Still haven’t received your inflation relief money? California extends payment schedule

Some Californians may have more time to receive their inflation relief money.

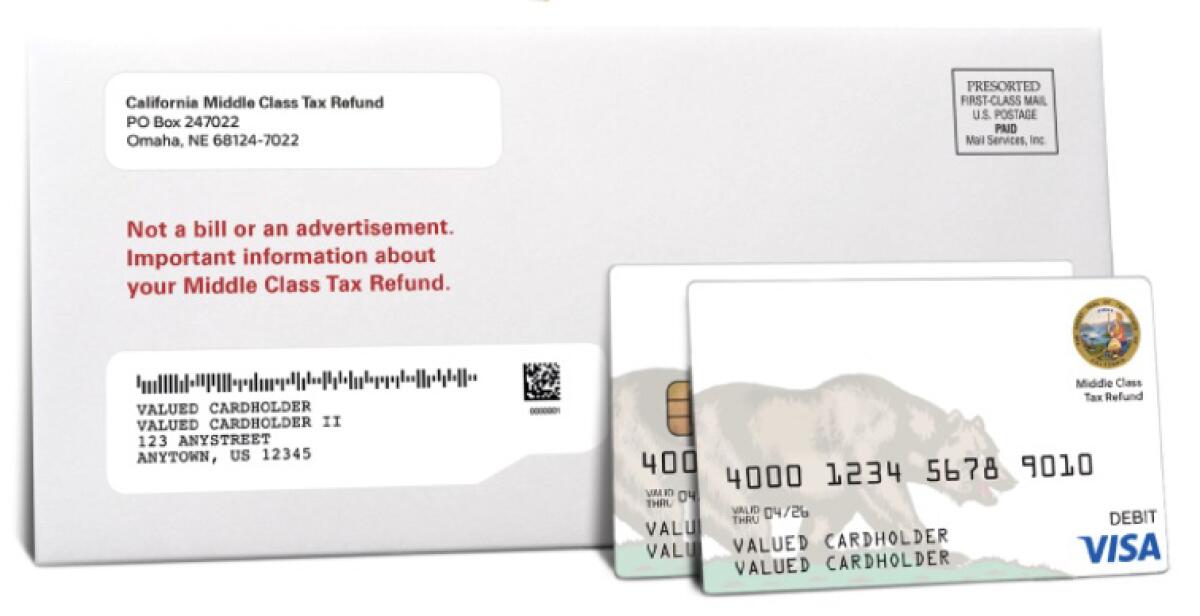

All direct deposits have been issued as of Nov. 14, but more debit cards still need to be mailed out, according to the California Franchise Tax Board. Debit card recipients whose addresses have changed since filing their 2020 tax return could have their debit cards sent out between Jan. 30 and Feb. 14.

The Middle Class Tax Refund, or inflation relief program, aims to pay $9.5 billion to eligible Californians. Refund payments range from $200 to $1,050 depending on your filing status from your 2020 income tax returns and whether you claimed dependents.

“Some folks qualified for a direct deposit payment but were not part of the initial wave, which was wrapped up by Nov. 14 last year,” said a Franchise Tax Board spokesperson, according to KTLA-TV Channel 5. “The bulk of all direct deposits were issued by then. However, some payments require additional review and were, or will be, issued later. We anticipate that an additional 460,000 MCTR direct deposit payments will be issued by the end of this week.”

The bipartisan program lifted 4 million children out of poverty and decreased food insecurity. But as the pandemic receded, so did its chances of survival.

As of last week, more than 7 million people have received direct deposits and at least 9 million have been issued debit cards, according to the latest information from the state Franchise Tax Board.

The one-time payments range from $400 to $1,050 for couples who filed jointly on their 2020 state income tax return and $200 to $700 for people who filed independently. Eligible residents need to meet the state’s adjusted gross income limits and have filed their 2020 tax return by Oct. 15, 2021.

Prices have risen 6.5% over the last 12 months, according to the latest available data from the Bureau of Labor Statistics. Although the Consumer Price Index for All Urban Consumers dropped overall by 0.1% in December, prices for food rose 0.3%. The energy index also dropped 4.5% over the month, but other energy indexes went up.

You can check your eligibility and calculate your total payment amount with the Franchise Tax Board’s refund estimator.

1. Am I qualified to get money through the California Middle Class Tax Refund?

Requirements for eligible Californians to get their payments include:

- Already filed your 2020 tax return by Oct. 15, 2021.

- Not being claimed as a dependent on your AGI.

- Making $500,000 or less in adjusted gross income.

- Is a California resident on the date the payment is issued and has been a California resident for at least six months in the 2020 tax year.

Residential customers of Southern California Gas Co. will see bills jump, the utility warns, because of sharply higher wholesale natural gas prices. Consumer advocates cry foul.

2. How will I get my payment?

Payment type will depend on how your 2020 income tax return was filed:

- If you filed your 2020 income tax return electronically, you should have gotten a direct deposit electronically to the same bank account where the 2020 income tax return was deposited.

- If you filed your 2020 income tax return with a paper form, you should get a physical debit card.

- If you filed your 2020 income tax return electronically, but have since changed your bank or bank account number, then you’ll get a debit card.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.