How public service workers can get student loan forgiveness

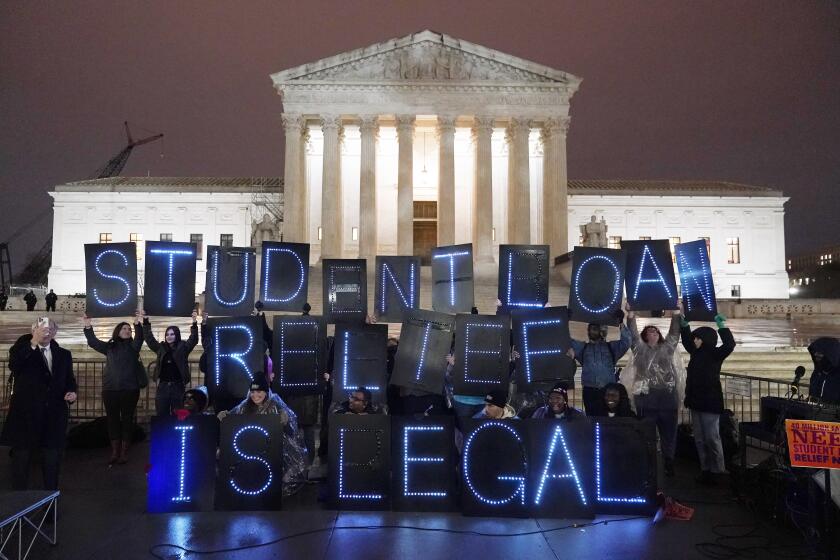

Many former college students throughout the country who work in public service are eligible for a federal program that could wipe out or reduce student loan debt — and it has nothing to do with Friday’s Supreme Court ruling that rejected President Biden’s plan to forgive student loans.

Not enough people, however, have signed up for it.

The basics of the program called Public Service Loan Forgiveness, or PSLF, seem clear: Government and nonprofit workers who make monthly payments on their federal loans for 10 years are eligible to have the rest of their debt wiped clean. But as thousands of borrowers discovered in the years since the federal program was created in 2007, enrolling in PSLF has been extremely complicated.

The Supreme Court has ruled that President Biden does not have the authority to forgive millions of student loans.

Onerous rules and poor communication mired borrowers in confusion, shutting out many who qualify — if they knew about the program at all. Between May 2018 and May 2019, the Department of Education loan servicers denied 99% of applications submitted for PSLF, according to a report from the federal government.

The rules temporarily changed last year. To address the problem, the Biden administration introduced a waiver that relaxed program requirements by making it possible for workers to retroactively receive credit for previous payments that would not otherwise count.

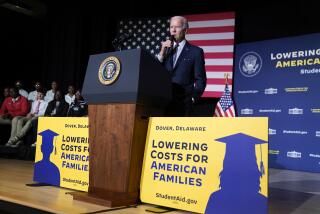

More than 600,000 borrowers — public school teachers, police officers, social workers — have qualified for public service loan forgiveness since he relaxed the rules, Biden said at a press briefing Friday. Before the changes, just 7,000 borrowers had qualified.

But, he said, “so many more people can be helped. And I encourage you to apply if you haven’t already, you’re still eligible,” directing borrowers to studentaid.gov.

The deadline for the waiver passed in October but borrowers can still sign up for the program — they’ll just face the same strict requirements that were in place before the waiver.

In California, more than 825,000 people qualify for PSLF but fewer than 15,000 borrowers have received loan forgiveness, according to a coalition of groups that launched the California Student Debt Challenge, an effort to notify borrowers of their eligibility.

“There are a lot of borrowers who are completely unaware that the program exists or that their employment qualifies,” said Cody Hounanian, executive director of Student Debt Crisis Center, a nonprofit that advocates for fixes to the way higher education is financed.

The federal government plans to forgive up to $20,000 in student loan debt for millions of Americans. Here’s everything you need to know.

What are the basics?

In addition to working in public service and making 120 qualifying payments over 10 years, borrowers must meet other criteria.

Applicants need a specific federal loan called a Direct loan, or consolidate other federal student loans into a Direct loan. And they must enroll in an income-driven repayment plan, which sets monthly payment amounts according to a person’s income.

To receive public service loan forgiveness, borrowers must submit a PSLF form to the Department of Education, which also requires a signature from an employer certifying a person’s employment. The department recommends borrowers complete that form annually to help track and verify qualifying payments.

What type of jobs qualify as public service?

Workers employed by a federal, state, local or tribal government, or nonprofit organizations, are eligible for the Public Service Loan Forgiveness program.

That covers a host of jobs including public school workers, and many first responders and healthcare workers. Borrowers can check if they work for a qualifying employer on the federal PSLF website.

Borrowers need to make monthly payments for 10 years while working for a government or nonprofit job to receive credit for forgiveness, but those years do not need to be consecutive.

For example, a borrower who worked three years at a nonprofit while making monthly payments on their loans would still receive credit for those payments if they choose to leave for a job at a for-profit company. If the borrower decided to work for another nonprofit later in their career, they would have to make seven years worth of payments to qualify for loan forgiveness.

Where can I find more detailed information and help?

Advocates have focused on educating employers about Public Service Loan Forgiveness, who can then pass on the information to workers. In the months leading up to the waiver deadline, they distributed information to county governments, teachers unions and nonprofit organizations in the hope of signing up borrowers before the waiver period ended.

But borrowers do not need to wait on their employer to apply for PSLF, nor are they necessarily out of luck because the wavier period ended.

“It’s really important that folks remember that the public service loan forgiveness program existed before the waiver, and it will exist well into the future,” Hounanian said. “We’re inching towards fixing the program. But for many borrowers, the rules of the game are going to look a lot like they were before the waiver.”

Still, Hounanian acknowledges the process for applying for public service loan forgiveness is confusing. What’s more, Mohela, the student loan servicer responsible for maintaining the program is “essentially dropping the ball,” he said.

“We have heard from borrowers since before the waiver, that they cannot get Mohela on the phone, that they are getting communications via email or mail that are incorrect, that there’s errors in their paperwork” he said. “And yet there seems to be no way to address these problems.”

Borrowers interested in finding more information about the recent changes to PSLF can visit the Department of Education PSLF help tool or this webpage established to answer questions about the program.

Advocacy groups that are working to distribute information about Public Service Loan Forgiveness include:

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.