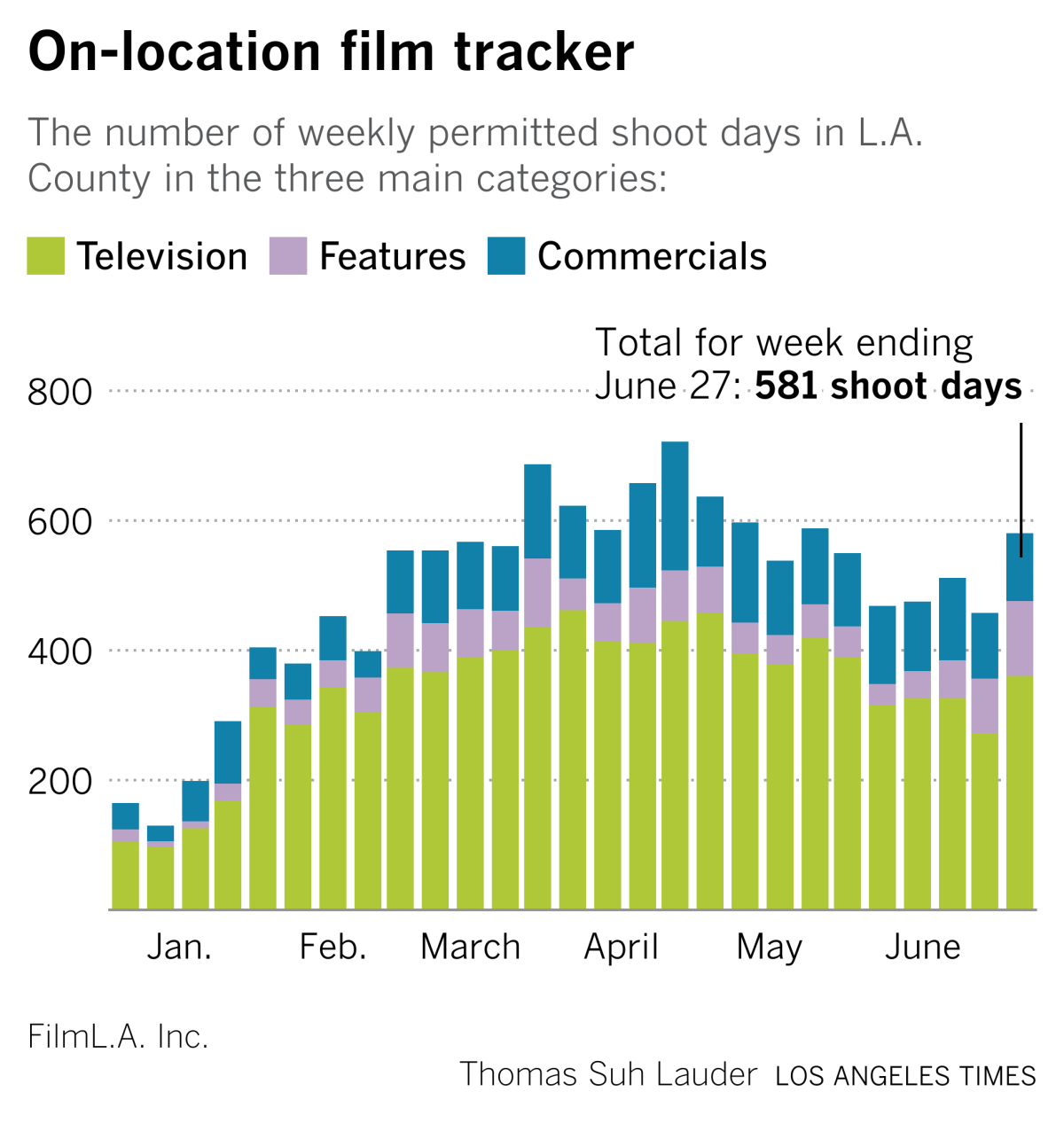

Hollywood production

Finally ...

The Olympics are coming, which means it’s a good time to return to the Twitter feed of Leslie Jones, whose video commentary on the trials should really be livestreamed on Peacock.

Lastly, Joni Mitchell’s “Blue” turned 50 this month. The Times’ music team produced a remarkable series of stories commemorating the landmark folk rock album.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.