The six fire-, flood- and storm-prone cities where billionaires love to buy homes

Rising interest rates. Natural disasters. There are a host of reasons not to buy a home in the current real estate market — particularly in certain areas. But the ultra-rich are unfazed.

As most of the market recovers from its COVID-19 pandemic hangover, megamansions in some cities have been immune to the slowdown. Across the country, billionaires are still spending tens of millions of dollars on homes, despite traditional logic telling them to park their money elsewhere.

A new report from Realtor.com says six cities have emerged as the favorites of the elite this year, and two of them are in California. Tops for the fat-cat crew are Malibu, San Francisco, Aspen, New York City, Miami and Palm Beach, Fla.

All six have seen sales north of $50 million in 2024, and a handful have seen sales much, much higher.

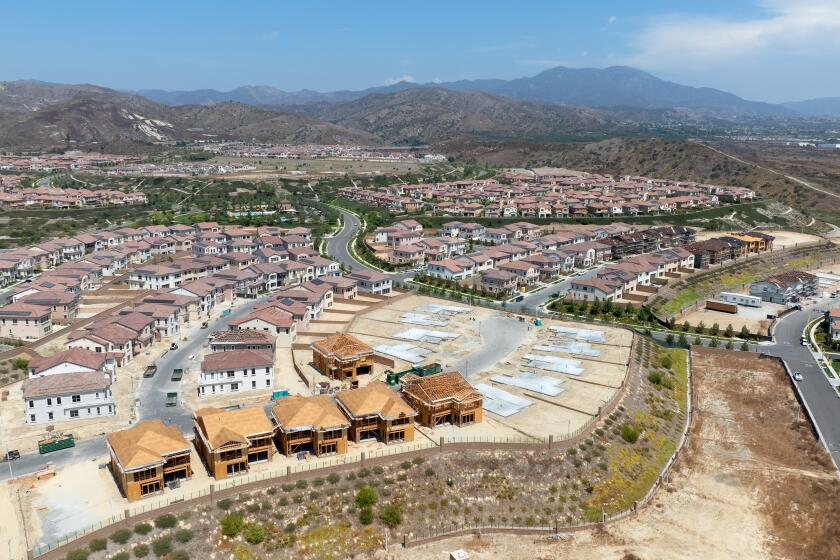

Irvine had the largest surge in U.S. home values over the last year and is defying population and homebuilding trends, in part because of Asian and Asian American buyers.

In May, a private island compound in Palm Beach fetched $152 million, setting the all-time price record in the Sunshine State. California saw a record of its own a month later when Oakley founder James Jannard sold his Malibu spread for $210 million.

For every excuse not to buy, billionaires find a workaround, the report said.

For example, climate change and its ripple effects — floods, fires and storms — threaten homes in coastal communities across California and Florida. But Federal Emergency Management Agency regulations and insurance providers have raised the standards for home builders and developers, requiring increased wind and flood protection. So well-heeled buyers in Florida, for instance, see many new homes, especially expensive ones, as hurricane-proof.

Storm-prepped homes may be too expensive for some, but not for those with a budget of $50 million or more.

The same logic goes for other environmental disasters, the report said. Wealthy beach-house hunters can minimize the effects of coastal erosion by buying a home with a concrete foundation and brand-new sea wall, which protects against crashing waves and shrinking beaches much better than do the older, less pricey homes built on wood stilts in the 1950s and ’60s.

For mansions in fire-prone areas, billionaires outfit estates with fire suppression systems and even hire private teams of firefighters to protect their homes from the flames.

The other factor barring some potential buyers from the housing market? Soaring interest rates.

Unlike during the pandemic, when rates plummeted to 2% or lower, rates in the modern market hover around 7%.

The reincarnation of the former Westside Pavilion mall as a UCLA research center got a major boost from billionaire Gary Michelson and his wife, Alya.

A mortgage payment with a 7% rate can cost thousands of dollars more per month — or even tens of thousands more for multimillion-dollar properties. But billionaires aren’t at the mercy of interest rates for a few reasons, the report said.

Some affluent buyers can pay cash for a luxury property, avoiding interest altogether.

Others are able to broker special deals with banks due to their longstanding relationships and massive holdings. In other words, the more zeroes you have in your account, the better rate you’ll score from a bank.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.